The market is still trying to rally today, and up barely a smidge, and this is despite Facebook (FB), Amazon (AMZN), Netflix (NFLX), Google (GOOGL) and Apple (AAPL) being ghastly in the red today. Internals are not that great either. Nothing great or trendy with the TICKS, VIX is

Technical Outlook: Another melt up into the close while lagging throughout the morning. This has been the trend over the past two days, where the market is unable to garner any traction throughout the trading sessions until the afternoon when the buyers come in during the afternoon and drive the market higher. Yesterday’s volume was

Market and stock analysis including $SPX $SPY $QQQ $IWM $COMPQ $STT $FB $AMZN $NFLX $GOOGL $USO Enjoy!

The market acts like it isn’t sure what to do with itself. The market rallied off the lows this morning immediately following the market’s open, but since then it has given back those gains and momentum and now is just floundering around. Up? Down? Who freakin’ knows. Buyers and sellers aren’t overly inspired except for

Technical Outlook: Yesterday SPX showed strong potential leading up to the FOMC statement to break out of its four day price range and push and continue its dead cat bounce. But once the FOMC statement came out, SPX saw a 44 point reversal from the highs of the day. Volume saw a slight

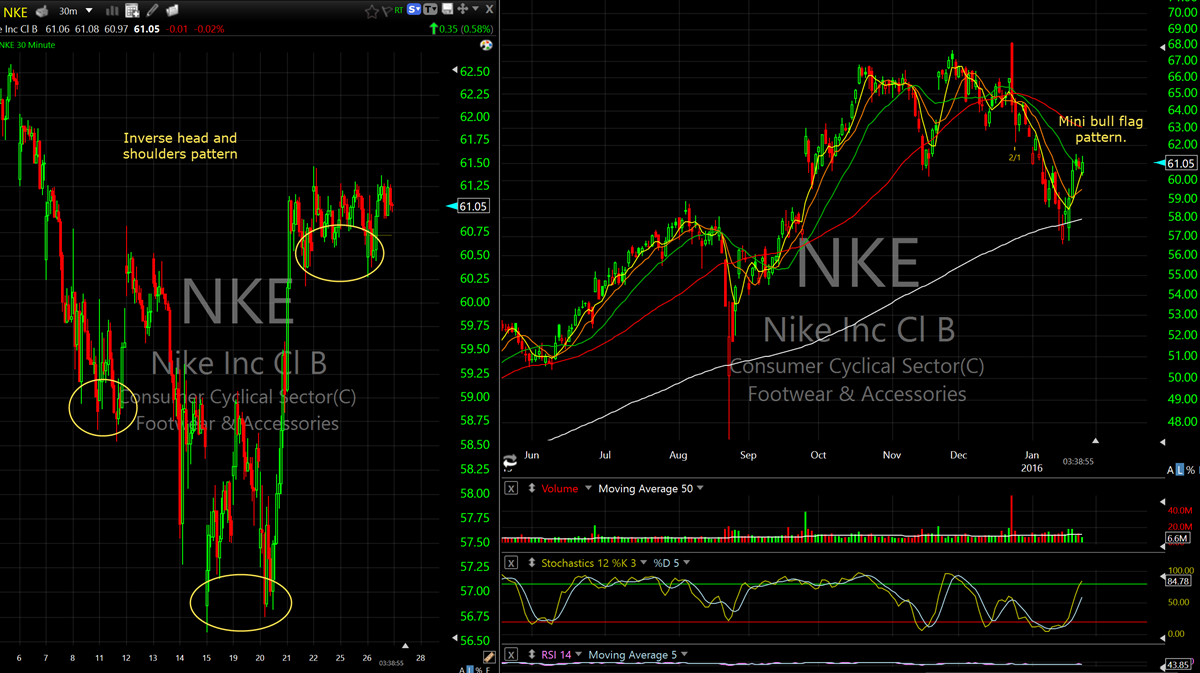

Here are today's swing-trades in NKE and GOOGL Nike (NKE) 1/26: Massive head and shoulders pattern on $NKE on the 30 minute chart, that can also bee seen during the month of January on the daily chart. Looking for a move back up to $65 from here. Risk can be dramatically tightened as the trade

Technical Outlook: SPX rallied a solid 2% yesterday further the dead cat bounce gains and recapturing the 5 and 10-day moving averages. Volume on SPY dropped for a second straight day and just a little bit above average. No overly impressive in that regard. When considering the price action from Friday, it

2015 was gone at the strike of midnight and with its farewell comes 2016. For almost every trader out there, that is great news. It is the hope of all traders that the potential for profitability in 2016 is much more attainable. In this past year stocks were down, bonds were down, commodities crashed, hedge

2015 was gone at the strike of midnight and with its farewell comes 2016. For almost every trader out there, that is great news. It is the hope of all traders that the potential for profitability in 2016 is much more attainable. In this past year stocks were down, bonds were down, commodities crashed, hedge

Technical Outlook: SPX provided strong follow through yesterday, bouncing back and reclaiming the 5 and 10-day moving averages. A test of 2076, the peak of the lower-high that was previously established could be challenged with a massive move today, but a more likely scenario would be 2061 that represents the convergence of the 50