My Swing Trading Approach

I will look to add 1-2 new positions today if the market strength can hold this morning. I booked profits in a number of positions yesterday, but will gladly ‘hop’ back into my positions today, should the market allow.

Indicators

- VIX – Only small push higher yesterday, of 3.6%. Very much, a muted move.

- T2108 (% of stocks trading below their 40-day moving average): No indication of selling accelerating just yet. Only down 3.5% yesterday, snapping a seven day streak. Closed at 49%.

- Moving averages (SPX): Held the 5-day moving average yesterday, no other technical developments took place.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Utilities and Defensive were at the top of the pack yesterday. Significant selling seen in Tech stocks, as there was a rotation out of that sector and into Healthcare and Industrials.

My Market Sentiment

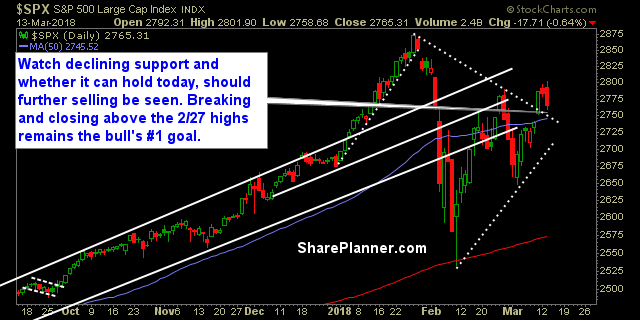

Tested and held the 5-day moving average yesterday. Needs to hold support at the declining resistance level. Tariffs continue to plague the market but have yet to create any real technical damage to the charts.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Long position