Episode Overview Ryan Mallory digs deep on measuring risk as it pertains to position size and stop-losses and how to take into account headline risk for your swing trades. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:58] Chester’s questionA listener asks how Ryan defines risk in practice and how withdrawals or account

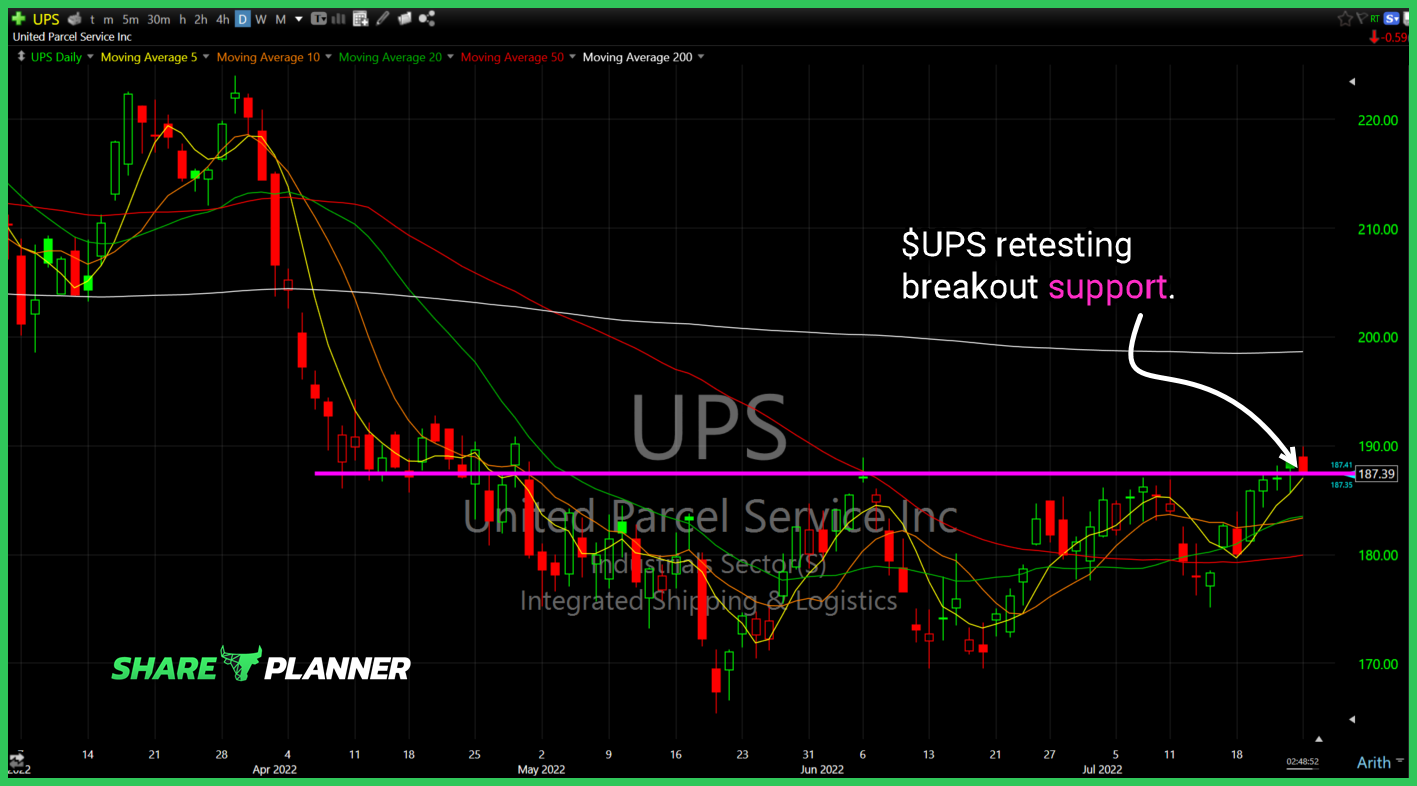

$UPS retesting breakout support. Needs to hold and bounce.

And with that $SNAP officially loses its long-term support level.

Episode Overview One trader has seen his trading account drop by 33% and after 82 trades in the stock market since February, he's asking the question, "Should I just admit that I've blown up my account, and start over?" 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off setting up

$LRCX clearing significant resistance both short-term and mid-term.

$GME declining resistance being tested today.

$SRG pushing through significant resistance – high risk/high reward play.

Learn to let the charts tell you the story it wants to tell you. You can't be too dogmatic on particular indicators, or moving averages. Instead look for the edge that a chart might be trying to tell you and what works for one chart doesn't necessarily work for all charts when it comes to

Nancy Pelosi bought between $1 million and $5 million of Nvidia stock (NVDA). Is this the time to buy NVDA stock ahead of the possible passage of the semiconductor bill currently in Congress? How does Nancy Pelosi's stock trades measure up in this bear market?