Pre-market update (updated 8:30am eastern):

- European markets are trading 0.7% higher.

- Asian markets traded 1.2% higher.

- US futures are moderately higher ahead of the open.

Economic reports due out (all times are eastern): Jobless Claims (8:30am), Existing Home Sales (10am), Philadelphia Fed Survey (10am), Leading Indicators (10am), EIA Natural Gas Report (10:30am)

Technical Outlook (SPX):

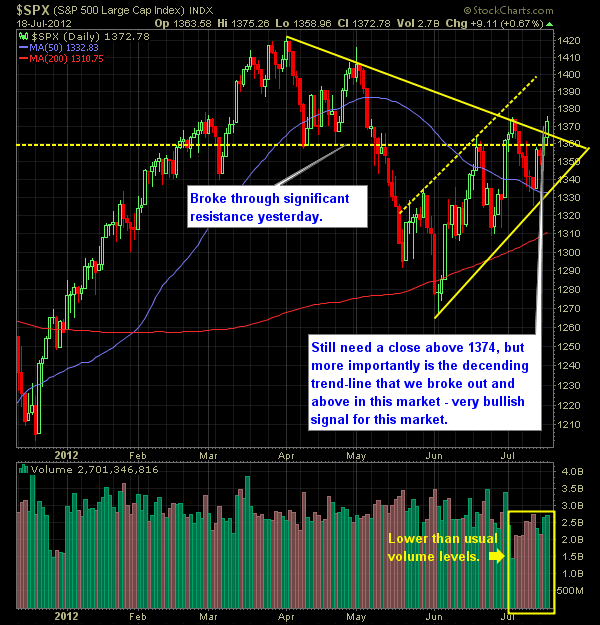

- We finished just a shade below that critical 1374 resistance level. Today’s early morning pre-market strength has us gapping up and through this price level.

- By finishing above this price level, we’ll essentially put in a new higher-high in the market, but only the closing price matters.

- Yesterday we managed to break through the descending trend-line off of the 4/2 highs (see chart below).

- Weak jobless claims number may provide some headwinds for the market today .

- A close below 1325 would create both a lower-high and a lower-low, and thereby turn the market bearish.

- It didn’t take long but SPX is back into short-term overbought.

- Weekly shows SPX coming off of overbought levels, ever so slightly.

- Not any more. There’s actually the possibility that we are forming a head and shoulders pattern on the daily chart when looking at the action from the past month.

- Volume continues to provide low readings.

- Watch the SPRI – it shows a much more overbought market.

- After last Thursday’s elongated lower shadow, I’ve decided to adjust the upward trend-line off of the 6/4 lows connecting it with that day’s lows.

- As a result, there is a well-defined channel that the market is trading in, and eliminates the bearish channel we had seen before.

- A break below 1333, would break the channel.

- The VIX remains under 17.

- 30-minute chart shows somewhat of an inverse head and shoulders pattern, and support at 1356.

- Breaking through the 1390’s will be difficult as there are plenty of separate resistance levels in that area.

SPX broke right through this resistance level yesterday.

My Opinions & Trades:

- Bought MDT at $38.47.

- Did not close out any positions yesterday.

- Raising the Stop-loss in AGU to $94.25 from $87.99, and locking about $6.26/share in gains.

- I’m in a position now, where I’m not really interested in expanding the # of holdings, instead I’ll look for opportunities to swap out non-performing trades with better trade opportunities.

- Still long TPC at $12.43, NFLX at $82.76, AGU at $89.66, PCLN at $644.80, and CIE at $24.22

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.