Technical Outlook:

- SPX had a wild and turbulent ride yesterday watching price drop 26 points, only to rally to break even on a leaked Fed minutes, followed by another drop of 17 points into the close.

- Today SPY is looking at its 8th straight gap down in the market.

- There has been plenty of dip buying of late and could possibly see the same happen again today. However, the dip buying has been strong enough to take the market back to break even but struggles mightily with actually going and staying in the green.

- It stands to reason at this point that the Fed will not raise rats in September – possibly not even this year. This could be reason to inspire the dip buyers to take the market back up today despite the overall weakness heading into the day.

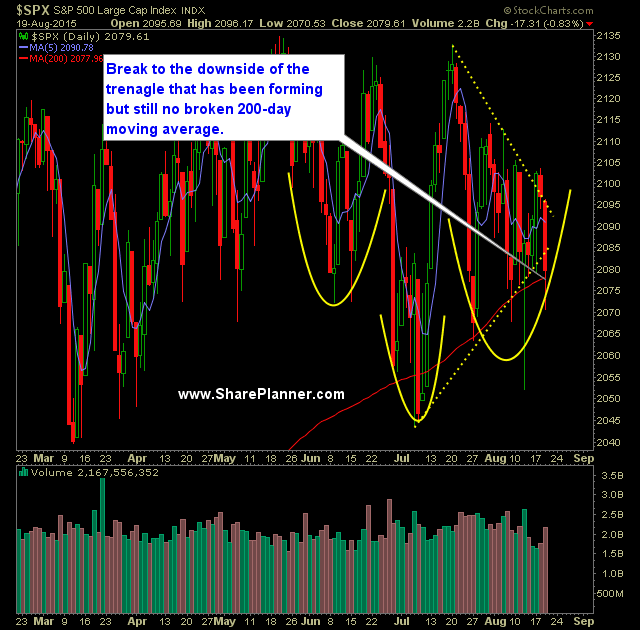

- The 200-day moving average is no doubt on the forefront of my trading today. Can the bears break and close below this all-important MA.

- Nothing but a massive chop for SPX 30 minute chart.

- As of today this is the longest period of consolidation for the market this far into a year. The second longest and tightest period was 1911. yes, this is a trading range for the ages.

- SPX crushed all the short-term moving averages including the 5, 10, 20, and 50-day moving averages.

- VIX had a rather tumultuous day as it finished up 1.6% after multiple +10% swings in both directions. It is currently at 15.25.

- Significant increase in the volume, nearly more than the previous two days combined. I’d look for similar volume readings again today.

- A view is emerging that a rate hike in September might be off the table. Today’s Fed minutes may shed more light on this area.

My Trades:

- Did not add any positions yesterday.

- Did not close out any positions yesterday.

- 50% Long / 50% cash.

- Remain long: SBUX at 56.37, UPRO at 67.17, AAPL at 114.64, NFLX at 123.45, FB at 94.66.

- Weakness continues to hit the market hard each and every open, however, the bears are unable to break down this market. I have yet to make a trade this week (a rarity) due to the fact the market for better or worse, can’t decide what it wants to do here.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.