Bull Flag in the market indices pointing towards higher prices. I am predominantly long on this market, but still waiting to see if it really wants to extend itself notably higher than the highs established in January. So far the price action has bee a little sluggish, but on the same note, it isn’t giving

Remember when Trump was going to put us in World War III with Iran? Or how about The Trade War would ruin the global economy? Hell, I’m old enough to remember when North Korea was going to kill us all with their nuclear arsenal. But nothing has us freaked out like the Coronavirus! People are

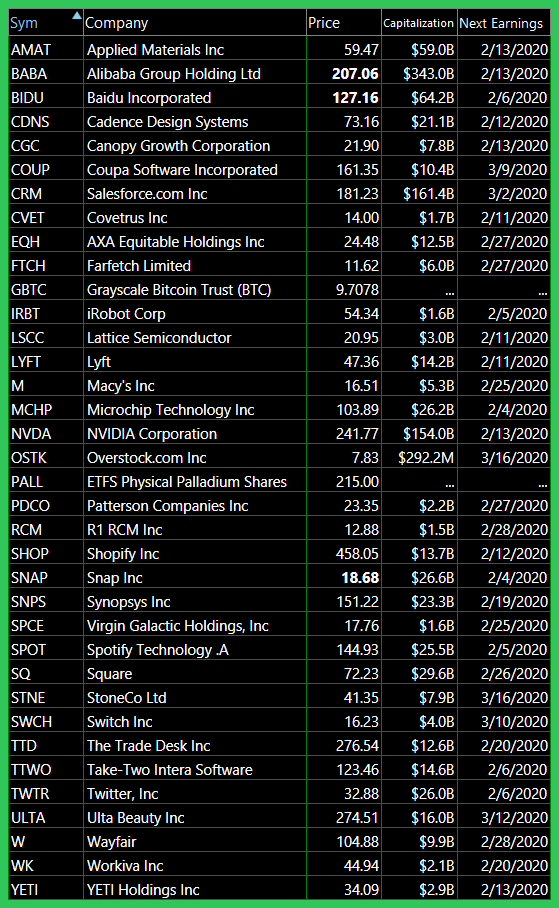

The Bulls Are Finding Solace in China’s Market Manipulating Tactics I can’t say that I am, though I have been rather quiet on the trading front today, I did manage to take a flier on a few trades like I am certainly benefiting from today’s action with Sqaure (SQ) rally +6%, and Smartsheet (SMAR) rallying +4%,

With SPX gaping down over 50 points this morning, there was no way the bulls wouldn’t buy the dip. To not do so, meant they would have to throw the towel in on this rally that has pushed higher incessantly since October. To not buy the dip means they would have to raise cash, and

I actually have a few short positions amid all of my long setups A couple of them actually are doing really well so far. Considering the market has ripped the life out of the bears the past few months, the fact that I have a short setup of any kind that is profitable is kind

Let’s be honest, Trade War, WWIII and Inverted Yield couldn’t take out this market, do you really think the Wuhan Coronavirus will? At some point, yes the rally will end, but it won’t be because of a virus that has 300 cases and 6 people that have died from it. Unless people start turning into

There’s no heights this market can reach where I will stop developing a list of stocks to short. You might be surprised, but I actually have a few short positions in the portfolio. On a day like today, they are actually doing well, and that is with the market trading ‘slightly’ higher. There’s not much resistance

Not much has changed with the market since last week. The market remains insanely bullish and little signs of weakness, if any. I closed out my last half position in Beyond Meat (BYND) today, getting stopped out at $120 for a +37% profit. I got long on January 9th at $87.75. What and awesome trade

It is hard enough just trying to find a short setup, try actually getting some downside out of them. With as bullish as the market has been over the last three months, it is next to impossible to find a legitimate short setup that can buck this market’s uptrend for any real length of