Swing Trading Strategy: Incredible day yesterday as I finally closed out my Virgin Galactic (SPCE) trade at 33.41 for a 77% profit. Really fun trade, followed the plan, and exited when it wouldn’t let me stay any longer. I added one new long position as well as a short position. Indicators Volatility Index (VIX) – VIX

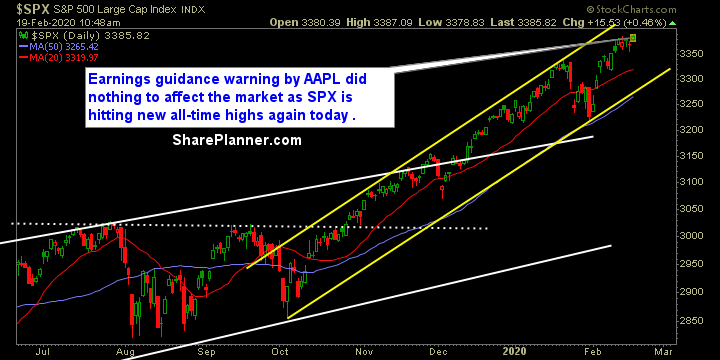

Swing Trading Strategy: Virgin Galactic (SPCE) continues to steal the show, with another large pre-market gap higher. Still long from 18.98, with more than +60% in profits. I closed out the last half of the Apache (APA) for a manageable loss. Some negative news in the pre-market with Apple (AAPL) lowering guidance for the quarter,

Swing Trading Strategy: Trimmed some positions yesterday, that included +15% in Square (SQ), +7% in Advanced Micro Devices (AMD), +2% in Tesla (TSLA) and +3% in Switch (SWCH). I am open to adding more positions to the portfolio this morning, and quite ready for a possible market pullback should it happen. Indicators Volatility Index

Swing Trading Strategy: Nothing major happening in my portfolio yesterday, but I did have a number of positions rally hard for me – most notably was the +20% in gains currently in the portfolio for Virgin Galactic (SPCE). Stopped out of a short position Corning (GLW), which annoys me on a day like today, when the

Swing Trading Strategy: I closed another portion of my Virgin Galactic (SPCE) trade for +11% profit and will ride the remaining position as long as possible. Closed my short position in Dana (DAN) for a 3% loss. I closed Shake Shack (SHAK) out flat – as it just couldn’t push its way through the

Swing Trading Strategy: Great day today. I was spooked out of a little of my Virgin Galactic (SPCE) position perhaps a little too early. I sold a third of my position for a +5% profit. Good, but I would have liked to have booked those profits may a liiiiiiittle bit later than what I did.

Swing Trading Strategy: I added two new long positions and topped it off with a “just in case” short position for the portfolio. I closed out Steris (STE) for a 1% loss – the stock has literally done nothing for me the past month or so that I have owned it. Earnings tomorrow, and no way

Swing Trading Strategy: Closed my last remaining half of the Splunk (SPLK) trade yesterday at $161.32 for a +9% profit. Also made a nice day-trade in Tesla (TSLA) that I scaled out of for a gains that were as high as +11%. One of my short positions was also stopped out – PNC for a -3% loss.

Swing Trade Approach: Big day for the market yesterday! But for me? Not so much. Software stocks all took a hit across the board, and that had been my bread and butter over the past couple of months. However, I did book +24% in my UBER trade that I had been holding since December,

Swing Trade Approach: Big day for my long positions – the smaller amount of short positions that I held previously overnight didn’t fair too well, all but one at least. I closed my short on the biotechs (IBB) for a -3% loss. It was a great pattern that was showing a lot of weakness,