My Swing Trading Approach

I held off adding any new long positions yesterday, while continuing to increase my stops on all my trades. I am doing the same again today. The possibility of getting short exists as well, as you have renewed trade war jitters which creates a headline-risk trading environment, allowing for renewed fear in the market.

Indicators

- VIX – Despite falling 6% yesterday, expect a strong pop in the indicator today.

- T2108 (% of stocks trading below their 40-day moving average): Small divergence yesterday with SPX rising and T2108 declining slightly. I expect a further decline today if today’s bearishness holds.

- Moving averages (SPX): Back above the 5-day moving average, but likely to challenge the 10 and 20-day moving averages today depending on the market’s weakness.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Consumer Cyclical and Technology continues to be your go-to sectors to trade. Healthcare is coming about very nicely as well. With increased worries about a trade war with China, you may start to see the Utilities and Staples start garnering some interest from the street. Financials still remains a heap of trash.

My Market Sentiment

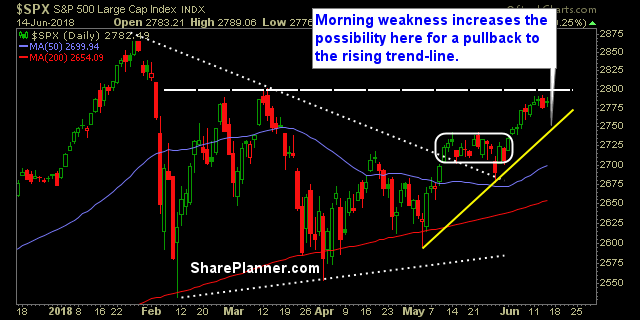

The trade wars being renewed here, and China showing a willingness to retaliate, isn’t going to do this market any favors, and a pullback to the existing trend-line seems likely here. If it can hold, would offer a great dip buying opportunity.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 5 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.