Plenty of takeaways during the month of November for my swing-trading.

For one, it was another successful month, but there were a few stretches in there, that I’d like to soon forget. Most notably was the way in which it ended.

Up until the last few months, everything was superb. If it could have done without the last few days of trading, it would have been even better.

Nonetheless, it was a profitable month, and that is what counts the most. Every month you trade there will be trades that you wish you could have had back. The key to it all though, is managing the risk, and when you have a period where the trades are not going your way, you can get out of the trade, without killing your portfolio in the process.

This can best be seen in Square (SQ), where I was stopped out at $41.73. But it didn’t stop there – it kept falling, day after day, and today it is currently trading in the $34’s. Quite the fall, and had I not followed my stops, it would have wiped out all my profits in the other successful trades I had made.

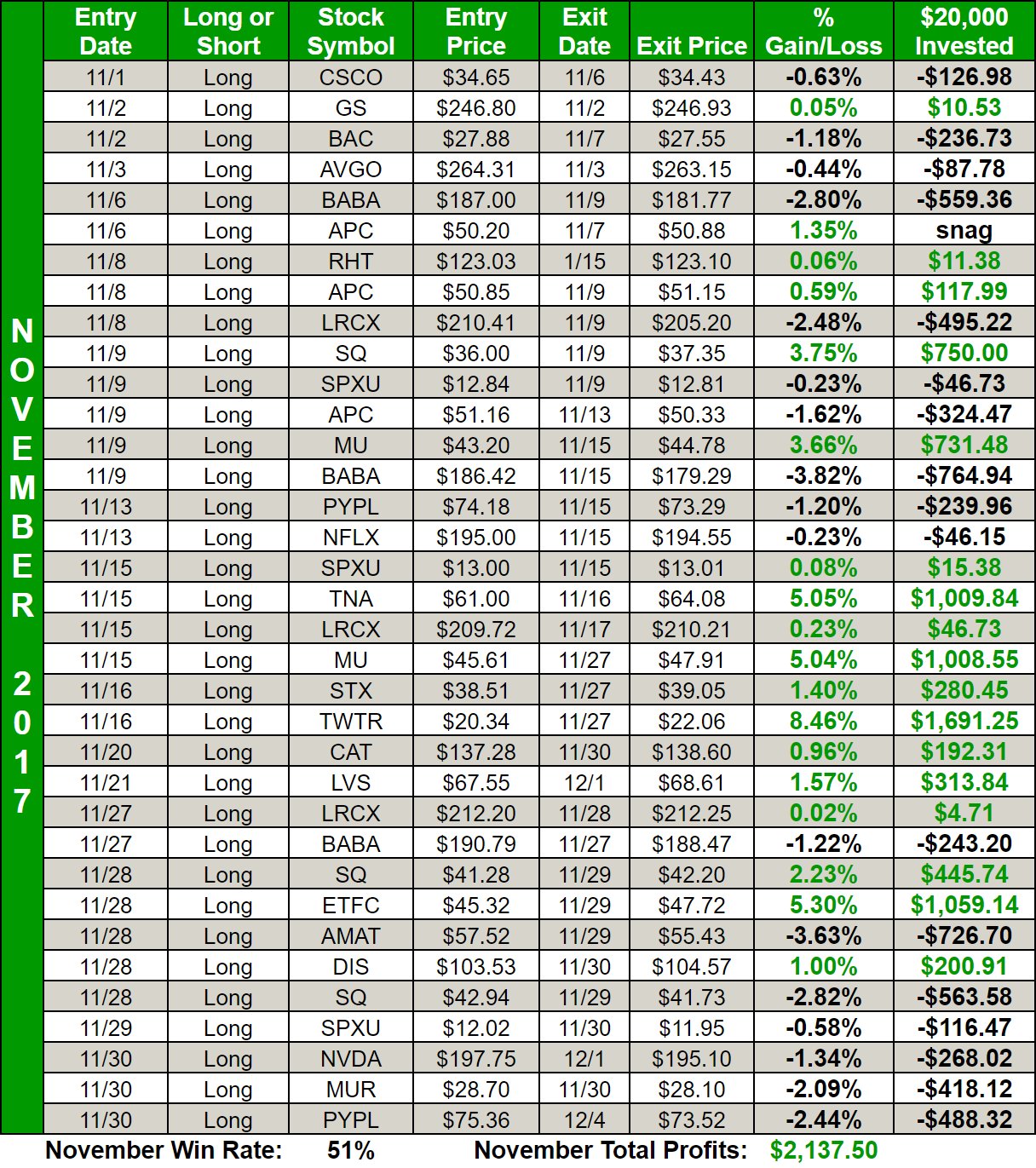

Here are all my trades:

So here’s a breakdown of my trading on the month:

- I was profitable on 18 out of 35 (51%) of my trades

- 17 out of 32 (53%) of my trades were profitable that were focused on bullish/long setups

- 1 out of 3 (33%) of my trades were profitable that were focused on the bearish/short setups

- 2 out of 4 (50%) of my trades were profitable that were focused on using exchanged traded funds (ETFs)

- 16 out of 31 (52%) of my trades were profitable that were done with trading the stocks of companies.

Another month where there wasn’t really any good shorting opportunities! You could make the argument that there really hasn’t been any good period to short this market the entire year, so the results of the few times I did short this market, not being overly successful, isn’t all that surprising.

What worked in my swing-trading:

- Financials and Payment Processors

- Technology

- Dip Buying the Russell

Companies like E*Trade (ETFC) and Square (SQ) managed to provide me, overall, with some solid profits on the month, the former’s gains was due to the huge run the financials experienced at the end of the month.

There were a handful of good trades from Tech, during the month too, but November marked a month where the Semiconductors (SMH) really started to slow down some and that continued into December as well. But Micron (MU) still managed to provide returns of 5% and 3.7%. Then you have a first time trade in Twitter (TWTR), which I have to admit, my hand was practically shaking having to trade that stock, but the setup was too good to pass up, and the returns was handsome, providing a return of 8.5%!

Another stock/ETF that I don’t typically trade, but saw a nice opportunity for doing so was in the Russell 3x ETF – TNA. It had been about five years since I last traded it, but a dip in the Russell on the the 15th, gave me a tight risk/reward setup that yielded a quick 2-day profit of 5.1%. The manner in which I traded it, probably wasn’t ideal, as I should have probably just raised the stop-loss on it rather than popping out of the trade so quickly. Had that been the case, the gains on the trade would have been double what I took from it.

What did not work in my swing-trading:

- Semiconductors not “MU”

- Alibaba (BABA)

- More is not better

As mentioned in the previous section, semis simply fell apart at the very end of the month, in particular on 11/29, where most semis saw declines of 5% to 10% in losses. Up until that point, it made sense to have a portfolio tilted toward semis, but since then, the industry simply cannot find its footing, and continues to struggle as of this post.

Three strikes and I’m out on Alibaba (BABA). Three trades and all three of them royally stunk! I looked back at the charts for each trade, and they weren’t horrible, two were dip buying opportunities/bounce plays and the other was an attempt at the breakout. I don’t necessarily think they were “can’t miss” trade setups, but I don’t think it was a bad decision to trade them – they simply just didn’t work.

The last aspect that didn’t work was the higher frequency of trading that took place in November. There were two days where I made five swing trades. Now the first couple of trades panned out well, but the latter three provided a net loss. Bottom Line: More Trades did not equate to more profits. Going into 2018, that is definitely something that I plan to put a heavy focus on.

Wrapping up November Swing Trades

The month was looking even better than what the results would show, but that sell-off in Tech (but not the Dow or SPX) was brutal on my holdings, not to mention the December start had on my late November trades. Nonetheless, the month was profitable, but I think there was some opportunities to have made more in profits.

Overall, there are always lessons to learn, even in the most profitable of trading months. The key is to spot the areas that need improvement and that is what I do, with these posts. The truth is, I tend to be pretty hard on myself. Even when I have a stellar trading day, I am still thinking about the opportunities missed, or what stocks that I should have closed out, or sold earlier. It is in my nature to behave that way, so when I do these write ups, that definitely comes through in my critical nature, when it comes to evaluating my trading.

With that said, you can join me and the host of other traders in the SharePlanner Splash Zone. Here you will learn what it takes to profit consistently and regularly and take the mystery out of trading altogether and simply profit regardless of whether it is a bull or bear market. The key is playing the cards the market deals you and you’ll learn this in no better of a place then the SharePlanner Splash Zone.

So Join Today and start your Free 7-Day Trial that you can cancel at anytime. With your membership you will get access to the chat room that I trade in each and every day, as well as all of my real-time trade alerts, that include the entry, stop-loss and target prices that I use as well as the rationale for each trade. These alerts come to you via text, email, and in the chat room. No matter where you are, you can take the Splash Zone with you!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.