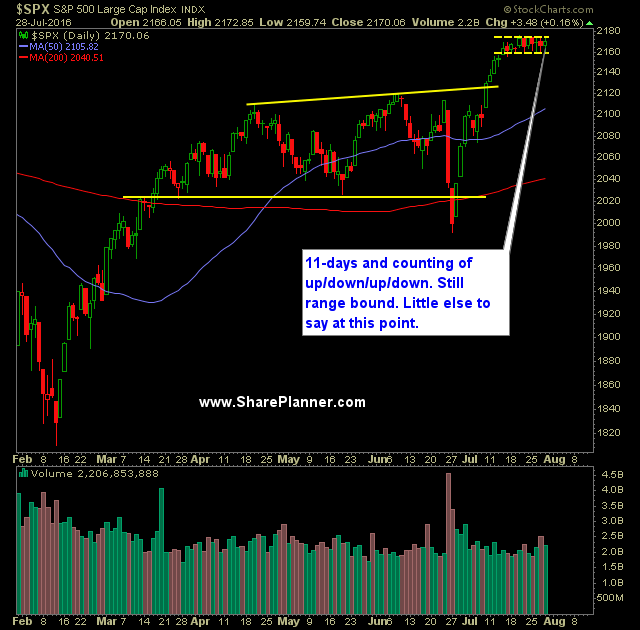

Technical Outlook:

- Solid earnings reports from the big companies aren’t helping to lift the market at all from its current trading range. Today we’ll see if Amazon (AMZN) or Alphabet (GOOGL) can pull it off.

- The trading range over the last 11 trading sessions has been less than 1% – one of the tightest ranges ever to occur during such a stretch.

- A positive finish higher today would end the up/down/up/down pattern that the market is putting on.

- This has only happened eleven other times since the 1920’s.

- Volatility Index (VIX) continues to struggle on any move above 13. Each time creating a sell-off resulting in a doji candle close.

- Price action continues to be wedged between the 5 and 10-day moving averages on the S&P 500 (SPX)

- So far, SPX has been digesting recent gains through time rather than through price.

- SPDRs S&P 500 (SPY) volume dropped yesterday from the day prior, and came in well below recent averages. Nine straight days of below average volume.

- GDP came in well below expectations today 1.2% versus expectations of 2.6%. This could weigh hard on today’s price action.

- Oil continues to drop hard and fast. Eventually this will take its toll on the stock market. United States Oil Fund (USO) has retraced 60% of the move off of the February lows.

- Nasdaq (COMPQ) and Russell (RUT) continue to trend higher and break out of their current ranges while the Dow Jones Industrial Average (DJIA) continues to show signs of rolling over.

- SPX trading range continues to come in incredibly choppy. Two price levels to watch that will signify further weakness in the market is 2059 and 2055.

- At this point, and with the election ahead, I’d expect the market to keep rallying higher. I don’t expect there to be a rate hike between now and the election. To do so would impact the market and thereby the election. I don’t think the Fed wants that, particularly since Trump has indicated that he would replace Yellen.

My Trades:

- Sold AMZN yesterday at 746.72 for a 1.5% profit

- I don’t hold trades through earnings, so this was planned all along.

- I did add one new swing-trade to the portfolio yesterday.

- May add 1-2 new swing-trades to the portfolio today.

- Will consider hedging the portfolio as well with a short position.

- Currently 40% Long / 60% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan covers the topic of averaging into your winning trades. Is this a viable strategy that maximizes profits, or does it expand the risk factor at the expense of reward?

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.