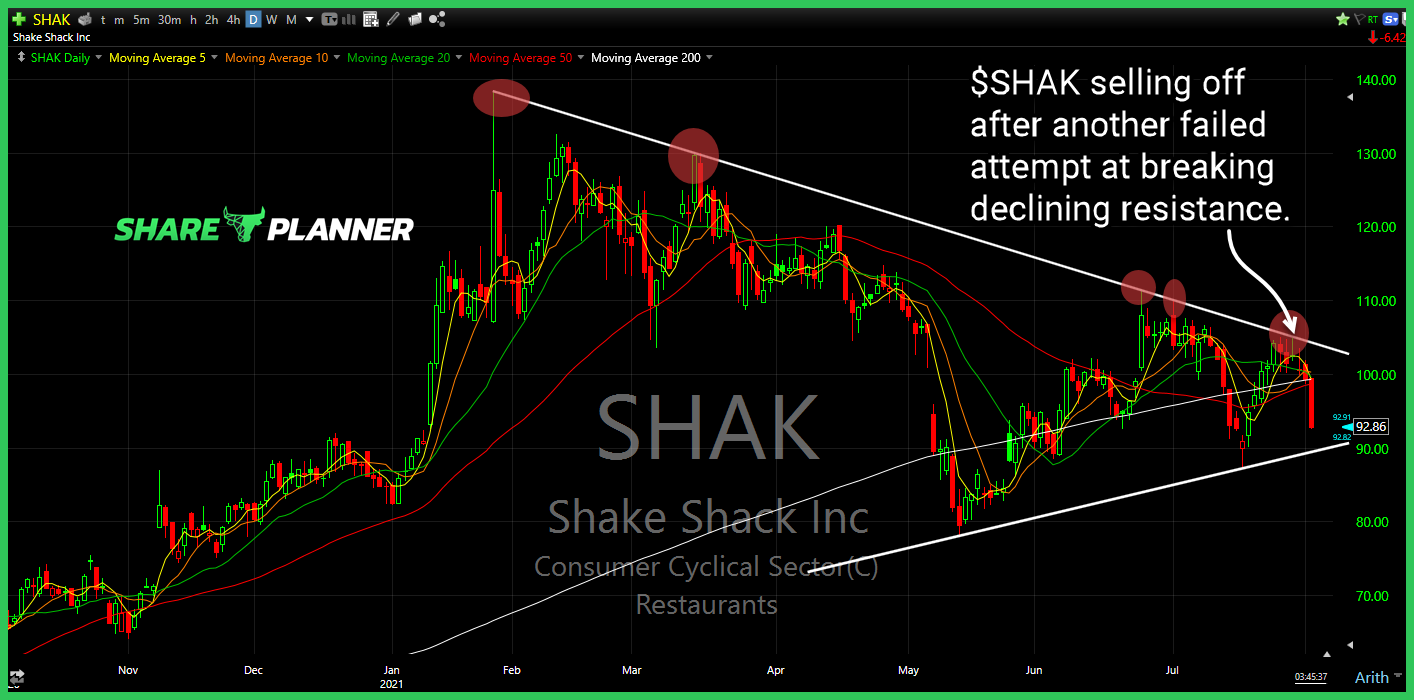

$SHAK breaking below key support today.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Swing Trading Strategy: I closed another portion of my Virgin Galactic (SPCE) trade for +11% profit and will ride the remaining position as long as possible. Closed my short position in Dana (DAN) for a 3% loss. I closed Shake Shack (SHAK) out flat – as it just couldn’t push its way through the

Shorting stocks in this market feels like an impossible task. I have a few short positions right now, but tons of longs to offset them. Even so, my short positions today are doing enough to really be a real irritation to me today. In fact right now, in the middle of this post, I closed

Swing Trade Approach: Whoa! That was quite a day for the stock market. I was stopped out of a few positions right at the open. The big ones being Universal Display Corp (OLED) and Delta (DAL) for a -6.8% loss and -5.7% loss (Those loser trades don’t deserve being highlighted in bold, I hate those things, and you

Swing Trade Approach: Overall a profitable day. I scaled back a tad, my long exposure, while keeping my short exposure the same. Still, I’m not against adding more positions here, but I have no desire to take on a ton of new long positions. I sold half my position in Shake Shack (SHAK) for a +12%, sold half

There’s no heights this market can reach where I will stop developing a list of stocks to short. You might be surprised, but I actually have a few short positions in the portfolio. On a day like today, they are actually doing well, and that is with the market trading ‘slightly’ higher. There’s not much resistance

Not much has changed with the market since last week. The market remains insanely bullish and little signs of weakness, if any. I closed out my last half position in Beyond Meat (BYND) today, getting stopped out at $120 for a +37% profit. I got long on January 9th at $87.75. What and awesome trade

I know I act like at times the bear case is dead, but there are some really good opportunities here and there. And the bear case is never dead, just greatly hampered, and in this particular case postponed. When the bull market has been raging for over ten years and is the longest one in

My Swing Trading Strategy I closed my only short position in Shake Shack (SHAK) yesterday for a +6.5% profit. Now I am 100% in cash, waiting to see whether the bulls can push price through resistance or whether it is going to fall apart again at the highs. Indicators Volatility Index (VIX) – End of day sell-off in