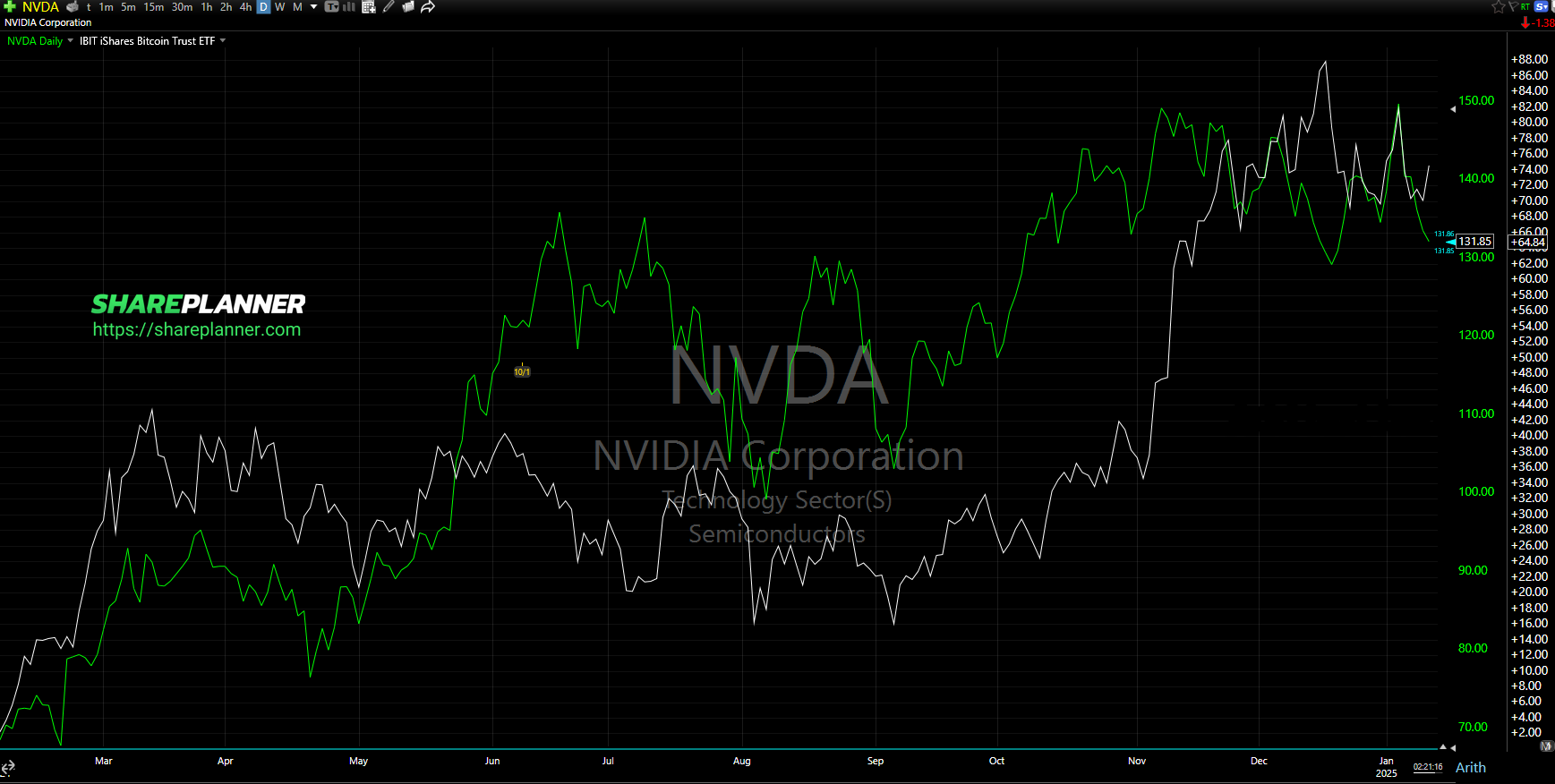

Is it time to buy the dip in NVDA? Nvidia (NVDA) had a 17% decline in one day, representing over $600 billion lost in market cap, which was the single biggest decline in market cap in the history of the stock market (META held the record before at $232 billion). Wit that being said, is

Nvidia (NVDA) or Tesla (TSLA)? I analyze two of the most popular stocks, Nvidia (NVDA) and Tesla (TSLA). I provide the technical analysis for each stock and decide whether TSLA or NVDA is the better swing trade for traders, with the overall stock market in mind. Become part of the Trading Block and

Managing Portfolio Volatility in Swing Trading: Essential Tips for Success The stock market is a dynamic environment, and succeeding as a trader requires more than just knowledge of when to buy and sell. Managing portfolio volatility is crucial to sustaining long-term success in swing trading. It’s not just about making profits; it’s about protecting them

Can we expect another major move from NVDA earnings this time? NVDA earnings is coming up and in this video, I provide everything you need to know about their earnings report and what to expect from the report. In this video, I'll cover NVDA's recent price action, earning expectations and what that means from an

Buy the dip in semiconductor stock? Semiconductor stocks have plummeted over the past month. Is it now time to buy the dip in semiconductor stocks like Nvidia (NVDA) and Advanced Micro Devices (AMD), among others? In this video I discuss the potential for a bounce within semiconductor stocks and the SMH ETF as well as

Market Rotation Into Small caps is unfolding. IWM ETF appears to be set to make another rally here to the upside as the market rotation into small caps continues. Russell 2000 (IWM) pulled back late last week and is now bouncing off of the Fibonacci retracement levels and sets up for a potential rally

The indices are making new all-time highs on a regular basis, following NVDA, MSFT and AAPL - but is it time for the "everything else rally"? But what about all the other stocks that have been lagging behind? In this video, I'll explore whether these overlooked stocks are poised to play catch-up and join the

Navigating the Storm: Cash Strategies for a Market Correction During a stock market correction, it is natural to feel anxious and wonder if going cash in one’s portfolio is the best course of action. As a seasoned trader, I’m here to tell you that going to cash during a correction is not a rookie move