You can still see where the bears really haven’t bee squeezed yet, despite Friday’s rally, and today’s attempt at one, though right now it is still trading flat on the day. Big leaders are struggling, and if this market is going to sustain a bounce and do it in a convincing fashion, it will need

These market conditions continue to ugly themselves here. I don’t like it. Overall the NYSE Decliners holding a 16:13 edge so far today, which doesn’t bread confidence, and neither does the small caps trading 0.81% lower on the Russell.

The bears are trying to extend the sell-off into a third straight day. But let’s be frank, the selling is hardly anything to get concerned with at this point, there is little volume to it, and the VIX indicator is hardly moving either, as it still sits in the 12’s.

Today the market is pushing lower. There’s a chance here we see a retest of the 2900 level here, which today would respresent key support from the rising trend-line that was created off of the June lows. It also represents the 20-day moving average as well. But in the very short-term, you have support at

The bulls are dropping the ball today, following a solidly bullish week, where SPX traded higher each day. The problems lie with big tech today, which are absolutely getting slaughtered – even Amazon (AMZN) had a moment, where it came within a few bucks of its 50-day moving average. Then you have Apple (AAPL)

The market right now is not conducive to the bears. Getting heavily short right now, is certainly a fool’s game.

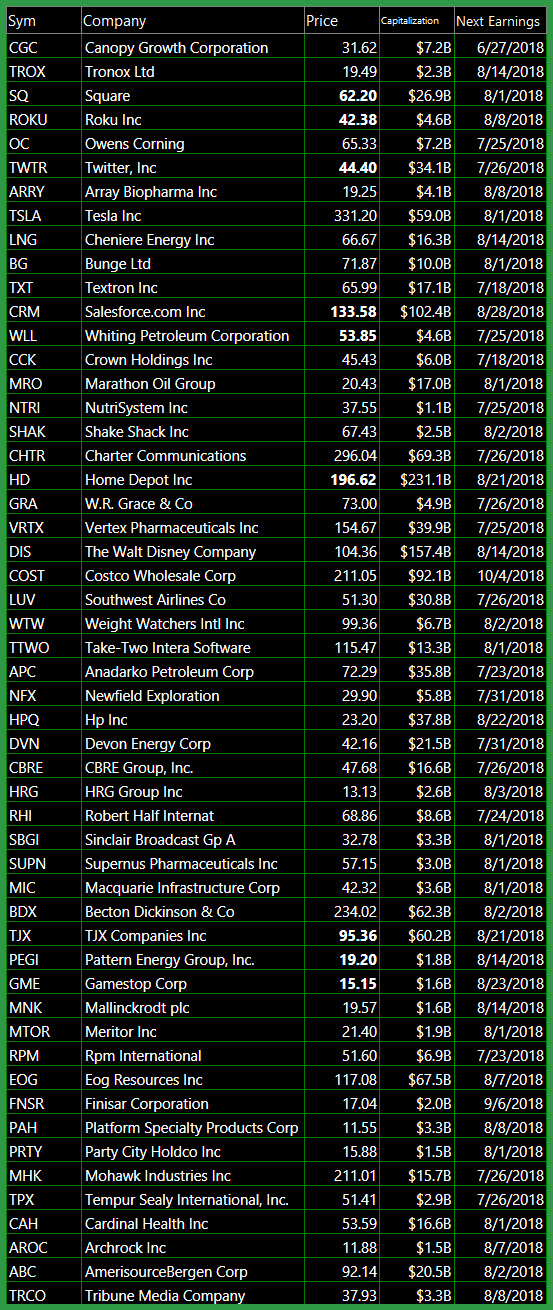

I’m not even sure I understand the title of the article, but hey, I provide you with a bearish watch-list you can trade from every week, but just because I provide you with one, doesn’t mean you should be making use of it. Right now is one of those times. Heck, I don’t even know

The Bulls are running today, but as has been the case of late, it is rotating sectors each day. Basically whatever sectors are leading the market one day, is what will be lagging the market the following day. Technology is struggling today, after leading the market on Friday. Despite the market trading higher, the breadth

The bulls fell of their rockers today, but as has been seen many times more in the past, the dip buyers tend to come in and save the day at the last second. So obviously, that is what I am looking for here today. Getting short at the open didn’t have a good risk reward

The bulls for a second straight day has managed to rally from +20 points down to near break even. While the trade war jitters keeps hitting the overnight price action, once the market opens, the dip buyers are in full force, gobbling up as many securities they can get their hands on.