$TTD testing the declining trend-line off the August highs. Watch for a potential rejection.

How high can this stock market rally go? Where will the market bounce stall out at? Using my technical analysis, I highlight some concerning downtrends to be aware of.

$COST cup and handle pattern attempting to breakout. Shaky footing so far.

Episode Overview Ryan Mallory talks about the importance of trading without conviction in his stocks and in the stock market, and instead focusing on his conviction for risk management, and the manner in which he swing trades the stock market. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan sets the stage

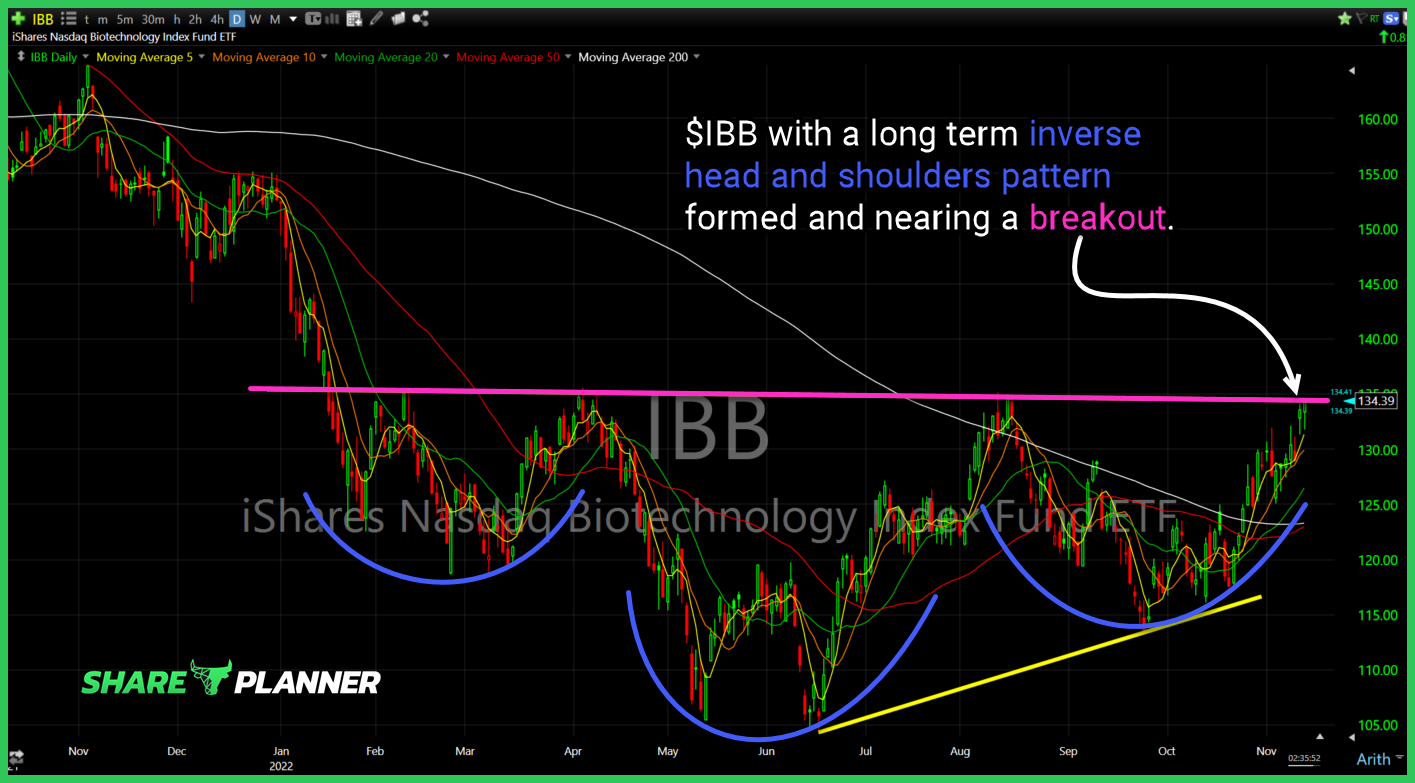

$IBB with a long term inverse head and shoulders pattern formed and nearing a breakout.

Nice breakout on $IESC but the volume makes it unplayable.

Episode Overview Following up on one trader's darkest day as a trader, Ryan finds out what helped one trader improve and find profitability in his swing trading strategy, while also going over the hazards of goal setting dollar amounts in one's trading strategy. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan

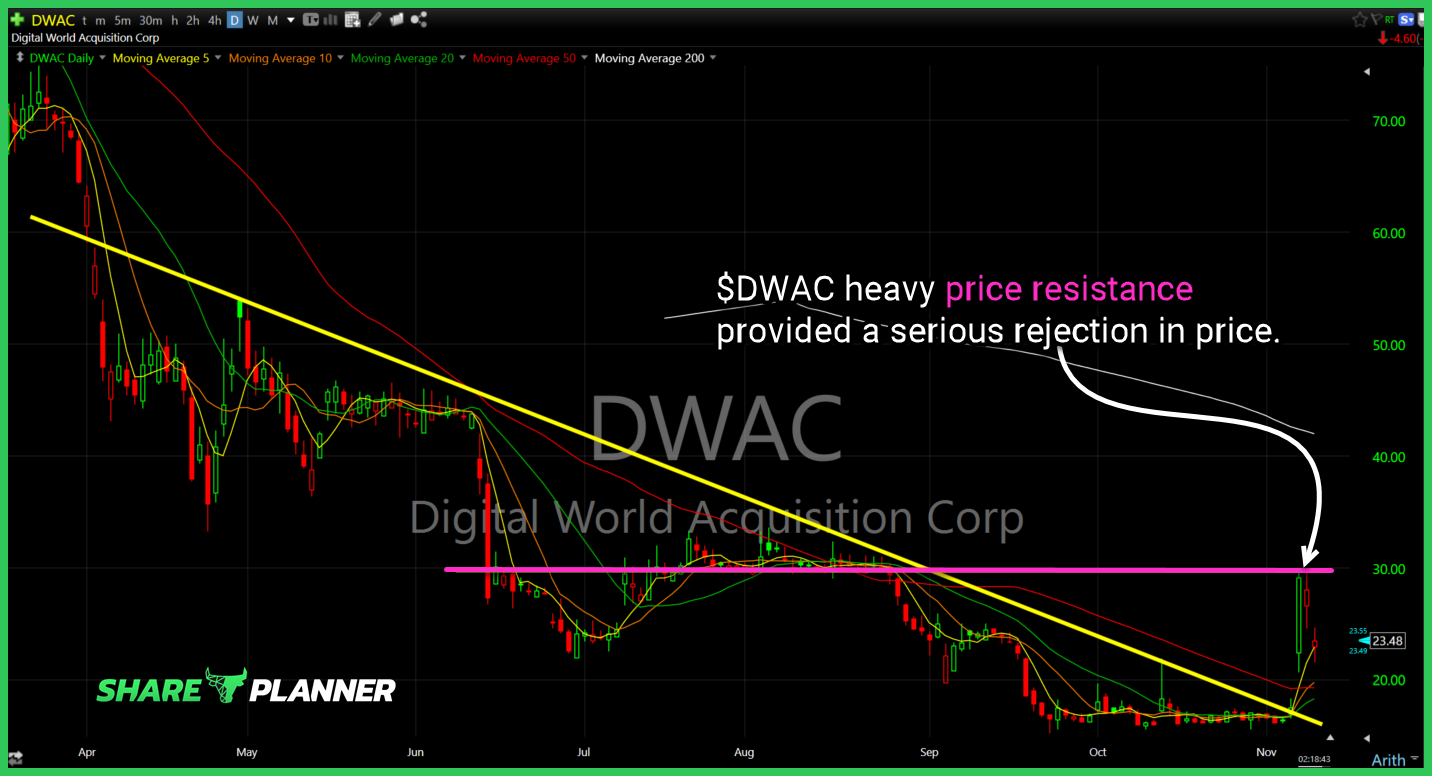

$DWAC heavy price resistance provided a serious rejection in price.

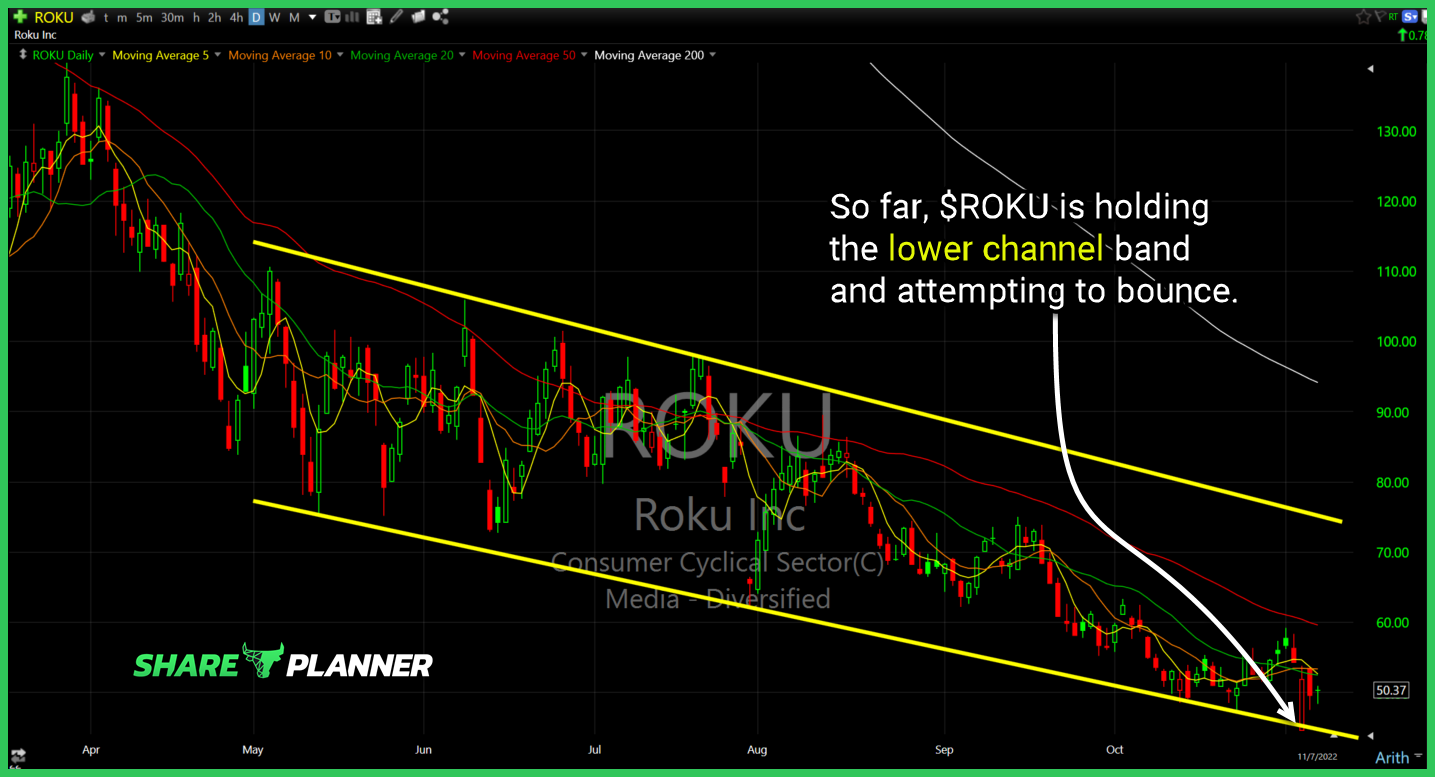

So far, $ROKU is holding the lower channel band and attempting to bounce.

Episode Overview Ryan tackles the differences in what it means to be a Joe Buck type of trader and not a Chris Collinsworth trader. Both are announcers in the NFL, and both couldn't be further different. You'll have to listen to this podcast to find out exactly how it applies to swing trading and how