Technical Outlook:

- Day 2 of the dead cat bounce unfolded yesterday and it was a brilliant one.

- Back-to-back +30 point days on SPX is a rarity in general, but not when you are coming off the heals of a major sell-off.

- Much of the Brexit losses have been erased following the two day bounce. Only 43 points away from the closing highs prior to the Brexit vote.

- Considering that Monday SPX was trading below 2000 and now back at 2070 two days later, is quite impressive.

- Today is the last trading session of the month – typically bearish. Only once this year and twice last year, did it result in a positive return and June tends to be the most bearish of the of all the last day of trading months.

- There may be a great deal more of maneuvering by the funds today to get their window dressing done in light of the events of the past week.

- Global terrorism seems to have lost its effect on the market. The attack in Orlando and in Istanbul has had zero impact on price action as have other ones before it.

- SPY volume has dropped off for a third consecutive day, but still above recent averages. I suspect volume with get incredibly light over the next two days as the holiday weekend gets closer.

- Some big gaps from the past two days remain unfilled on SPY and other charts (DIA, IWM, QQQ).

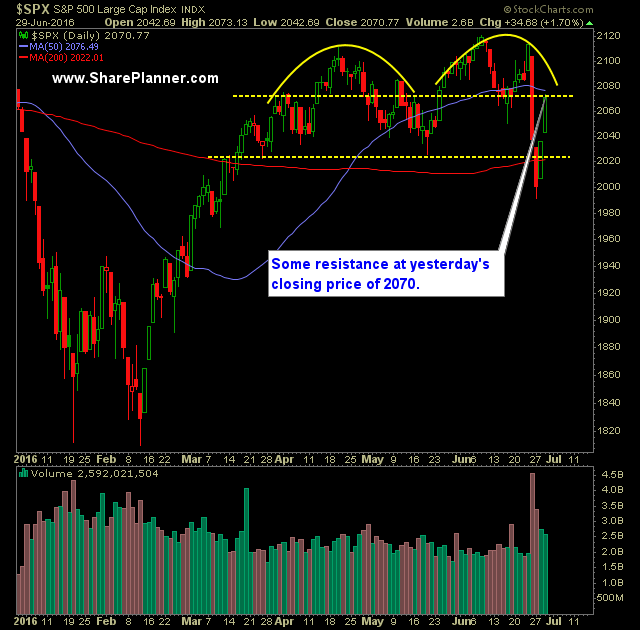

- SPX 30 minute chart shows a market that has bounced hard and fast with resistance overhead looming at the 2085 area.

- VIX is back to a very important level – the 16.40s. This level has been a strong place of support and resistance, and could see a hard bounce off of it today.

- SPX reclaimed its 5 and 10-day moving averages yesterday, but the bigger 20, 50-day moving averages loom overhead.

- As price creeps back into the 2050-2090 range on SPX, you have to be concerned with price action giving way again to bearish tendencies.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

- Biggest issue for the time being for the bears is that the Brexit vote to leave, may not generate a ton of additional headlines and there is no guarantee, that the politicians, who are against such a move, would even allow it to happen.

My Trades:

- Sold IWM yesterday at $112.90 for a 2.3% profit.

- Sold BA yesterday at $127.17 for a 1.2% profit.

- Sold GS at $143.12 for a 1.1% profit.

- Sold GOOGL yesterday at $694.35 for a 1% profit.

- Sold NKE at 54.53 yesterday for a 1% profit

- Did not add any additional positions to the portfolio yesterday.

- Currently 100% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, Ryan dives into stop-losses, where he places them and how he goes about deciding where the ideal stop-loss placement is for each of his trades. Ryan also explains why doesn't use trailing stop-losses and only uses manual stop losses in his swing trading.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.