Two key support levels could offer up some support on the weekly for $UPS.

Episode Overview Swing trading in a volatile market requires extraordinary amounts of attention to position sizing. Too large of a position can be the difference of panicking and getting out of the trade right before the trade becomes profitable. It is important to trade a position size, especially in volatile markets, that won't impact your

Watch the neckline on $COST for a potential head and shoulders confirmation (hourl

Episode Overview As traders, should we expect to evolve in our approach and strategy? Should we look to add new tools and strategies to the trading strategy one already has in place? In this episode, Ryan discusses the areas he has evolved in as a trader, and another area he is still evolving in, to

$XLE barely held support for a second straight day.

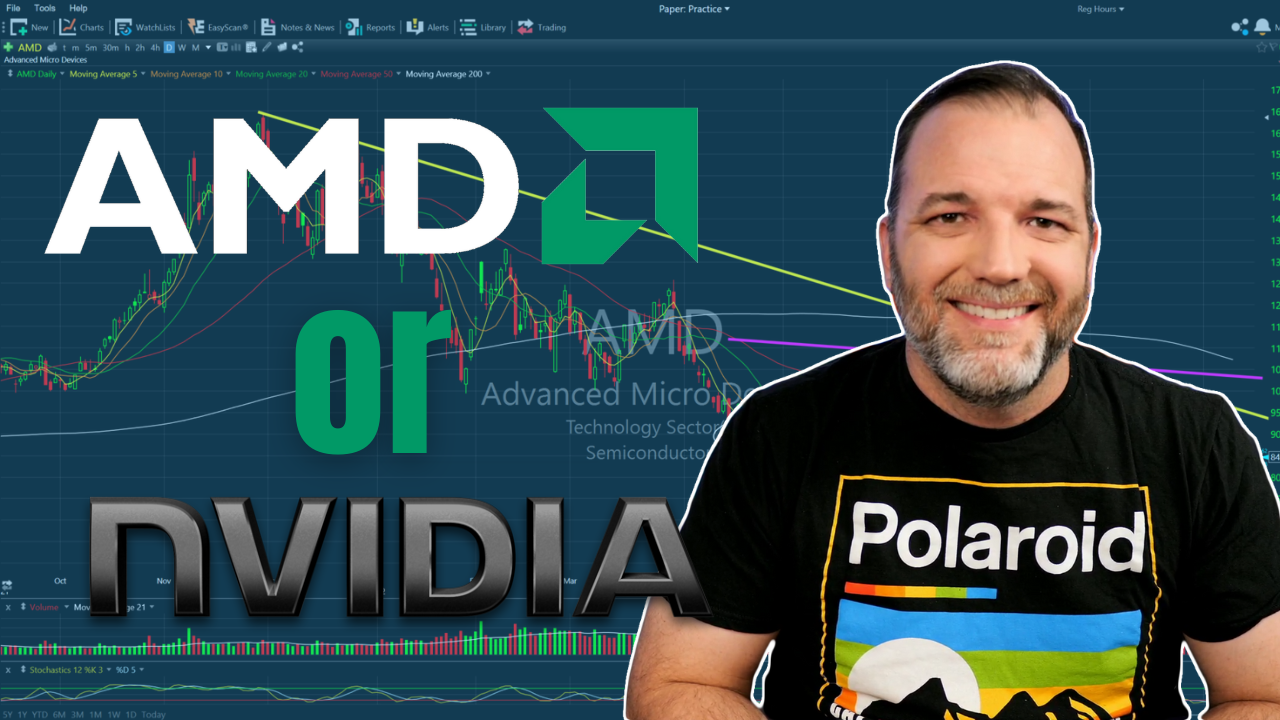

The bear market of 2022 has made swing trading challenging with massive swings in price and volatility. How can you swing trade the stock market successfully in a bear market or even worse in a stock market crash? In this video, I cover three unique ways to better help you achieve profitability in a bear

The bear market of 2022 has made swing trading challenging with massive swings in price and volatility. How can you swing trade the stock market successfully in a bear market or even worse in a stock market crash? In this video, I cover three unique ways to better help you achieve profitability in a bear

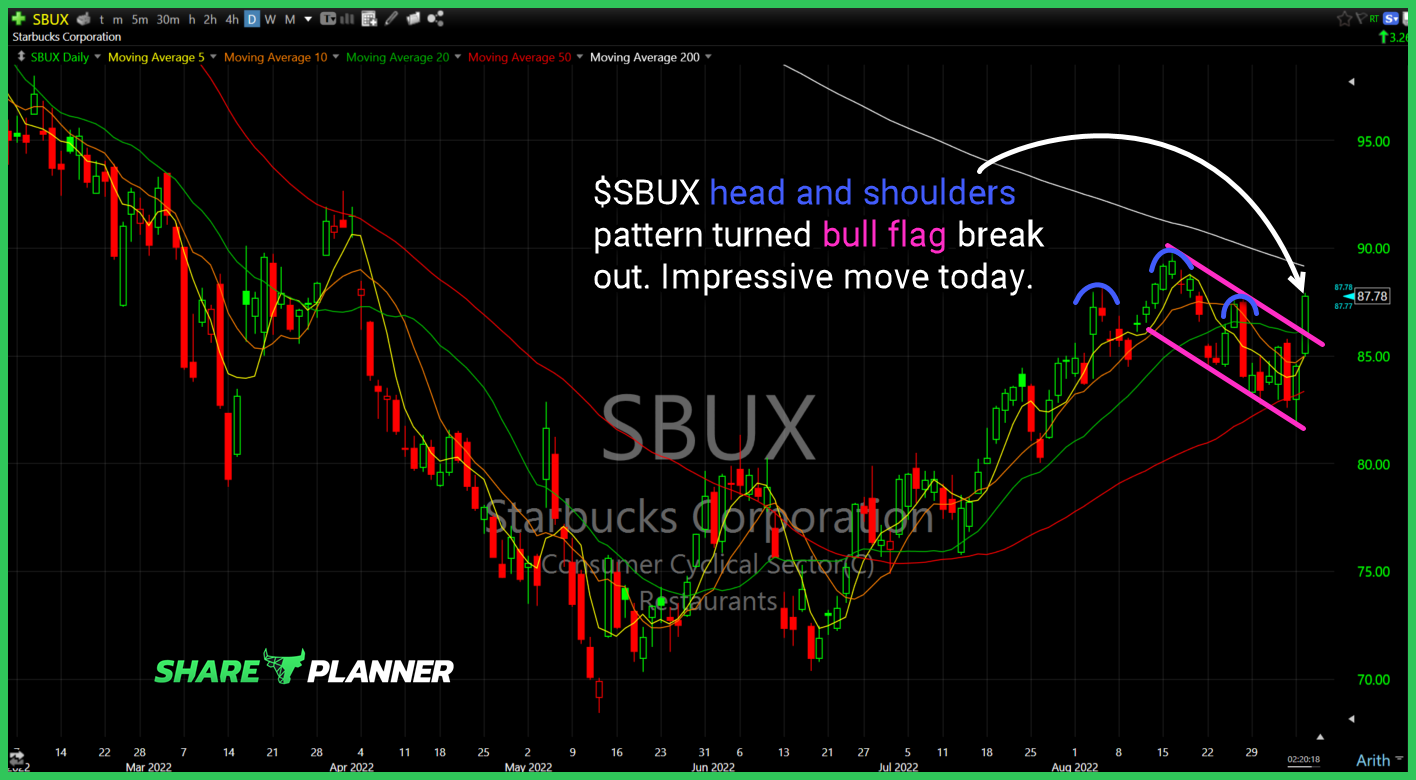

$SBUX head and shoulders pattern turned bull flag breakout. Impressive move today.

$LYFT short-term support getting tested. Possible there is a bounce, but don’t count on it.