Swing Trade Approach:

Big day for my long positions – the smaller amount of short positions that I held previously overnight didn’t fair too well, all but one at least. I closed my short on the biotechs (IBB) for a -3% loss. It was a great pattern that was showing a lot of weakness, but when the market rallies 70 points in just two days, ETFs like IBB are likely to bounce pretty damn hard under such conditions – so no surprise there I needed to go ahead and get out of that trade. It was broken. But the rest of my positions, which were all long did exceptionally well for me.

Indicators

- Volatility Index (VIX) – To say the move in VIX from last week is getting crushed this week, is a total understatement. Trading above 19 on Friday, it is now hitting 16, and likely to see the 14’s today. While it managed on Friday of last week to break the declining trend-line off of the December 2018 highs, it couldn’t sustain the move beyond one trading session. VIX currently sits at 16.05, following yesterday’s 11% decline.

- T2108 (% of stocks trading above their 40-day moving average): SPX is setting up to hit new all-time highs today, and less than 50% of stocks are trading above their 40-day moving average. This continues to be the major bearish divergence for this market as has been the case since October of last year, but not real impact to market pricing has occurred.

- Moving averages (SPX): Back to trading above all the major moving averages and reclaiming the 5, 10 and 20-day MA yesterday.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities was the only sector to see any selling yesterday, which isn’t all that surprising when the market has an appetite for risk. Industrials found the support this week it needed at the November levels of last year. Materials finally showing some life and a willingness to bounce following the double top pattern. Technology and Discretionary poised for new all-time highs.

My Market Sentiment

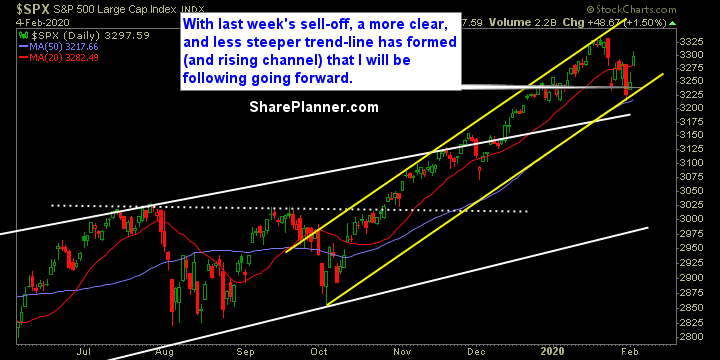

Day three of the bounce unfolds today, following a two-week sell-off and likely to hit new all-time highs. With the pullback, a better formed rising channel has been created to provide guidance to the market going forward. Headline risk still hangs a cloud over this market that you need to be mindful of though.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.