Technical Outlook: A relatively low volume, flat day of trading in S&P 500 (SPX) until the final 30 minutes where the majority of its gains were acquired. SPX is now turning bullish again, although it is still stuck in a short-term trading range. New all-time highs are within arm’s reach, and to add short positions to the

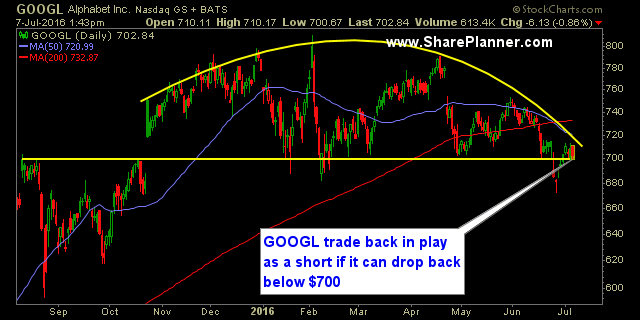

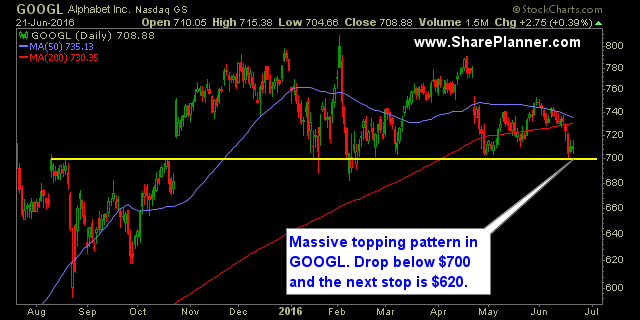

I’ve put together a quick video talking about the current state of the stock market, key stocks and the major indices in general. I cover the following stocks: IBM, MCD, ADBE, NFLX, FB, AMZN, GOOGL, CMI, SINA

Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my

Technical Outlook: Solid earnings reports from the big companies aren’t helping to lift the market at all from its current trading range. Today we’ll see if Amazon (AMZN) or Alphabet (GOOGL) can pull it off. The trading range over the last 11 trading sessions has been less than 1% – one of the tightest ranges

Technical Outlook: SPX pulled out of its 3-4 day holding pattern and broke out to new all-time highs yesterday. 5-day moving average continues to hold strong. Look for a break and close below the 5-day for signs of short-term weakness. Slight increase in volume yesterday, but still way below recent averages. The trade to the

Technical Outlook: Market pulled back for the second time in the last three trading sessions. The volume was extremely light on SPY yesterday, and barely above Christmas Eve’s half day of trading last year. Needless to say, volume was well below average readings and half of what was seen on Friday. Mini-bull flag pattern developing

Technical Outlook: Quiet day in the market yesterday with a finish five points higher on SPX. Right now SPX is riding that 5-day moving average. The last two days it has tested the MA and held it both times. Today, there is some pre-market weakness that will likely result in another test of the 5-day

The second half of the year is upon us. Get your portfolio right and start consistently profiting in this crazy and volatile market. Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription, you

Technical Outlook: Day 2 of the dead cat bounce unfolded yesterday and it was a brilliant one. Back-to-back +30 point days on SPX is a rarity in general, but not when you are coming off the heals of a major sell-off. Much of the Brexit losses have been erased following the two day bounce. Only

Join the SharePlanner Splash Zone and see for yourself what a membership can do for your portfolio by signing up for a Free 7-Day Trial. With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each