$TSLA noticably down on the week despite rising 4 out of the last 5 days.

Episode Overview Can a trader use technical analysis on inverse and ultra ETFs or should he only focus on the underlying asset the ETF is pegged to? Also, Ryan dives deep on this current bear market rally and how long it may rally for. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07]

Watch how $COIN holds up against a retest of the breakout/support level. Critical that it holds.

$EVH fading its breakout of resistance today, but may become a nice bounce play off if it can hold the breakout level.

Episode Overview Ryan goes in detail what his computer setup looks like for swing trading the stock market. He also provides the specs on a number of key hardware aspects, as well as his preferred trading platform, and where he got his trading desk from. And he answers the question that many people want to

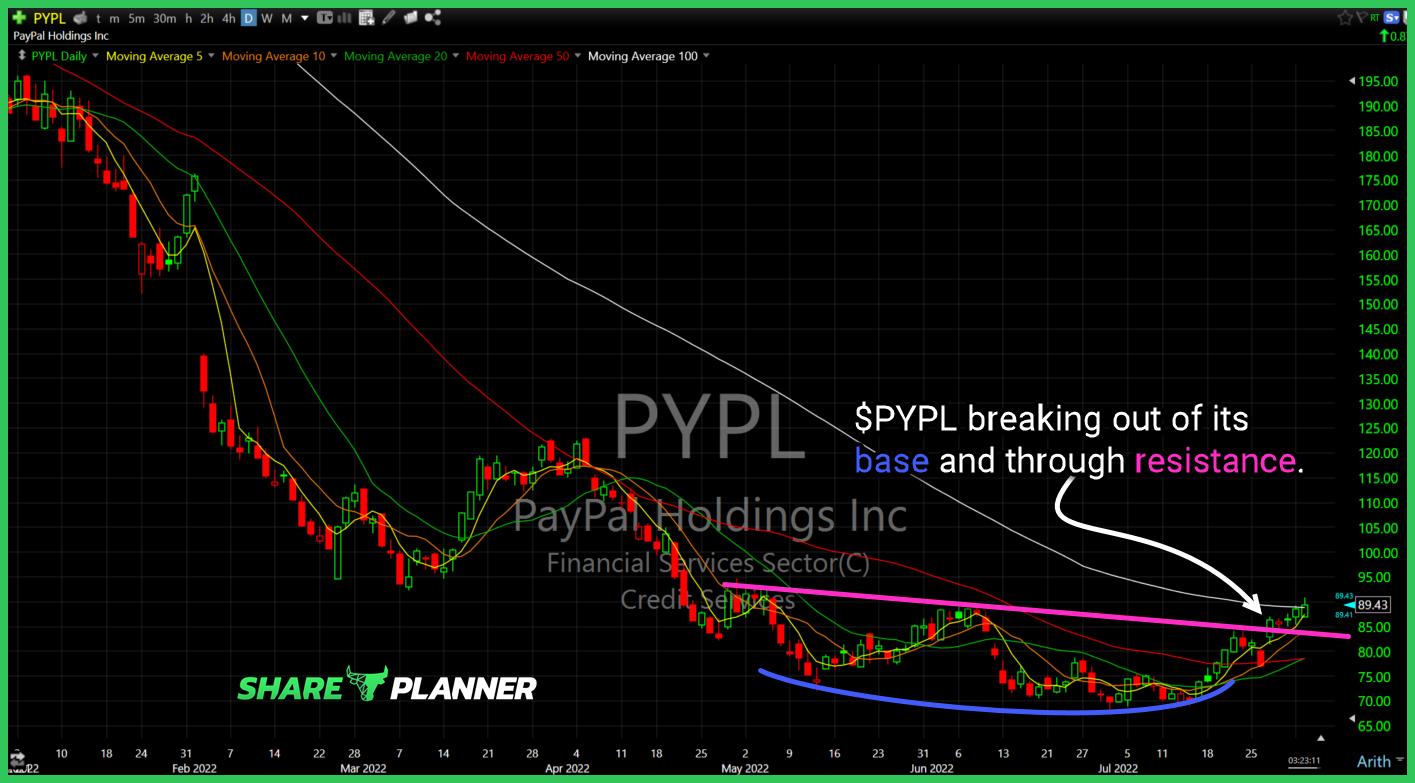

$PYPL breaking out of its base and through resistance.

With an amazing stock market rally over the last few weeks, is it safe to say the stock market bottom is in or should we expect the stock market crash to continue? In this video I provide my analysis on the stock market by using technical analysis on the SPY, QQQ and IWM ETFs.

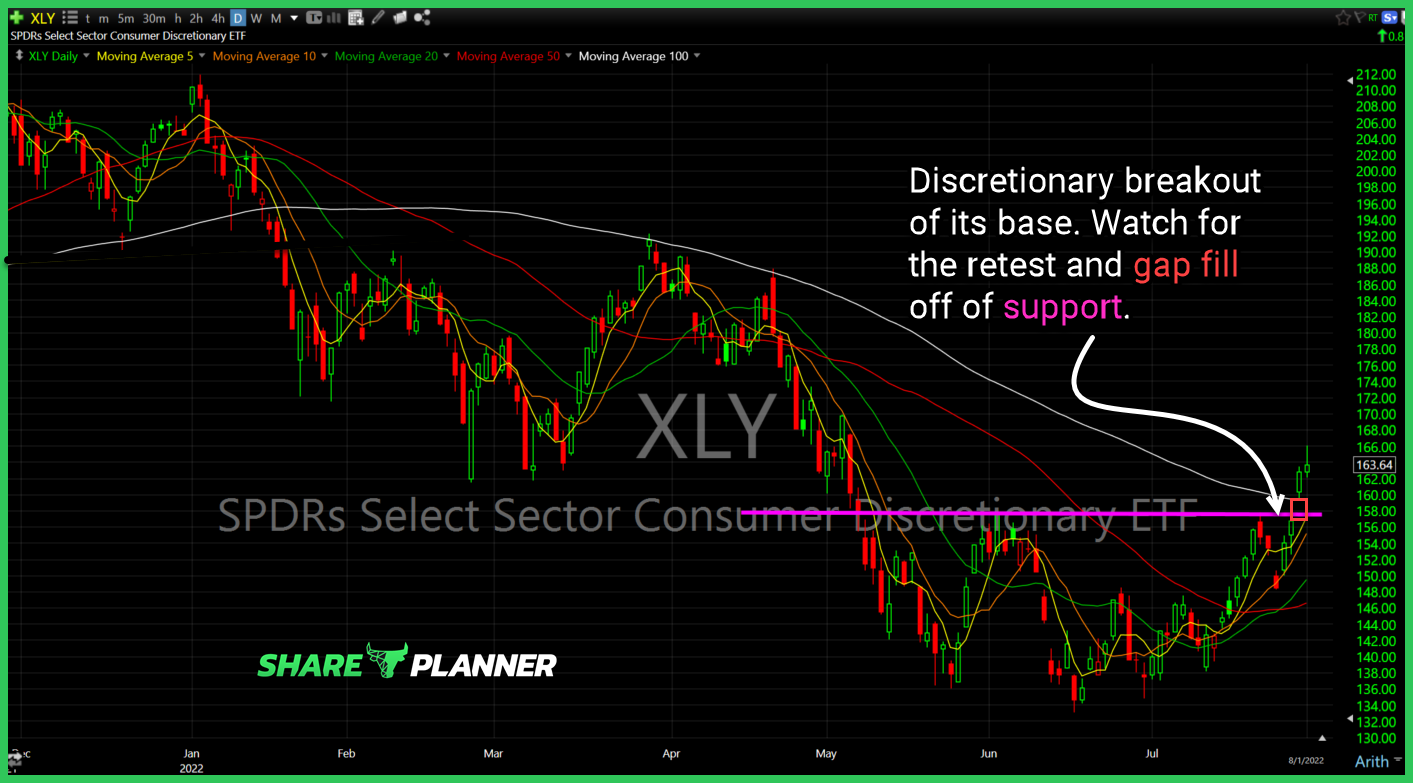

$XLY breakout of its base. Watch for the retest and gap fill off of support.

$BABA – Watch this rising support level off the March lows and whether price holds.

Episode Overview Ryan shares a raw account of his most recent swing trade, how awful it was, what he learned from it, and what he must do going forward. It is a raw reflection in the anguish and disgust that comes with losing on a trade, even when one remains completely disciplined in their approach.