Swing Trade Approach:

Busy day on Friday. I covered one of my short positions, Nutrien (NTR) at 44.39 for a 6.7% profit. Nice gain for a short position that I have held since November 26th at $47.60. But I didn’t stop there. I sadly closed out one of the more impressive trades of the year Visa (V), which was the final half position at 204.62 for a +11% profit. There was also the final half position in McDonalds (MCD) at 211.04 for a 6.3% profit. I also took the Advanced Micro Devices off the table at 50.13 for a +2% profit. Also worth mentioning that I also added one new long position and one new short position, and if the market weakness holds into tomorrows open, it is likely I will add a few more short positions.

Indicators

- Volatility Index (VIX) – VIX didn’t hold all of its gains, but it still managed to rally 12% to 14.56. Not a higher-high by any means but a push above 16.50 and things will get interesting.

- T2108 (% of stocks trading above their 40-day moving average): This indicator is deteriorating quickly and the fact that SPX is only 1% below its all-time highs, yet the T2108 has declined for five straight days, below its 200-day moving average and now sits at 52% is mind boggling, and indicates the strong potential for lower prices.

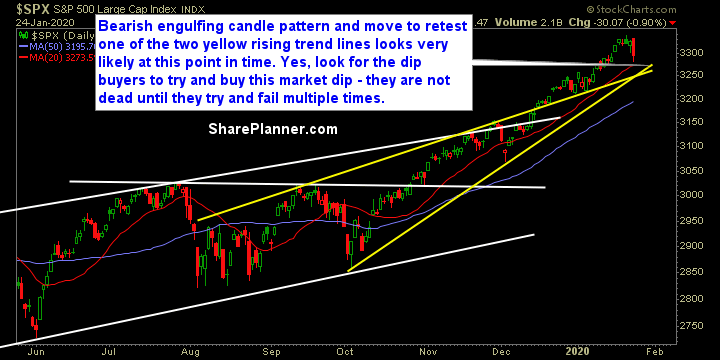

- Moving averages (SPX): Broke below the 5 and 10-day moving averages, and very likely a test of the 20-day MA will be seen tomorrow.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The only sector to finish in the green yesterday was Utilities, while Healthcare was the big loser on the day. Energy continues to highlight the worst of all the sectors, declining for a fifth straight day. Materials have formed a double top that you should be concerned with. Financials breaking to the downside and out of its consolidation.

My Market Sentiment

The market has a big test ahead of it. With futs dipping substantially lower on a market contrived crisis (for the market, not for the world outside of the market – there is a difference), the bulls will have there chance today to decide whether it wants to buy the dip on a substantial two-day move lower. Within just a couple of days, much of the market’s profits on the month has been wiped out. If the bulls are going to pop back in, it will need to do so now.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.