Swing Trading Strategy:

I closed another portion of my Virgin Galactic (SPCE) trade for +11% profit and will ride the remaining position as long as possible. Closed my short position in Dana (DAN) for a 3% loss. I closed Shake Shack (SHAK) out flat – as it just couldn’t push its way through the 200-day moving average. I’ve added two new long positions to my portfolio in the process, with additional long and short setups that I’m willing to consider going forward.

Indicators

- Volatility Index (VIX) – Stocks gave up most of their gains on the day and with that, VIX managed to bounce off of its lows and rally throughout the afternoon for a 1% gain, while still riding the declining support off of the August highs of last year.

- T2108 (% of stocks trading above their 40-day moving average): A respectable bounce back to 52% and once again a majority of stocks trade above their 40-day moving averages. However, this indicator strongly suggests that since late January, stocks as a whole have lost a good amount of their momentum.

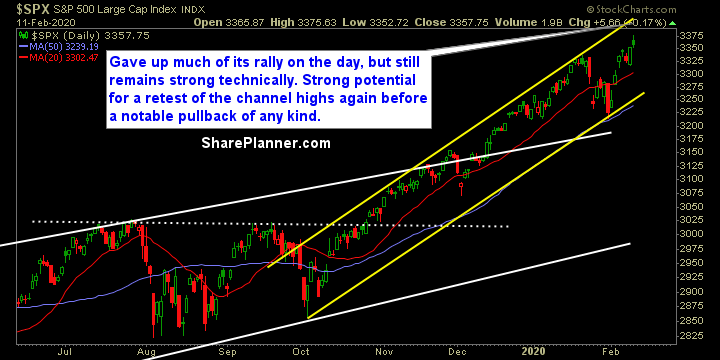

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Yesterday’s rally lacked Technology’s involvement and that is always an irritation for traders. Energy and Telecommunications led the way which isn’t ideal, because most people aren’t heavily weighted in those sectors. Much of the rally in the latter had everything to do with news out of Sprint (S) and T-Mobile (TMUS) merger news.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.