Technical Outlook:

- SPX dropped for a third straight day yesterday on Fed talk of rate hike at September’s meeting.

- SPX pushed below the converging moving averages below the 5, 10, 20 and 50-day.

- A gap up this morning to take place. It will be essential that the lows of the first hour of trading holds and that the gap does not fill for the sake of the bulls.

- Regardless of market strength today, the market will remain range bound unless it can break out to new all-time highs.

- The key for the bears will be to break the 7/27 lows.

- Solid support for SPX at the rising 200-day moving average.

- Despite 8 of the last 11 trading sessions finishing lower, the opportunity to profit from this market to the short side is very limited. The moves are very haphazard and lacks a true catalyst.

- With a higher-low off of the 200-day moving average and possibly a lower-high formed on Friday, you essentially have the making of a range inside of a range.

- Volume on SPY dropped significantly yesterday.

- VIX rose 3.5% yesterday to 13.00. Despite two weeks of steady selling on SPX, the VIX has hardly moved upward.

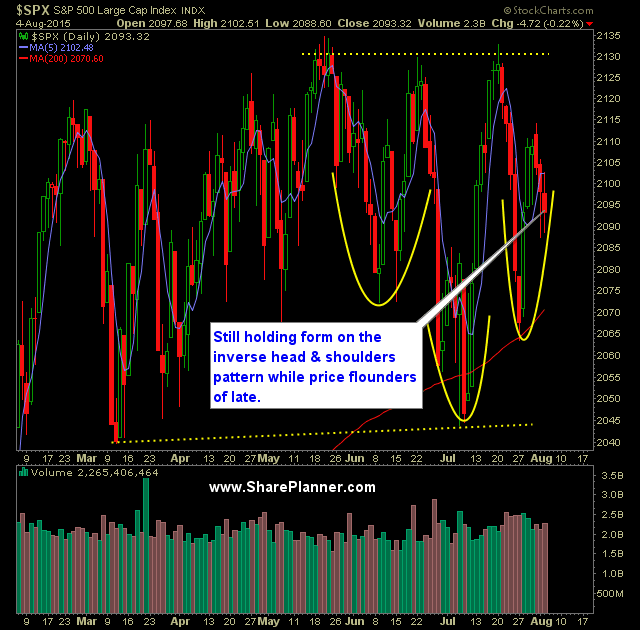

- Inverse head and shoulders pattern on the daily chart that will confirm if price action can break through to new all-time highs. The same pattern can be seen on the 30 minute chart as well.

- Oil is once again become a problem for the market again, as it broke the March lows on Friday and continued its move lower yesterday.

- Nasdaq is by far the best chart among the indices right now. Others are very much range bound, but the Nasdaq has established a higher-high and higher-low. If Apple (AAPL) can actually join this rally, which is a large % of the Nasdaq, the rally could really take off.

- My biggest ongoing concern with the market right now is the inability to establish new, clear-cut all-time highs that leads to an expansion of price as well. Instead SPX gets bogged down in the 2120-2130’s range and reverses course each time.

My Trades:

- Added one new long position to the portfolio yesterday.

- Did not close any positions yesterday.

- 40% Long / 60% cash.

- Remain long: QLD at 77.84, NFLX at 107.63, FB at 94.71.

- Will look to add 1-2 new positions today if the market can find its footing again. Otherwise, I will manage my current positions and consider some short opportunities.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.