$DKNG breaking below key support.

The mother of all head and shoulders patterns is forming on $TSLA.

$MSOS testing resistance on the spike higher.

$XOM attempting the breakout of the triangle here.

Episode Overview How does the futures relate to the indices and the overall outcome of the market? Are they a predictor of the future, like their name would suggest? Or are they simply an extension of the indices, metals, grains, etc. when the market isn't trading? In this episode I dissect what the futures market

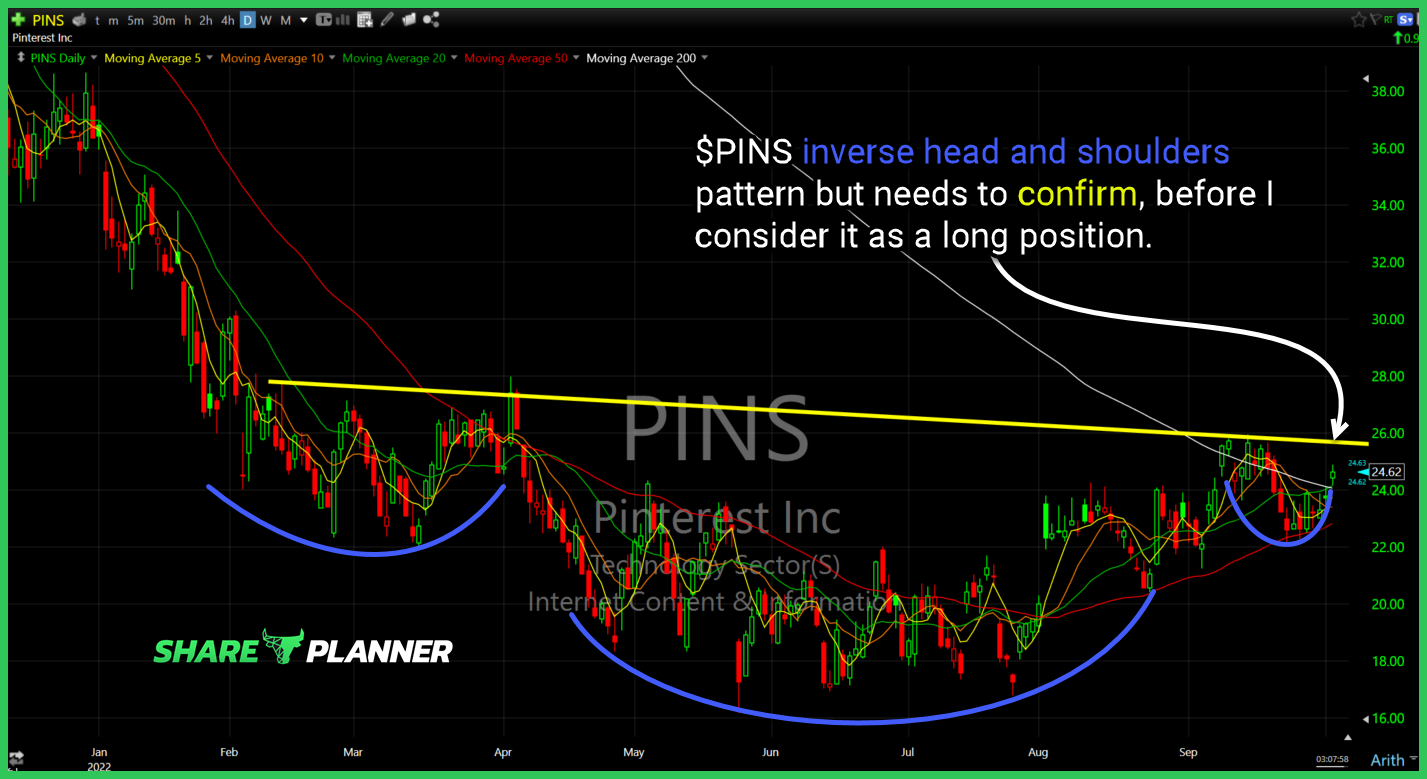

$PINS inverse head and shoulders pattern but needs to confirm, before I consider it as a long position.

$SLV broke declining resistance, but now needs to push through an confirm the triple bottom.

$XLE attempting to sustain a bounce off year-long support, following heavy selling.

Episode Overview One Instagram follower asks Ryan why he has relied so heavily on inverse ETFs in this Bear Market as opposed to individual stocks in his swing trading. PLUS, Ryan has one of the best bourbons he's ever had! 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Leveraging Inverse ETFs in

Any bounce in $USO should be viewed in light of heavy resistance overhead.