Technical Outlook:

- Nasty sell-off on Friday, that had only a marginal dip buy at the close.

- Overall, the market lost its 5 and 10-day moving averages and the last two trading sessions alone have wiped out the previous nine days of upward price movement.

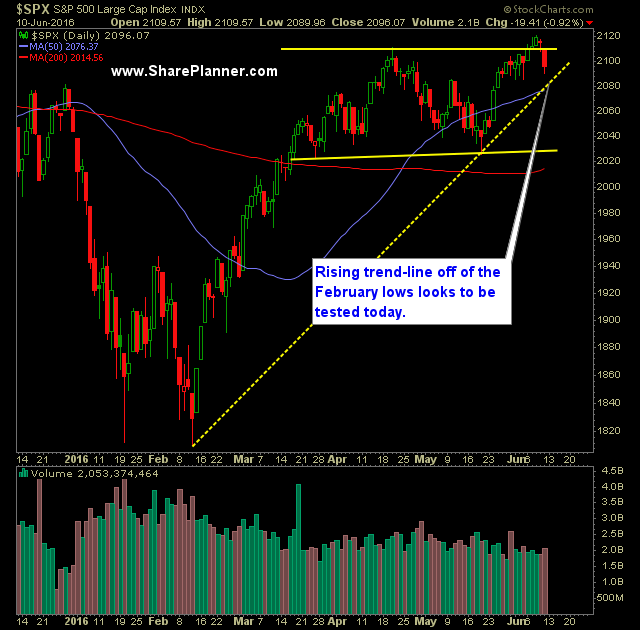

- As a result, there has to be some worries that a possible double top has formed on SPX with a confirmation at 2025.

- SPY volume was well above average and one of the highest readings that has been seen in almost a month.

- Above 2100 a lot of rallies go on to die. That is again what we are seeing here. Weakness suddenly creeping in and the bulls fleeing.

- Between 2186 and 2102 on the 30 minute chart there is a lot of choppiness of late that could offer some support to SPX that has been in a free fall since Friday.

- Watch to see whether price action can find support at the 20 and 50 day moving averages today.

- VIX breaking out in a bit way on Friday, though I’d prefer it clear the 17’s entirely, it nonetheless cleared the heavy resistance that has plagued it in the 16.40’s.

- As a possible brexit approaches, expect the volatility to increase as well.

- I believe, at this point, profits have to be taken aggressively, and avoid the tendency to let the profits run – the market is in a very choppy range that has mired stock price for the past two years. Unless it breaks out of it and onto new all-time highs, then taking profits aggressively is absolutely important.

My Trades:

- Sold WYNN on Friday at $100.5 for a 1.1% profit.

- Sold UPRO on Friday at $66.98 for a 0.8% profit.

- Sold ZAYO on Friday at $27.55 for a 1.4% loss.

- Sold LNKD on Friday at $131.48 for a 2.1% loss.

- Currently 10% Long / 10% Short 80% Cash

- Remain short QQQ at $109.92 and long one other position.

- Have the flexibility to go either way the market wants to take us today.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.