Pre-market update (updated 8:00am eastern):

- European markets are trading -0.2% lower.

- Asian markets traded -0.5% lower.

- US futures are trading slightly lower ahead of the open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45am), Bernanke Speaks (8:45am), Redbook (8:55am), PMI Manufacturing Index Flash (8:58am), FHFA House Price Index (10am), Richmond Fed Manufacturing Index (10am)

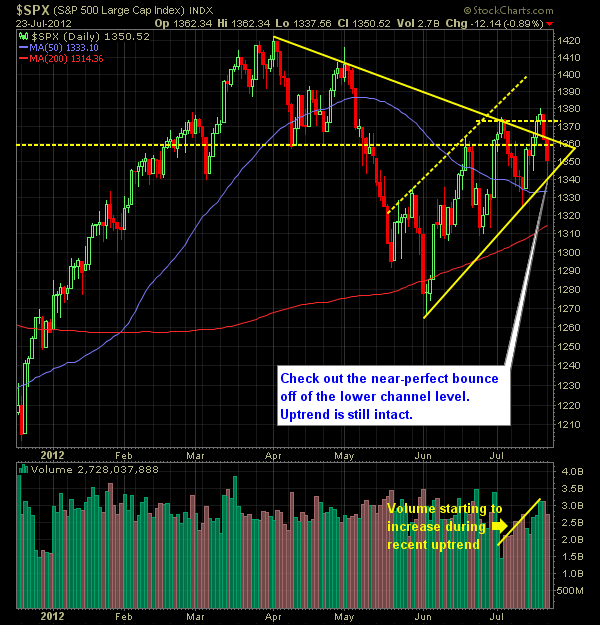

Technical Outlook (SPX):

- SPX gaped down significantly yesterday, and below the current uptrend, only to see consistent buying throughout the entire session, and eliminating over half of the day’s losses.

- As a result, we are still holding onto the current uptrend but need to hold on to 1343 today to keep it in place.

- Yesterday’s trading put us back below the 10-day and 20-day moving averages. Neither of these have been significant S/R levels for the market, but are simply worth noting from a sentiment/direction standpoint.

- Volume remained steady yesterday.

- A ‘lower-low’ would be put in place at a close below 1325, the latter of which would make this market notably bearish.

- Sell-off comes, after a few days being short-term overbought.

- On 7/18 we managed to break through the descending trend-line off of the 4/2 highs (see chart below).

- But not this is starting to look like an incredible ‘head-fake’.

- Watch the SPRI that I posted this past Sunday and how it shows us near-ready for the reversal signal.

- Also note the price resistance the SPX is up against on the weekly chart.

- The VIX remains under 19. A push back above 20, would increase the bearishness of the market.

- 30-minute chart shows a nice channel uptrend being threatened by today’s early morning action.

My Opinions & Trades:

- Busy Trading session yesterday, getting stopped out and also adding new positions

- Will look to buy the dip today, assuming 1343 holds up.

- Sold AGU at $93.70 from $89.66 for a 4.5% gain.

- Sold NFLX at $79.45 from $82.76 for a -4.0% loss.

- Sold PCLN at $659 from $644.80 for a 2.2% gain.

- Added new positions as noted below.

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.