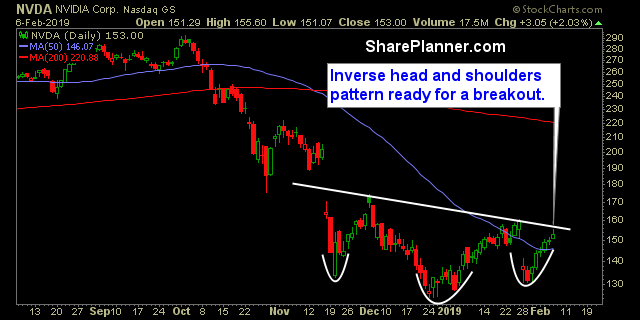

Tuesday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Nvidia (NVDA)

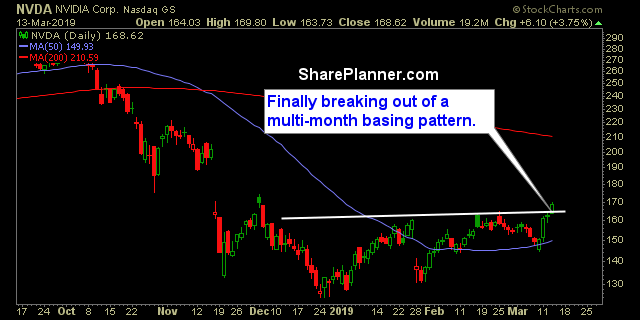

Thursday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Nvidia (NVDA)

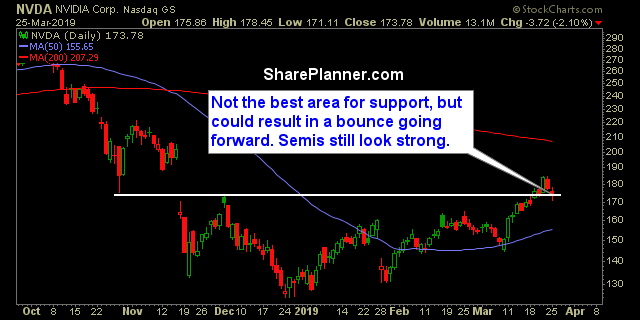

Thursday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Nvidia (NVDA)

The market is taking a bit of a hit today – nothing major or game changing though. But it is enough to spark concerns considering the selling accelerated as a second major tech company (Apple being the first) decided to cut guidance. Nvidia (NVDA) has certainly put a damper on the market today, but

My Swing Trading Approach I added two new long positions yesterday and closed NVDA out at $150.95 yesterday for a flat trade. I will be very tentative about adding any new positions today and will let the market play itself out in order to show it can handle a gap up. Indicators Volatility Index (VIX) -

My Swing Trading Approach I closed out my two swing-trades that I had open in SQ and NFLX for +5.3% and +1.4% respectively. I am now back in cash. And will consider getting back long or flipping to the short side, depending on the market's action today. Indicators Volatility Index (VIX) - Yesterday's VIX candle suggested

You can still see where the bears really haven’t bee squeezed yet, despite Friday’s rally, and today’s attempt at one, though right now it is still trading flat on the day. Big leaders are struggling, and if this market is going to sustain a bounce and do it in a convincing fashion, it will need

Friday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Nvidia (NVDA)