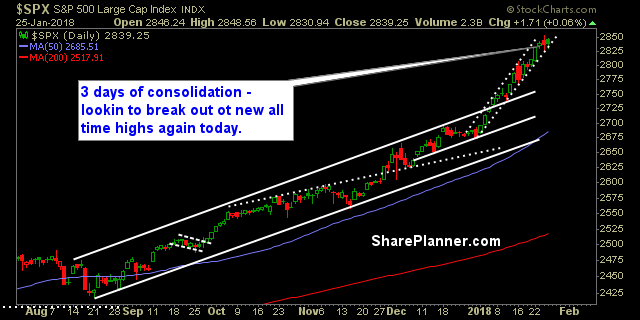

My Swing Trading Approach Same strategy as yesterday – with the market popping in the pre-market, if it can hold on to the gains in the early morning trading, I will be looking to add 1-2 new positions to the portfolio. Indicators

My Swing Trading Approach With the market popping in the pre-market, if it can hold on to the gains in the early morning trading, I will be looking to add 1-2 new positions to the portfolio. Indicators

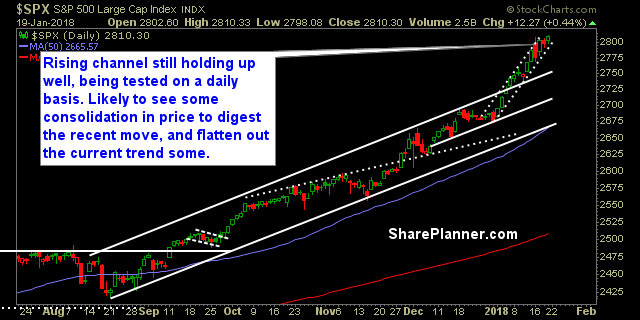

My Swing Trading Approach I added two trades to the portfolio yesterday, was whipped out of a another for a small profit. I will look to keep the portfolio the same, with little changes to it, beyond increasing my stops. If a great opportunity comes my way, I may pull the trigger on it. Indicators

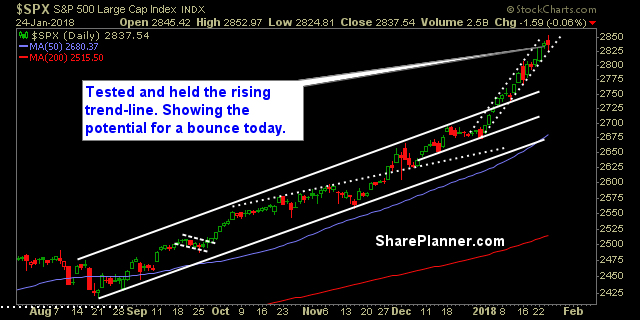

My Swing Trading Approach I added two trades to the portfolio yesterday. I may sit on the sidelines today if the market doesn’t show enough strength to get this market rolling again today. Indicators

My Swing Trading Approach Added two new positions to the portfolio on Friday, looking to add 1-2 more today. The market, simply isn’t breaking, and the trend can’t be wrestled with. Indicators

My Swing Trading Approach I am open to adding one to two new positions to the market today, but price action in the overall market needs to be favorable. Indicators

Friday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Nvidia (NVDA) Long Abbott Laboratories (ABT)

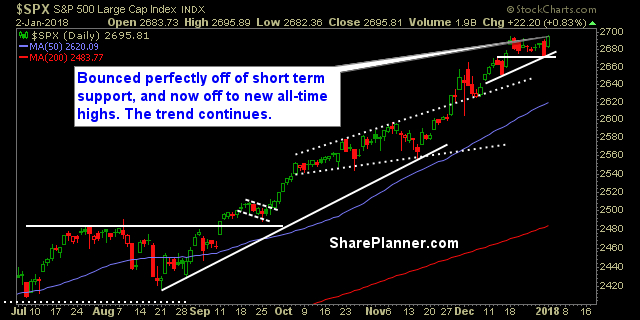

My Swing Trading Approach Should this rally continue into today, 1-2 new positions is likely for the portfolio. I will also continue raising my stops on my profitable positions. Indicators

My Swing Trading Approach A number of my profitable positions were stopped out yesterday. That’s what the stops are there to do – protect profits! So, if this market can sustain the early morning strength being seen so far, I will look to add 1-2 new positions to the portfolio today. Indicators

My Swing Trading Approach First, I’ll manage the profits in my existing positions, primarily by raising the stop-losses. Then I will look to add additional long exposure as the market permits. Indicators