Friday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Square (SQ)

Bears are certainly losing their grip on this market here, and the bulls are running in a low volume trading environment. Target those trade setups that offer above average volume. In this kind of market where the interest is low, spotting stocks with momentum and the interest of the strength is quite easy do.

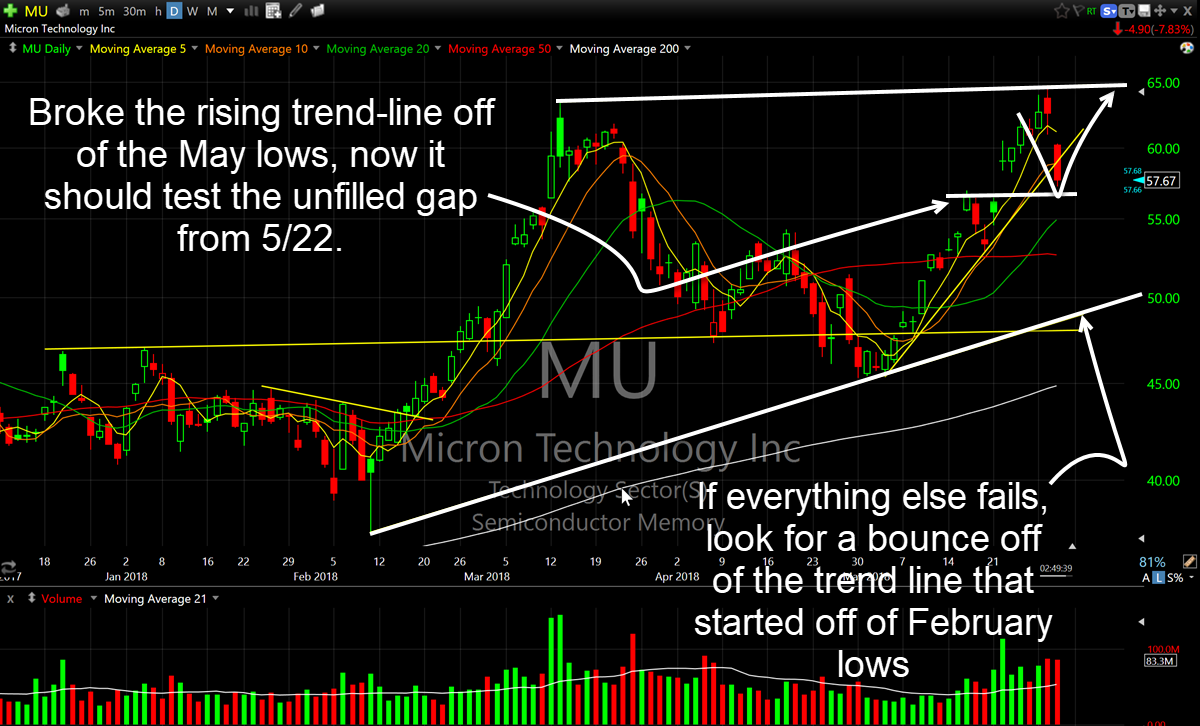

I’ve been watching Micron (MU) all day long to consider where this stock might bounce at for an ideal swing-trade. So far I have yet to pull the trigger on it. Though, had it bounced off of that trend-line off of the May 3rd lows, the opportunity would have been more than ideal. But

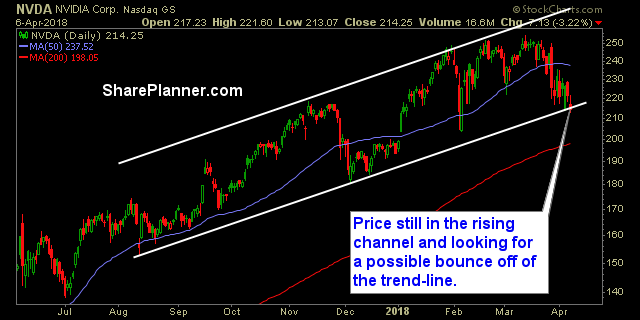

The charts on the Semiconductors simply look BAD! There is nothing redeeming about them here, and there are plenty of more earnings reports to come out on them still, including the big names like Advanced Micro Devices (AMD), Nvidia (NVDA) and Intel (INTC).

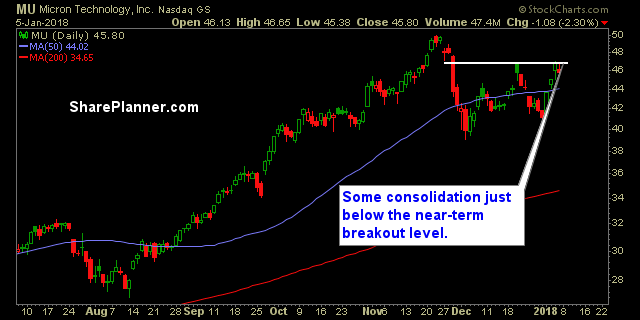

Tuesday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Micron Technology (MU)

Monday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Cypress Semiconductor

Monday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Micron Technology (MU)

Plenty of takeaways during the month of November for my swing-trading. For one, it was another successful month, but there were a few stretches in there, that I’d like to soon forget. Most notably was the way in which it ended.

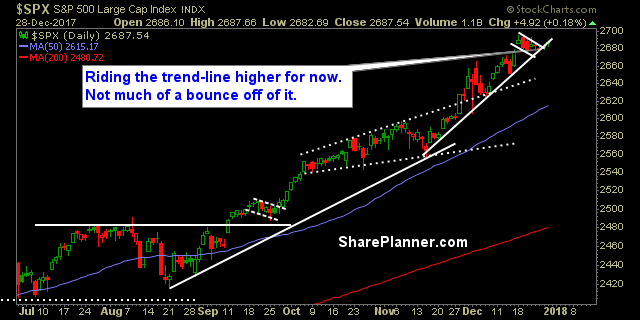

My Swing Trading Approach I expect to be conservative in my trading approach today, booking gains where it makes sense, and finishing out the year strong. Indicators

There are definitely some bearish divergences under the surface of this market Sure, we are trading at all time highs, but you have cracks starting to emerge in the small caps’ dam, and with only 56% of stocks as a whole, trading above their 40-day moving average, stocks are not as healthy as you’d like