Episode Overview What are some of the key metrics and considerations you should both achieve and think about when it comes to adding more capital to your account? Should your position sizes stay the same? In this podcast episode, Ryan Mallory gives you his thought process when it comes to increasing your account size. 🎧

$NU nearing a breakout of a four month base.

$BTU stuck in a channel until it can break the upside, creating much more bullish prospects.

Episode Overview Ryan Mallory goes over using trailing stops, versus manually setting stop-losses. Also discussed, is the use of covered calls and writing cash secured puts. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Managing Market VolatilityRyan explains trailing stops, covered calls, and cash-secured puts. [1:18] Bear Market Reality CheckRyan highlights how

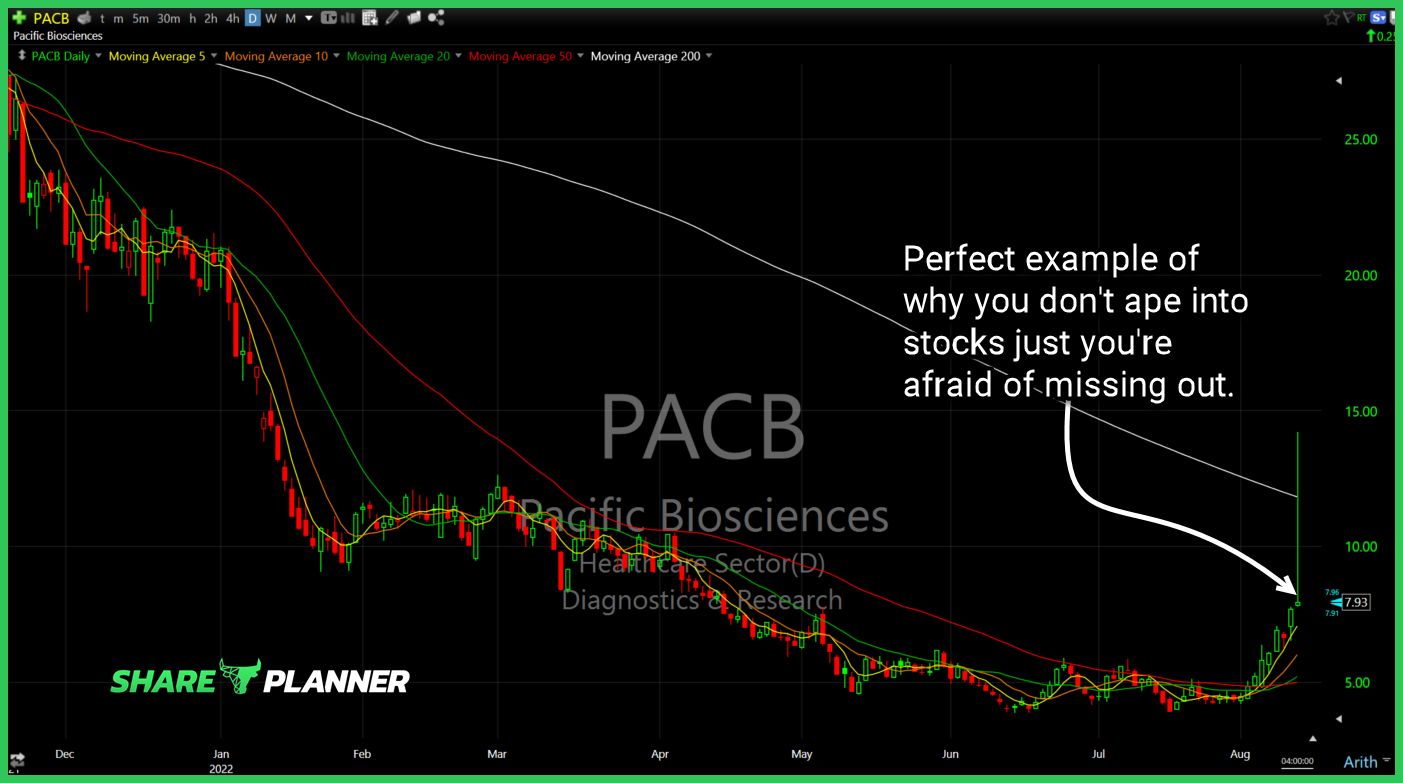

$PACB perfect example of why you don’t ape into stocks just you’re afraid of missing out.

Big move out of $DIS earnings!

$DWAC bear flag pattern below major resistance confirming today.

Episode Overview When should you give up on trading? At what point do you throw in the towel and just say "this isn't for me". Ryan Mallory tackles one reader's bad luck in trading, and despite loving trading, he wants to give up on it following a recent string of losses. 🎧 Listen Now: Available

Market sitting its rising trend-line on the $VIX after a 7 week decline.