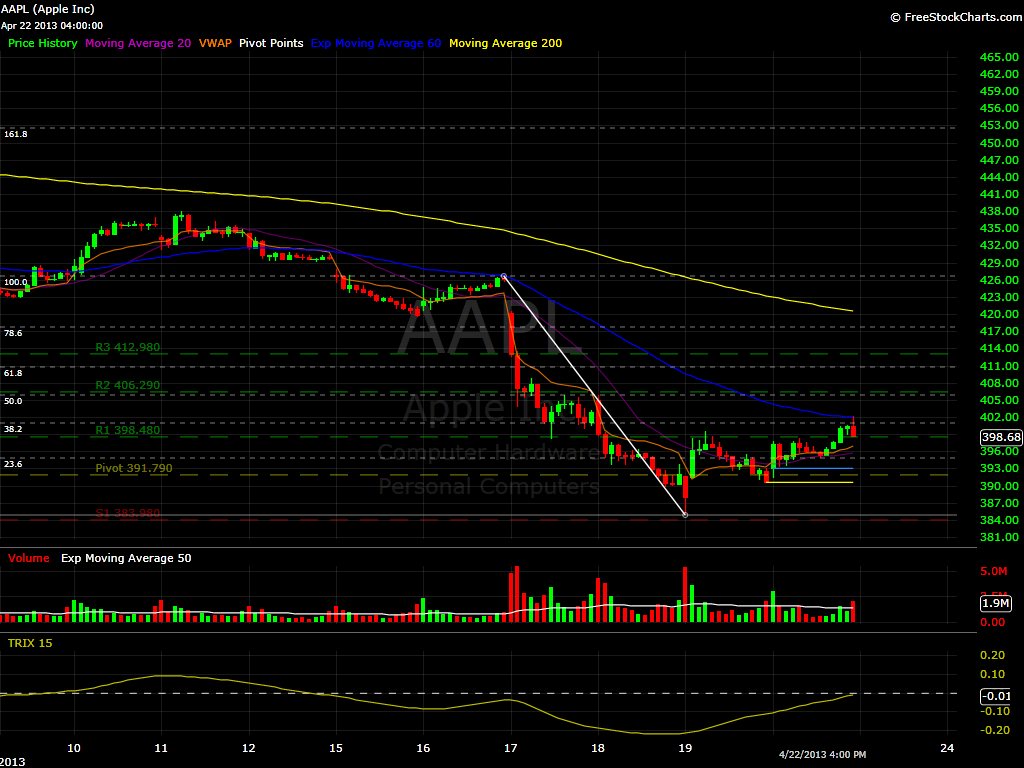

Apple (AAPL) 3 Day Chart – Nice move from the 385 level, that I tweeted about last week. It is currently above 400 which on a short term basis, correspond to the 38.2% Fibonacci Level. So as long as it stays above 400.90, it is a good long.

Amarin (AMRN) 4 Hour – I want to see if it can reach 7.37 before I can take it.

Arm Holdings (ARM) Hourly Chart – That is a huge gap, If it can hold above 43.40, I do believe it is poised to make new highs. If it can’t hold, this will be a nice short.

MCGC Daily chart – Hold that 5.08, and it is a nice long.

Netflix (NFLX) 2 Day Chart – Very impressive move, I will be watching to see if it can hold 209, and make new highs. If not, it will be a nice short, good for 20 points.

NXP Semiconductors (NXPI) 15 min chart – Nice gap, I will be watching for 26.75 to hold, before making a move.

SCMP Daily chart – Opening right under the 78.6% Fibonacci level. I am not convinced, I think it drops back down.

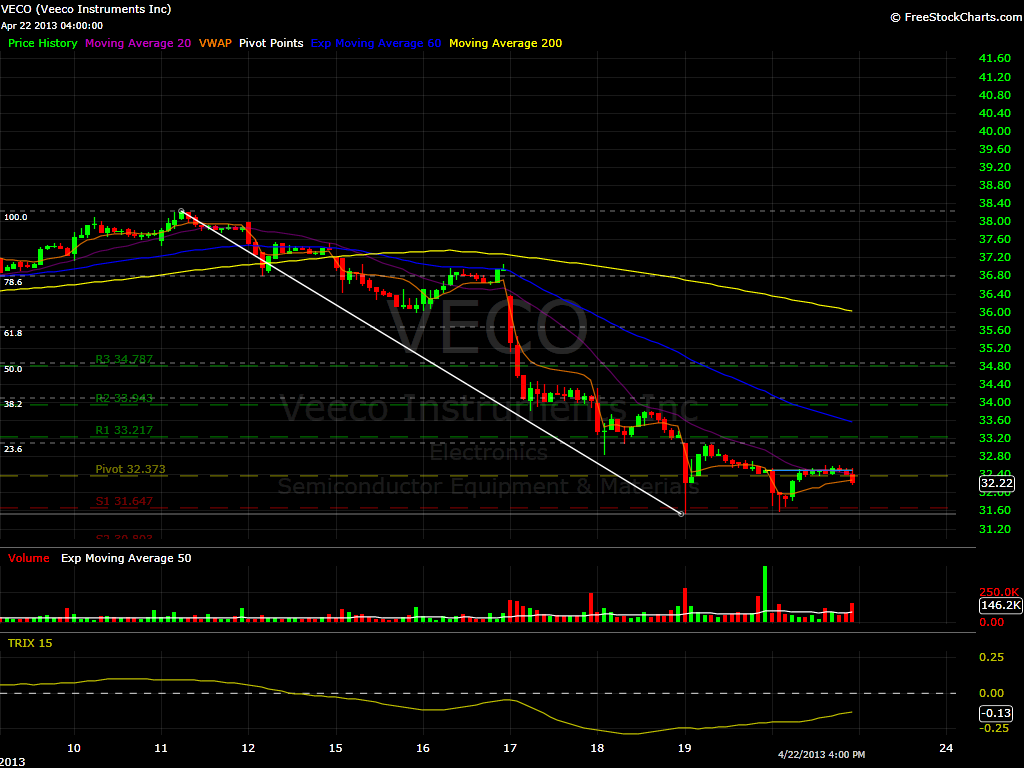

Veeco Instruments (VECO) Daily chart – Another monster move to the upside, The next Fibonacci level above the current pre-market is 36.80, that is where I think it will go before it pullsback.

I partnered with SharePlanner.com to bring a new trading experience service.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.