Technical Outlook: Day 3 of the sell-off ws equally impressive, faking out the bulls early on only to drop hard in afternoon trading. 20-day moving average was breached. Volume on SPY was well above average, very impressive, and increased for a fourth straight day. Most impressive though was the VIX chart that rose

Technical Outlook: Nasty sell-off on Friday, that had only a marginal dip buy at the close. Overall, the market lost its 5 and 10-day moving averages and the last two trading sessions alone have wiped out the previous nine days of upward price movement. As a result, there has to be some worries that a

Technical Outlook: The market continued with the same story that it has been engaged in for the past four months and counting… Buy every dip you can get your hands on. SPX sold off early on, but managed to recover nearly 75% of its losses by the close of the day. SPY volume, as

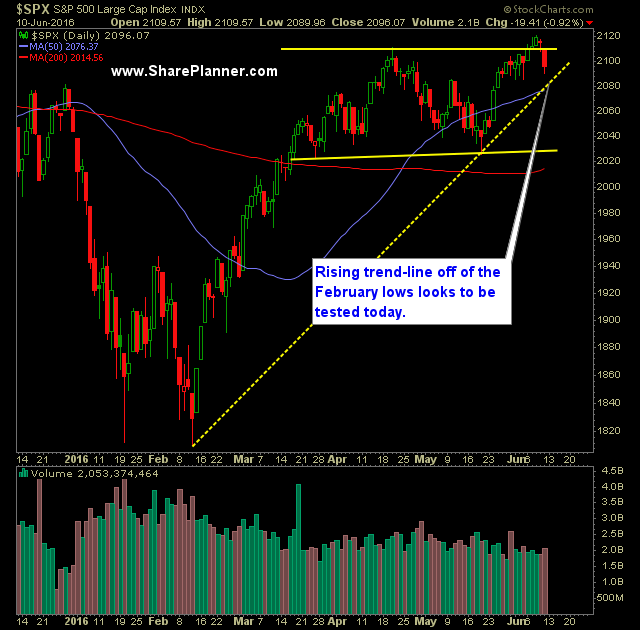

Technical Outlook: Choppy price action that finished strong into the close yesterday, and pushed above the highs established at 2116 in November of 2015. A higher-high is clearly established off of the February lows now. SPX is now setting up for a test of the all-time highs. A 1% rally would be enough to establish

Technical Outlook: Strong move yesterday that faded late into the close. The problem with that, is a lot of rallies have gone on to die, the closer it gets to new all-time highs. As a result, I curbed some of my long exposure. Willing to add it back today, but also balancing that act with

Technical Outlook: A horrible jobs report, the worst since September 2010, led to a hard sell-off initially for stocks, but keeping with tradition, saw about 70% of the day’s losses recovered by the close. Despite news that would suggest an economic slowdown is underway, stocks simply cannot pullback and hold those losses into the close.

Technical Outlook: Over the course of the last three days the S&P 500 has sold off early on, only to recover all or most of its losses before the end of the day. The “buy the dip” mentality is alive and well for the stock market right now. Essentially, the bears have shown no willingness

Technical Outlook: Another day where the bulls might not be ambitious for higher prices, but still willing to buy any dip that comes the market way. Despite the early selling, SPX managed to finish the day in the green yesterday. At some point this month, the brexit vote will become a concern for the market.

Technical Outlook: A rare down day for the market – in the case of SPY, only its second in the past seven trading sessions. And as we have seen of late, the sell-offs are quite often mitigated by a huge swell of buying into the close that wipes out all of the day’s losses