Technical Outlook:

- A relatively low volume, flat day of trading in S&P 500 (SPX) until the final 30 minutes where the majority of its gains were acquired.

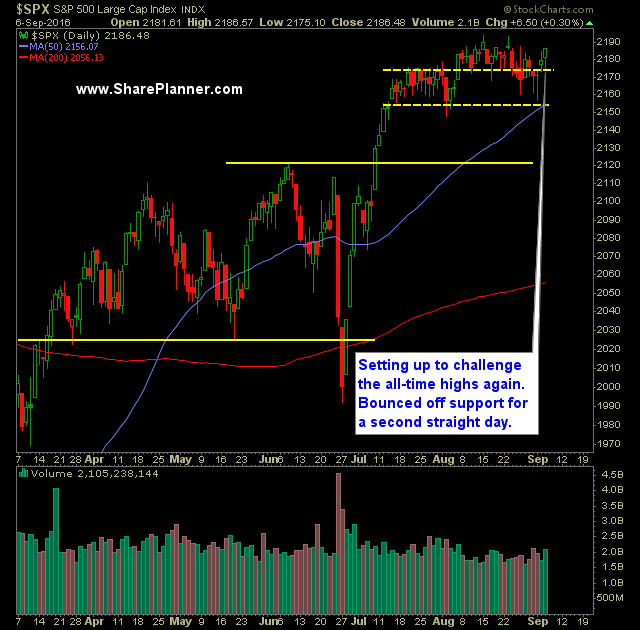

- SPX is now turning bullish again, although it is still stuck in a short-term trading range. New all-time highs are within arm’s reach, and to add short positions to the portfolio at this point, doesn’t add anything unless the bears can show it can reverse the course of the market from the past two days.

- Price on SPX is firmly above the 5, 10, and 20-day moving average.

- The aforementioned moving averages are all within a four point trading range of each other. It shows just how tight the price range has been over the past few weeks.

- SPDRs S&P 500 (SPY) volume was lower for a second straight day, and well below recent averages. That creates the possibility of a head fake of the last two trading sessions.

- Nasdaq (QQQ) broke out to new all-time highs yesterday and is the strongest of the indices at this point.

- Potential bounce unfolding in Crude Oil Futures (/CL) over the past two days. Breaking out and above the August highs will be crucial.

- CBOE Volatility Index (VIX) showing weakness again with an attempted bounce falling flat yesterday.

- The market is showing a decoupling from oil as the rise and fall of the commodity in June, July and now August has not impacted the equities market substantially.

- Three support levels to watch going forward on SPX is 2168, 2155, and 2147. The breaks are only valid if the price can close below those support levels.

My Trades:

- Did not add any new swing-trades to the portfolio on Friday.

- Covered GOOGL yesterday at $806.78 for a 1.9% loss.

- May add 1-2 new swing-trades to the portfolio today.

- Will consider adding additional short positions to the portfolio as the market warrants it.

- Currently 10% Long / 30% Short / 40% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

S&P 500 (SPX)

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.