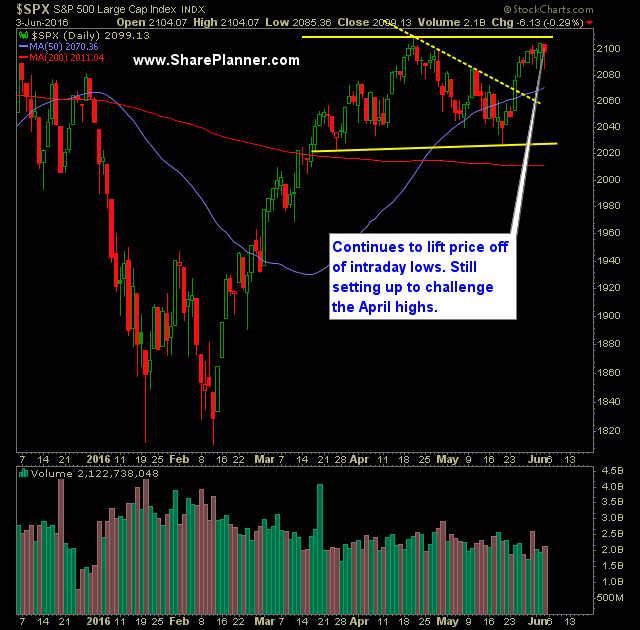

Technical Outlook:

- A horrible jobs report, the worst since September 2010, led to a hard sell-off initially for stocks, but keeping with tradition, saw about 70% of the day’s losses recovered by the close.

- Despite news that would suggest an economic slowdown is underway, stocks simply cannot pullback and hold those losses into the close. The dip buyers are as strong as ever.

- A rally of more than 12 points would break April’s highs and establish a higher-high for the market. A strong move above 2116 would take the S&P 500 above the right shoulder of the two year long head and shoulders pattern, and technically nullifying the pattern.

- There are scenarios at play here that can change the market for the better, and they are just a short distance away.

- SPY volume was strong on Friday and well above average levels.

- SPX bounced perfectly off of the 10-day moving average on Friday, and right on the 5-day moving average as well.

- Nasdaq sold off on Friday for the first time in 8 trading sessions.

- The market has really been spinning its wheels of late, with each morning seeing a heavy sell-off only to see the sell-off lose its losses before the close. In the mean time the bulls don’t really do anything to actually improve upon the price action.

- Consolidation over the past 8 trading sessions has kept price well contained. At this point, a move above 2105 is needed to break out of the range on the 30 minute chart.

- VIX tested support again in the low 13’s. Look for a test again of the support. A break and close beneath is key here.

- At some point this month, the brexit vote will become a concern for the market. So far, the market is ignoring its implications.

- For the bears, the objective is simply to sustain a hard sell-off and to not give back those losses by the close.

- The short-term head and shoulders pattern that we had been following last month has been nullified, but in the same time frame going back to April, you could make the case that a possible double top is forming if price begins to accelerate to the downside.

- I believe, at this point, profits have to be taken aggressively, and avoid the tendency to let the profits run – the market is in a very choppy range that has mired stock price for the past two years. Unless it breaks out of it and onto new all-time highs, then taking profits aggressively is absolutely important.

My Trades:

- Sold MSFT at $51.83 on Friday for a 0.2% profit.

- Sold CNK on Friday at $35.88 for a 1.1% loss.

- Sold MS on at $26.57 for a 3.3% loss on Friday.

- Added two new long positions to the portfolio.

- Currently 30% Long / 60% Cash

- Remain long: ADBE at $99.78 and two additional positions.

- Will look to possibly add 1-2 new positions today if the market can continue pushing higher.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.