Technical Outlook:

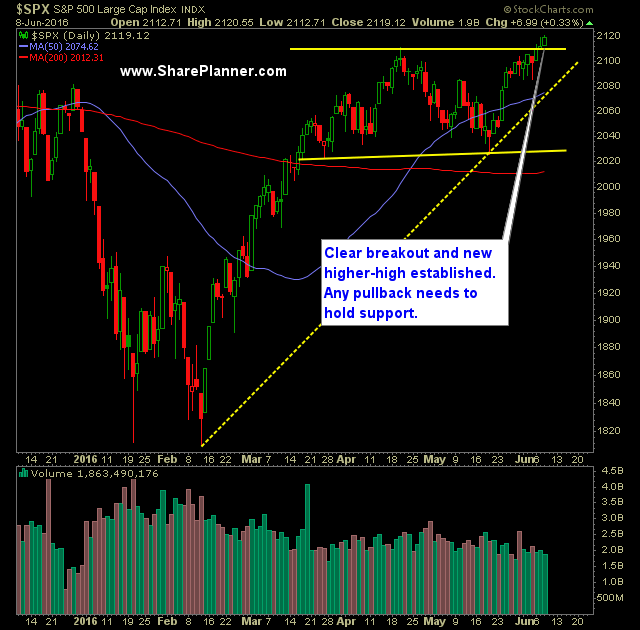

- Choppy price action that finished strong into the close yesterday, and pushed above the highs established at 2116 in November of 2015.

- A higher-high is clearly established off of the February lows now.

- SPX is now setting up for a test of the all-time highs. A 1% rally would be enough to establish a new all-time for the S&P 500.

- Volume on SPY was slightly higher than what we saw the day prior, but still weak and well below recent averages.

- A pullback to 2110-11 would bring price back to the rising trend-line off of the 5/19 lows.

- Futures are weak this morning, which will be interesting to see whether the dip buyers come in and lift the market back up as it has done plenty of times over the past few weeks.

- 30 minute chart of SPX continues to see a pattern of rally/consolidate, rally consolidate. I suspect we may see some consolidation today.

- Depending on how hard the market sells-off, if there are some technical breaks that hold into the close, it may be reason enough to start hedging long positions.

- If SPX doesn’t take out the all-time highs soon, speculation will quickly swirl that the market is starting to roll over again.

- VIX rallied for a third straight day despite SPX rallying during the past three days. The lower 13’s continue to be a significant bounce area for stocks, and worse, the place where equities begin to sell-off. Caution is warranted here.

- The major head and shoulders pattern that had been forming over the last two-plus years has been broken with yesterday’s rally, thereby nullifying the pattern that so many were expecting to confirm.

- At some point this month, the brexit vote will become a concern for the market. So far, the market is ignoring its implications.

- For the bears, the objective is simply to sustain a hard sell-off and to not give back those losses by the close.

- I believe, at this point, profits have to be taken aggressively, and avoid the tendency to let the profits run – the market is in a very choppy range that has mired stock price for the past two years. Unless it breaks out of it and onto new all-time highs, then taking profits aggressively is absolutely important.

My Trades:

- Added one new swing-trade to the portfolio yesterday.

- Did not sell any of my positions yesterday.

- Currently 30% Long / 70% Cash

- Remain long ZAYO at $27.96 and two other positions.

- Will look to possibly add 1-2 new positions today if the market can continue pushing higher.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone