Swing Trade Approach: Took half my position off the table in McDonalds (MCD) for a quick 4.1% profit. I’m looking at this point for obvious reasons to close out a trade. As good as this rally has been, I don’t want to be a person who doesn’t take advantage of an amazing market rally and

My Swing Trading Strategy Busy day yesterday, I started the day out long and strong, and just following price action, managed to somehow end the day with just a short position remaining in the portfolio. I closed Tesla (TSLA) for a +4.6% profit, then I closed Alibaba (BABA) for a +2.1% profit, McDonald’s (MCD) for a +1% profit and a Day-Trade in Square

My Swing Trading Strategy One new long position added to the portfolio. I took profits in McDonalds (MCD) on Friday as I became concerned with the amount of selling on average volume, when the market was rallying hard. I took profits of +1.5%. Thermo Fisher Scientific (TMO) I took small profits in. I’ll look at adding

Tuesday’s Swing-Trades: $SWK $MCD $CGC Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Stanley Black & Decker (SWK)

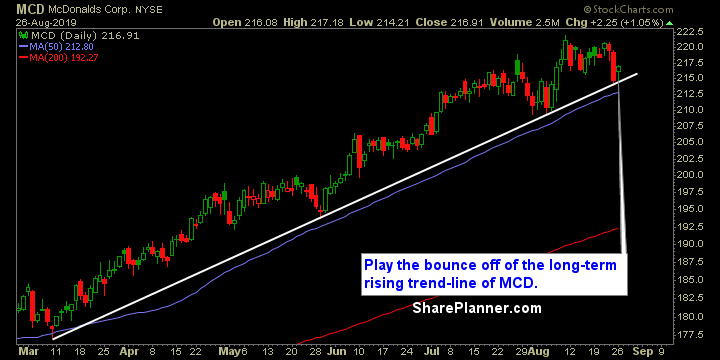

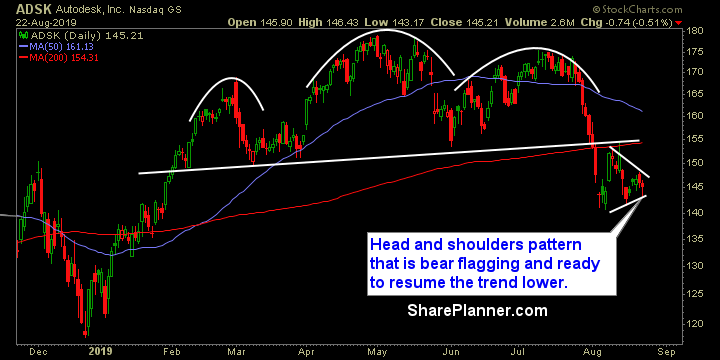

Friday’s Swing-Trades: $MCD $UPS $ADSK Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: McDonalds (MCD)

The market is trying to crash again like what we saw back in Q4 of last year, how are you going to be swing-trading it and most importantly preserving profits along the way. I go over the possibilities of a market crash, my swing-trading update, and the technical analysis of the most important stocks currently

My Swing Trading Strategy I’m coming into today 100% in cash. Tried shorting the intraday bounce yesterday, but quickly realized that wasn’t going to work, while also booking profits in McDonalds (MCD) too. To say the least, I am quite suspicious of this market bounce, and highly doubt that the worst is behind us at this

Volume has returned and the Trade War with China has made shorting stocks great again! Sure get excited about the dip buying today, but under the surface this market rally is anything but impressive. Breadth is okay, but with the walloping the market took yesterday, if this was a bottom for the market, we should

Friday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Marathon Oil (MRO)