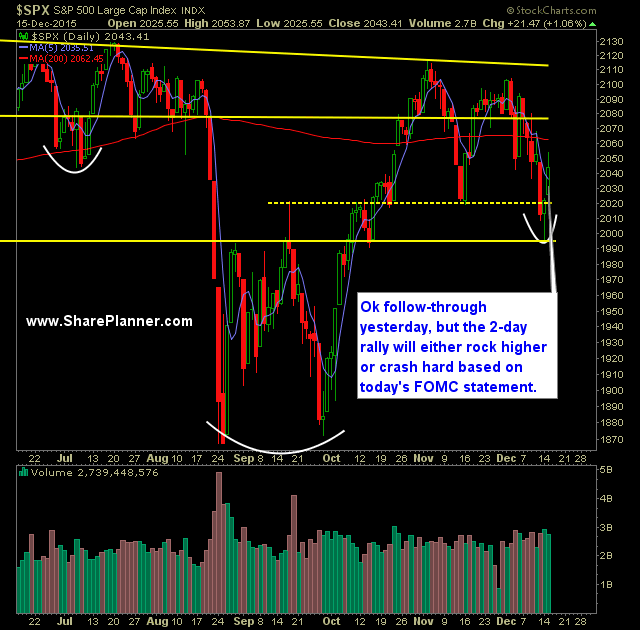

Technical Outlook: Respectable follow through yesterday, though SPY failed to do much of anything after the first 30 minutes of trading, finishing just barely higher than where it started the day at. Today is the day where the FOMC is expected to begin increasing interest rates – with today starting at a quarter point

It’s still never too late to finish the year off right – and you can do so by signing up for the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade

I just finished up another profitable month in November! It’s still never too late to finish the year off right – and you can do so by signing up for the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as

Not your typical way of posting charts these days, but with technology and to use these digital pens, it makes it far more easier to point out more of the nuances of a chart than ever before... so here you go.... Apple $AAPL: Microsoft $MSFT: Alphabet (Google) $GOOGL: Netflix $NFLX: Walt Disney Company $DIS:

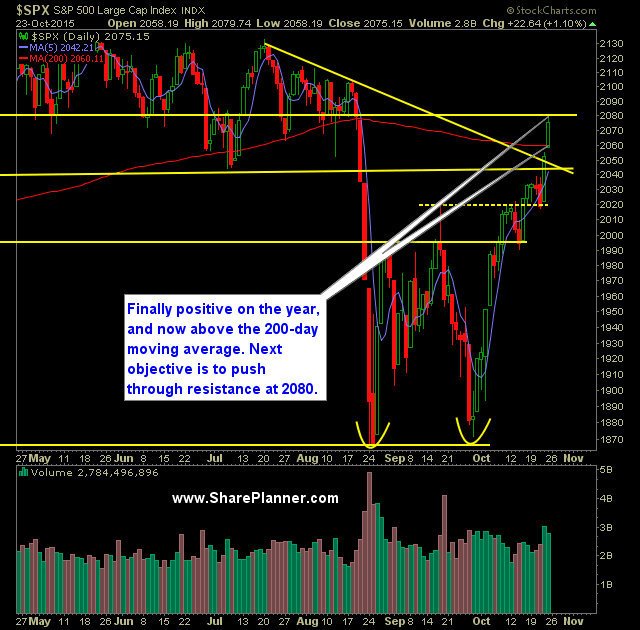

Technical Outlook: Huge rally again for a second day in a row, sending SPX up 56 points over that two-day stretch. Friday’s rally saw SPX get back into positive territory for the year. The 200-day moving average of SPX has now been broken. The rally was far from anything being broad-based. In fact the advancers

Technical Outlook: Quiet day of trading yesterday as SPX consolidated for a second straight day. Slight uptick in volume from the day prior but once again extremely low overall. SPY just a shade below major resistance at $204.11, which represents the underside of the February through August trading range of this year. SPX testing

Technical Outlook: Despite weakness early, dip buyers came in and rallied the market back to break even with a last minute spike in the trading session to put the market in positive territory. Essentially there are three resistance levels to watch: 1) Lower channel, range resistance at 2040 as shown below, 2) Declining resistance off

Solid day for Google (GOOGL) today despite its desire to close as close to $700 without actually going over it ($699.95 to be exact). But also important is the move above the new breakout level and there was really no struggle whatsoever with it. This bodes well as the week progresses. Though with earnings

Technical Outlook: Strong follow through on Friday that put the SPX at new rally highs and setting up for a test of key resistance beginning at 2040. This represents the bottom end of the range that SPX had been stuck in going back to March through August of this year. On the weekly SPX chart,

Technical Outlook: SPX managed to breakout above Tuesday’s intraday highs, and more importantly managed to close above 2020 again after a two-day pullback that threatened to rollover the market. Volume rose for the third straight day and almost was at recent average levels. SPX now poised to challenge the 200-day moving average in the