I’ve been watching Micron (MU) all day long to consider where this stock might bounce at for an ideal swing-trade.

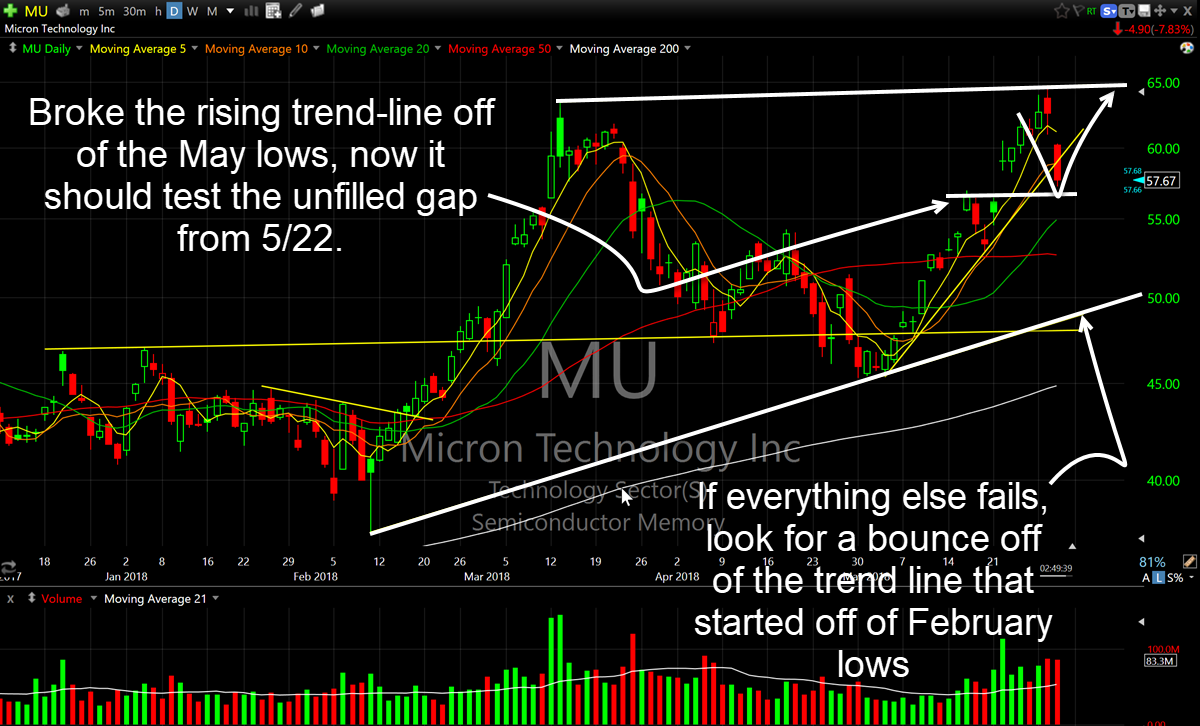

So far I have yet to pull the trigger on it. Though, had it bounced off of that trend-line off of the May 3rd lows, the opportunity would have been more than ideal. But for now it doesn’t look like it is ready, as it crushed that trend-line and has yet to find any support underneath.

Since that trend-line isn’t holding up, there are two more areas that I am targeting:

1) The unfilled gap from May 22nd

2) The rising trendline off of the the February lows. Either one will be totally fine with me, but the latter scenario will take a lot of patience, while the former scenario could happen today or tomorrow.

The key, will be timing the entry as such that you get in with a tight risk and near the bottom. Easier said than done with a stock like MU that does its killing before breakfast (Back to the Future III reference).

Simply put – stay patient – I have outlined two scenarios for buying the dip in Micron (MU) and those are the two best options at this point.

Here’s the Micron (MU) technical analysis:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.