To describe this market, there is no chart, and no analysis that can do it better than this random Russian guy deciding to go down a metal slide. The results speak for themselves and for the state of the current market: Needless to say, even though the bears have owned this market (sort of) over

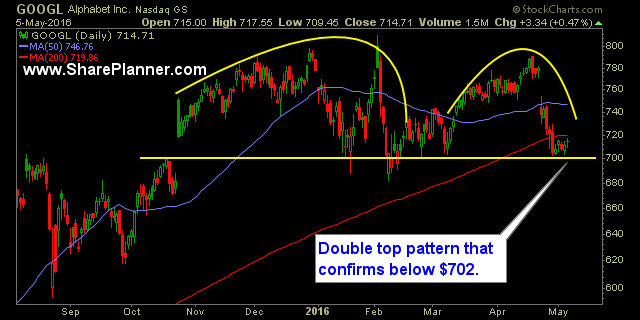

Fairly significant pattern still working itself out. Appears to me that the price action of late is a dad cat bounce that should be shorted. Looking for the initial move to take price down to $700, then $675. Also the rising trend-line off of the August lows has been violated and broken. Last week it

I have to level with you all…I find this market rally extremely skeptical. It is another one of those market-hijacked rallies based off of a headline from left-field. Two weeks ago, oil jump started its rally when an oil community in Canada was set ablaze. Today it is the market rallying off news Warren Buffett

Don’t let May waste away, instead learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I

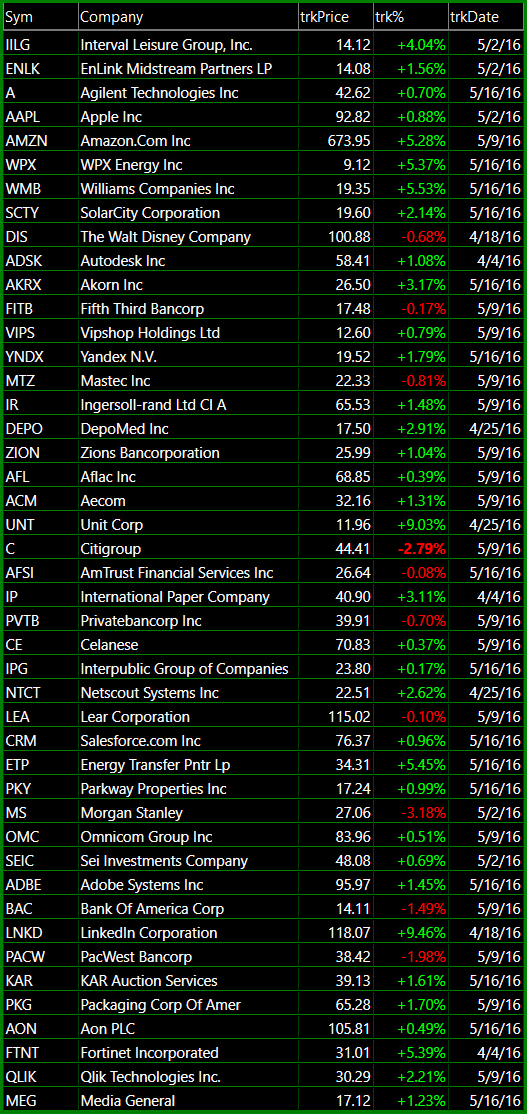

The market resiliency continued into last week with a positive return for the eighth time in the past ten weeks. There are some cracks beneath the surface though, particularly with earnings starting to disappoint on a large scale - most notably with Microsoft (MSFT) and Google (GOOGL). Tech is starting to lag some - with

Technical Outlook: First legitimate sell-off on SPX yesterday since April 7th. SPX finished the day trading below the 5-day moving average. Watch the rising trend-line off of the February 11th lows. Currently the trend-line sits at 2087. A slew of earnings came out last night and this morning resulting in hard sell-offs in

Futures are looking ‘okay’ right now, but there is some fair value cooked into them. For instance, the Nasdaq isn’t down only a few points, instead, it is down about 1% from where it closed the day at 4pm eastern. From the looks of things with Google (GOOGL) and Microsoft (MSFT) putting

SharePlanner Reversal Indicator is trying to point north again. However, no confirmation has occurred, but it won’t take much for it to do so if Friday results in a significant rally or we have another similar rally next week to what the market has become accustomed to of late. Not factored into the Weekly SPRI