We often talk about technical analysis being the bread and butter of swing trading, and for the most part, it is. But every so often, a geopolitical event hits the wires that shakes the market just enough to demand attention. The recent U.S. capture of Nicolás Maduro is one of those moments. When the news

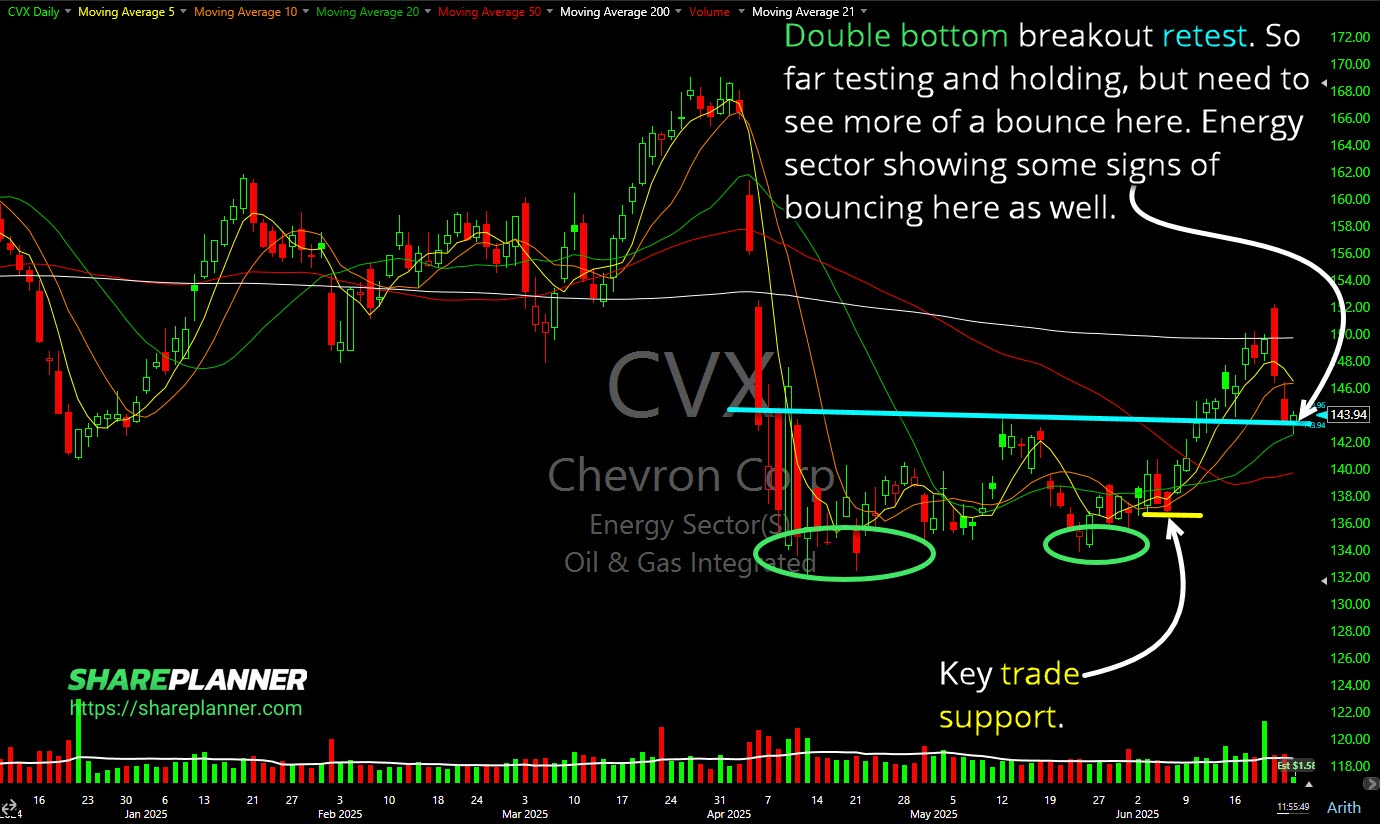

Is Chevron (CVX) on the verge of bouncing off breakout support?

Episode Overview How does Ryan invest in dividend stocks and how does he manage the risk on each of his dividend plays. You'll be surprised to find out that he doesn't use stop-losses on any of his dividend setups - so then how does he manage risk exactly? 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Chevron (CVX)Analysis 1) Short-term support broken, setting up for a retest of long-term trend-line. 2) Declining trend-line above creating lower-highs. 3) Short-term trend-line also broken. First Solar (FSLR) declining channel remains perfectly intact and seeing a hard rejection off the upper channel band today. Apple (AAPL) starting the week by pressing up against declining resistance.

Long-term support on Ford Motor (F) broken today. This is a scenario where trying to guess at where support might loom is not worth it. Best to let the stock start to base first instead of guessing where it might bounce. Financial Sector (XLE) nearing a potential bounce area here. Alphabet (GOOGL) slicing

Beautiful breakout in Chevron (CVX) today, and through resistance and the 200-day moving average. Zoom Communications (ZM) getting excited about what another variant might mean for the stock. Breaking through resistance today, but I don't have a lot of confidence in this moving lasting. Watch for converging support levels to come into play

Watch the $ORCL bullish wedge for a potential upside breakout. $NCLH potential bounce area for the stock following a sharp earnings sell-off today. Anybody want to address the elephant in the room? $TLT $AMD nearing a breakout of the bull flag pattern that has been forming since June. Pushing through the $117's into the 118's

Massive triangle $DOCU not to far from its all time lows. Formed a double bottom in the very short-term but that pattern is simply part of the much larger triangle. Pullback on $NIO could be targeting a retest of multiple breakout levels underneath. Watch to see if either provides a bounce going forward. $PLUG pushing

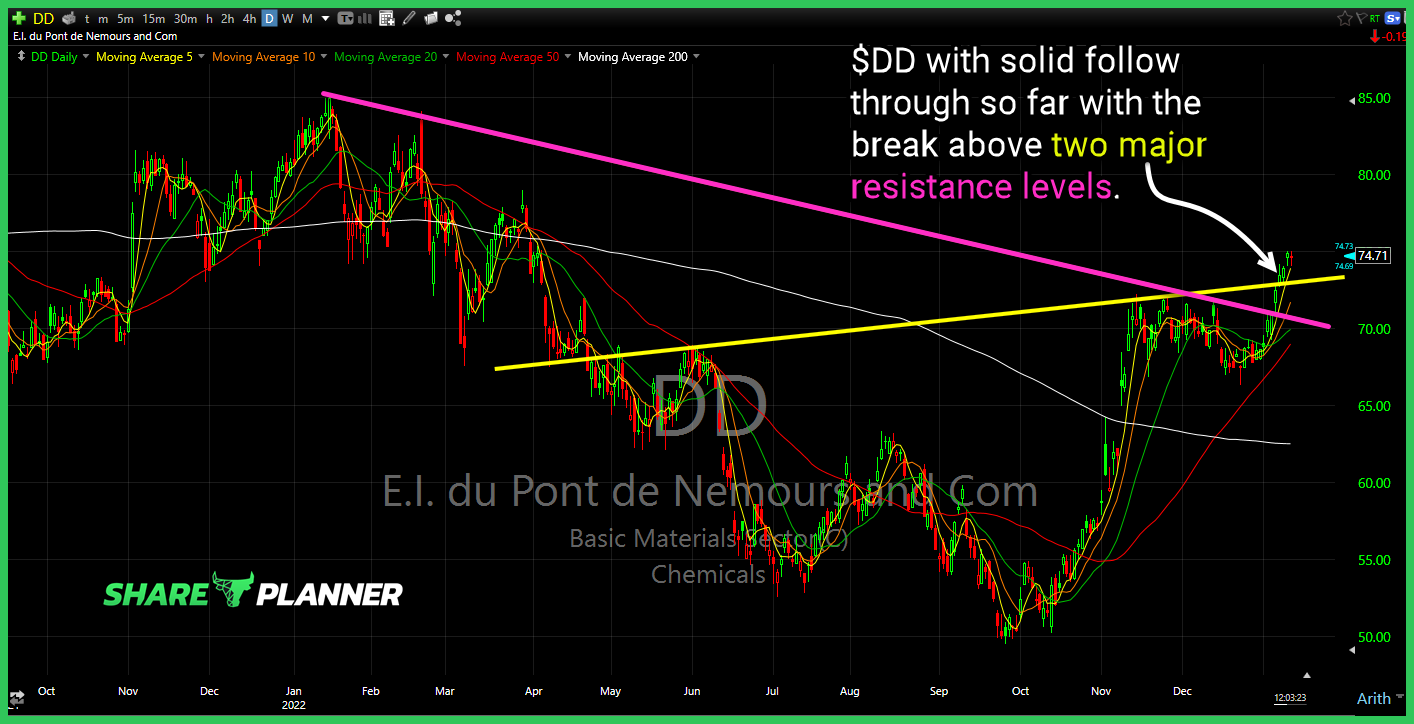

$DD with solid follow through so far with the break above two major resistance levels.

Nice consolidation from $CSIQ after confirming the cup and handle pattern.