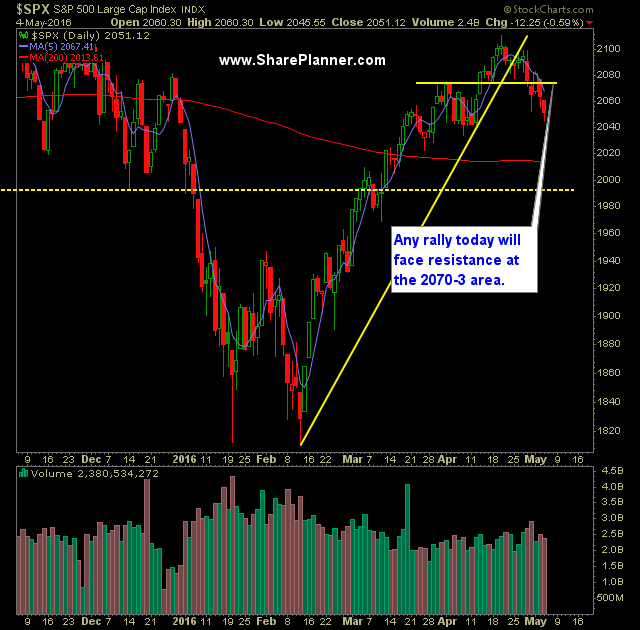

Technical Outlook: On Friday, SPX dropped nearly 1%. But more importantly managed to close below the 50-day moving average, despite bouncing off of it the previous two times. More importantly is the massive head and shoulders pattern that has been forming over the past two months on SPX. A move today and close below 2039

Technical Outlook: SPX gave up all of its morning gains and dropped further into the red throughout the morning. But, you guessed it, the bulls rallied the market hard in the afternoon to close the market at break even. For the purposes of staging entries into new positions in either direction, it becomes fairly

Technical Outlook: Major reversal to the downside following Tuesday’s rally. But now today, SPX looking at gapping higher and challenging Tuesday’s highs once again. Back in play is the head and shoulders pattern, particularly if today’s strength and gap up cannot hold. Just a reminder, the market has not played well with gaps of late.

Technical Outlook: Massive rally yesterday – the largest one since March 11th. SPX reclaimed the middle band (20-day moving average). Also recaptured the 10-day moving average. Despite a hard rally yesterday, the sell-off was still below recent averages. SPX, since bouncing off of the lows Friday (and off of the 50-day moving average) price

Technical Outlook: Yesterday marked an extremely boring an inconsequential day of trading In the final hour of trading, SPX gave up all of its gains on the day and finished nearly flat. The big concern for me on the chart is that there is now a very obvious head and shoulders pattern that is forming

Technical Outlook: SPX experienced a hard reversal on Friday where price found buyers at and around the 50-day moving average and ultimately ended up resulting in an 18 point reversal off the lows of the day. Despite all the days of selling that was to be had last week, SPX finished just eight points lower

Technical Outlook: Attempted bounce early on yesterday eventually resulted in a sell-off in the afternoon that saw SPX finish lower for the fifth time in the last six trading sessions. A late day rally attempt yesterday fell apart. Yesterday marked the first time since 3/24 that SPX sold off three straight days. Volume on

Technical Outlook: SPX sold off for the fourth time in the last five days and closed yesterday below the lows from last week. There was almost a test of the 50-day moving average yesterday but the dip buyers stepped in before that could take place. Again yesterday afternoon we saw the dip buyers come in

Technical Outlook: Another sell-off in SPX yesterday that once again saw the bulls buy the dip at the days lows and drive the price higher, thereby eliminating a good chunk of the day’s losses. It is hard to say that the bears have full control of this market when the bulls manage to rally the

Technical Outlook: SPX followed up with Friday’s afternoon recovery with a bounce to the upside yesterday that saw price reclaim the 20-day moving average and stall out at the 5-day moving average. Technically, very little improvement. On the 30-min chart of SPX, the rally simply took price straight into the neckline resistance of the head