Technical Outlook:

- Market pulled back for the second time in the last three trading sessions.

- The volume was extremely light on SPY yesterday, and barely above Christmas Eve’s half day of trading last year. Needless to say, volume was well below average readings and half of what was seen on Friday.

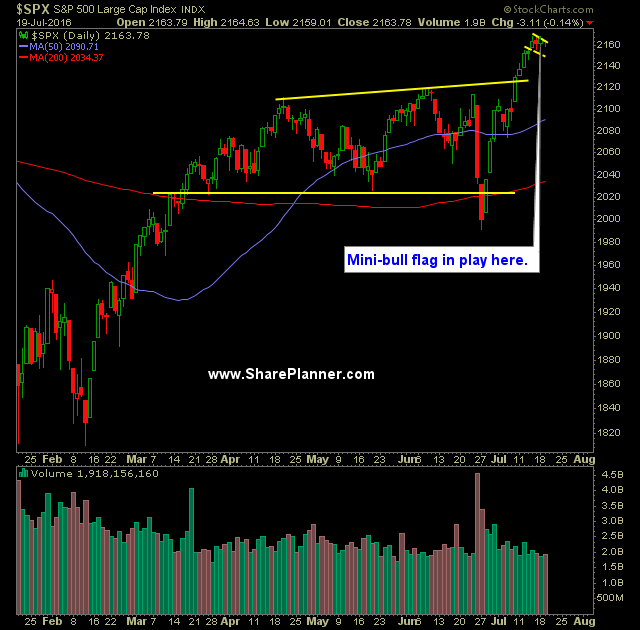

- Mini-bull flag pattern developing on the daily chart of SPX.

- Watch the 5-day moving average going forward. So far, the market has refused to break below this level.

- Consolidation over the past three days has been very healthy for the market. Recent rally was unsustainable. Some consolidation was overdue.

- So far, earnings season hasn’t been the disappointment that many thought it would be.

- VIX continues to melt away, and the lowest closing print in the past year (7/17/15 was the last time a reading was lower).

- SPX continues to trade sideways following the massive rally out of the trading range. Look for a possible break out of it today.

- SPX on the weekly chart is attempting to string together its fourth consecutive week in the green.

- SPX on the monthly chart is attempting to string together its fifth consecutive month in the green.

- Despite impressive monthly streak, it has been marked with consistent volatility seen most clearly in the Brexit sell-off and rally to new all-time highs.

- A break in the 5-day moving average could ultimately result in a pullback to the breakout level at 2120.

- The next three weeks will be the thick of earnings season. Know when your stocks are reporting and plan accordingly. Expect plenty of large moves and for futures to be affected by the reports of FB, AAPL, GOOGL, AMZN and others.

- At this point, and with the election ahead, I’d expect the market to keep rallying higher. I don’t expect there to be a rate hike between now and the election. To do so would impact the market and thereby the election. I don’t think the Fed wants that, particularly since Trump has indicated that he would replace Yellen.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

My Trades:

- Added two new swing trades to the portfolio yesterday.

- Did not close out any swing-trades yesterday.

- May add 1-2 new swing-trades to the portfolio today.

- Will consider hedging the portfolio as well with a short position.

- Currently 50% Long / 50% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan covers the topic of averaging into your winning trades. Is this a viable strategy that maximizes profits, or does it expand the risk factor at the expense of reward?

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.