$SBUX with a really good rally today post earnings. Now looking to test the declining trend-line.

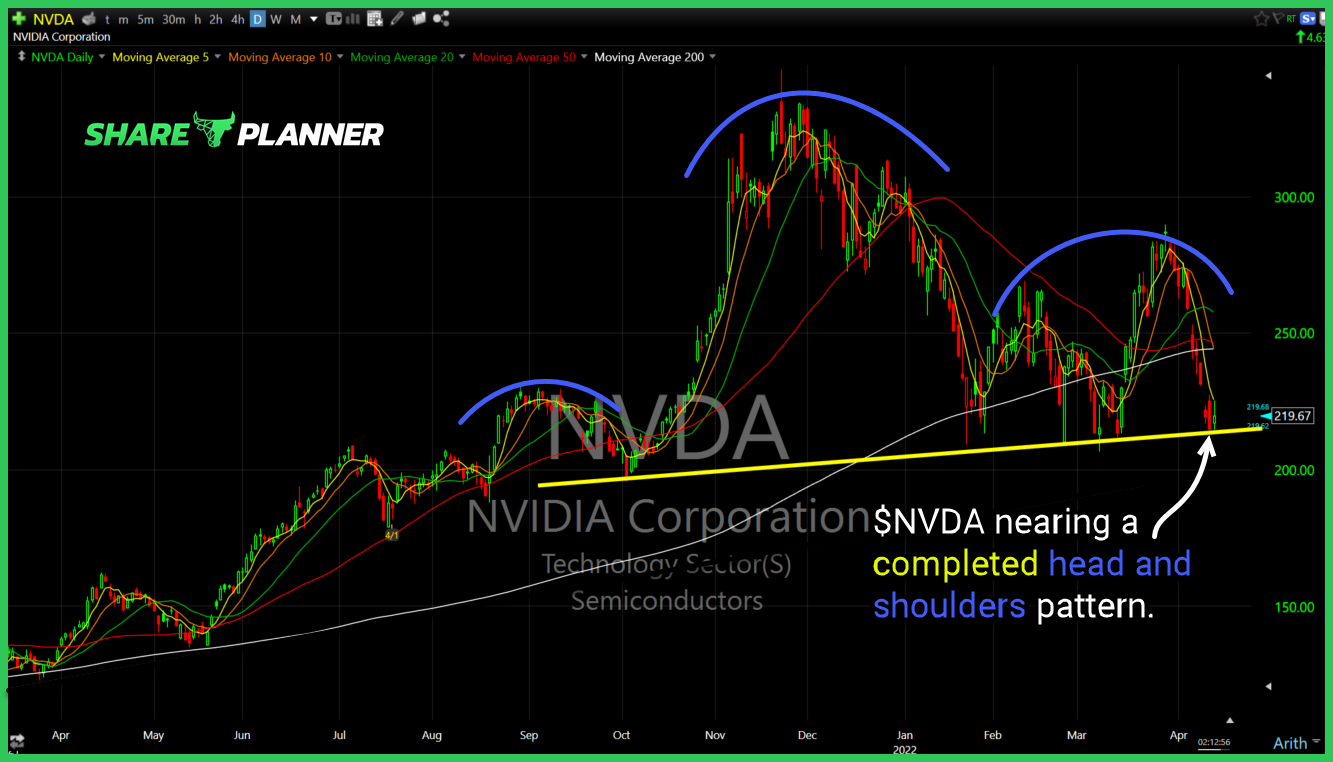

$NVDA closing in on the neckline of its head and shoulders pattern.

Macy's (M) testing key support levels right now. Nvidia (NVDA) once again trying to hold its 200-day moving average. Home Depot (HD) major support broken following its earnings. Digital World Acquisition (DWAC) pulling back to the breakout level - a key moment for the stock.

$ARKK bear flag and declining trend-line still causing trouble for investors… and Cathie Woods is the most overrated trader of my lifetime.

$TSLA long-term trend-line getting tested right here.

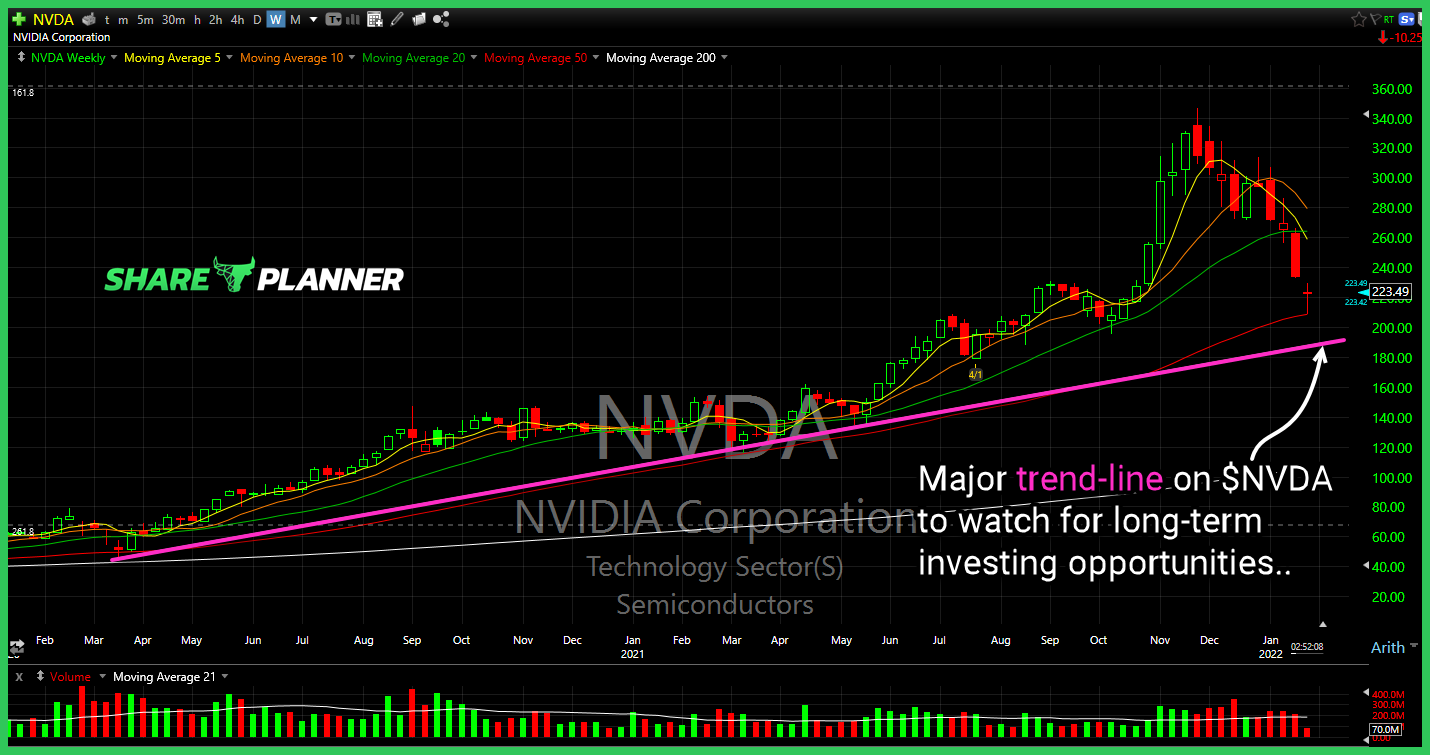

$NVDA long-term trend-line to watch for future long-term investment. A break of the trend-line and then it becomes the $160’s.

Affirm (AFRM) breaking through the head and shoulders neckline today. Nvidia (NVDA) pullback to its trend-line, $230's becomes the next trend-line if it breaks. Otherwise, watch for a bounce. Snowflake (SNOW) breaking its rising trend-line. Adobe (ADBE) huge double top in place, yet tor confirm, but testing the major support level.

Nvidia stock (NVDA) had an incredible week in the stock market. But with its earnings report coming up, and already up 128% on the year, is this the time to still buy NVDA stock or is there a better time for me to buy. How does Nvidia stock compare to Tesla stock? How do you

The stock market crash of 2020 is far outpacing the 1929 Stock Market Crash. People are panicking and now we all are wondering when will the stock market recover, and I should buy stocks now. People are wondering whether to sell stocks now. In my latest stock market crash update, I go over in detail

The Bulls Are Finding Solace in China’s Market Manipulating Tactics I can’t say that I am, though I have been rather quiet on the trading front today, I did manage to take a flier on a few trades like I am certainly benefiting from today’s action with Sqaure (SQ) rally +6%, and Smartsheet (SMAR) rallying +4%,