Technical Outlook: SPX closed above closing and intraday all-time highs yesterday. A feat that hadn’t been achieved since May of 2015. It is important that the S&P 500 can string together a few strong days after establishing the new all-time highs. SPY’s volume fell off quite dramatically yesterday, coming in well below recent averages. Not

Technical Outlook: Friday had one of the more improbable rallies following an unexpected, great employment report, and sending the S&P 500 nearly to new all-time highs. SPX is poised to establish new all-time highs at the open this morning. SPX has now risen 6 out of the last 8 trading sessions. Which will probably go

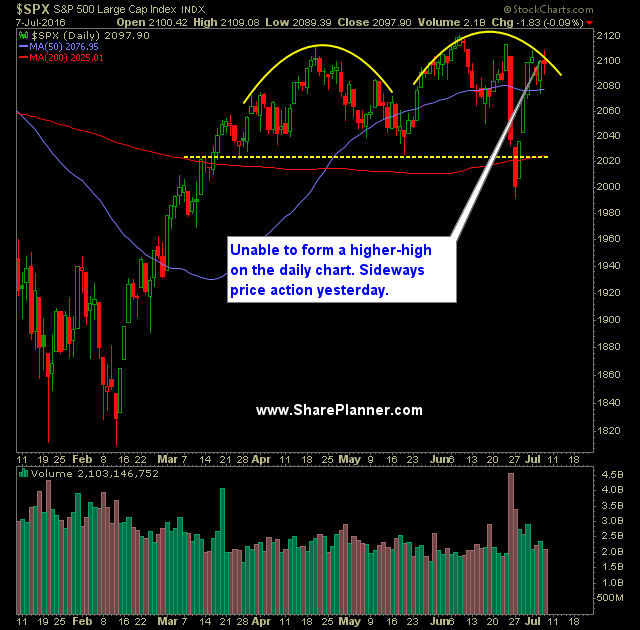

Technical Outlook: SPX tested last Friday’s highs and failed to break through, instead resulting in selling thereafter. Ultimately the trading session resulted in sideways price action. The bulls again exhibited their inability to do anything with price above 2100, but unwillingness to allow price to fall from it either. The end of day ramp job

Technical Outlook: Massive bounce yesterday at around the 50-day moving average, and closing a shade below 2100. Again the bears let go of another opportunity to jump start a sell-off. SPY volume dropped off yesterday and was notably below recent averages for the first time in 10 trading sessions. VIX continues to struggle

Technical Outlook: SPX rallied a meager 4 points on Friday to close just a shade below 2103, giving up much of its mornings gains throughout the trading session. Declining resistance off of the June highs are in play and could be broken today. For the first time during this 4-day rally, SPY is looking

Technical Outlook: SPX continued its epic rally yesterday, adding another 1.4% to its 3-day tally. The last time the market was down 4% on the month with less than a week of trading left, only to rally back into the positive to close the month out was in 1938. Yes, the move from this week

Technical Outlook: Day 2 of the dead cat bounce unfolded yesterday and it was a brilliant one. Back-to-back +30 point days on SPX is a rarity in general, but not when you are coming off the heals of a major sell-off. Much of the Brexit losses have been erased following the two day bounce.

Technical Outlook: Dead cat bounce started yesterday resulting in one of the year’s best rallies. These bounces, if it remains part of a larger sell-off, can last anywhere between 2-4 days. The VIX is melting away at an incredible rate. Over the last two days, has gone from almost tagging 27, down to 18.75.