My Swing Trading Strategy I added one new long position on Friday. Still concerned about the ability of this market to march all that much higher, which is why I am extremely light at this juncture. Completely willing to add short positions and wouldn’t be surprised to see myself do so before the end of

I don’t have any issues with any of the sectors right now except for Energy. Energy is seriously the most unpredictable and untradeable sector right now. Nothing holds to the upside, and just when you think a stock is breaking out, it reverses course and breaks down on you.

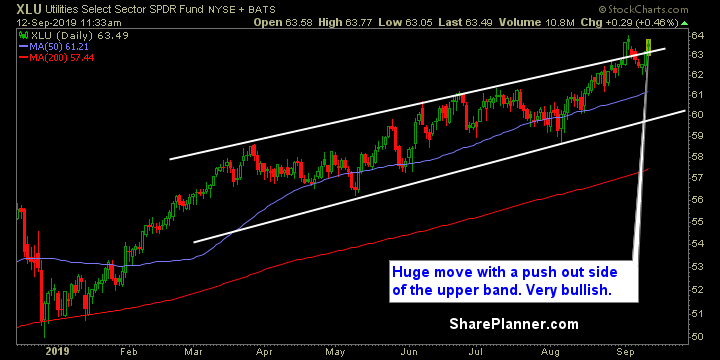

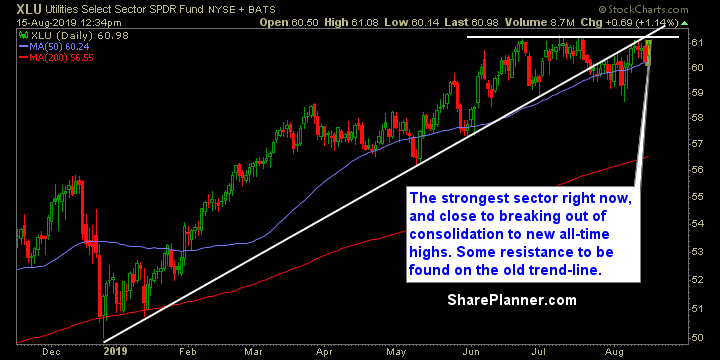

A lot of trend-lines breaks and topping patterns are forming The safe sectors is where big money is putting its capital. Utilities are practically on the brink of new all-time highs. I’d also like to add stocks supporting the military or have big dollars in the Pentagon defense budget are also holding up well and

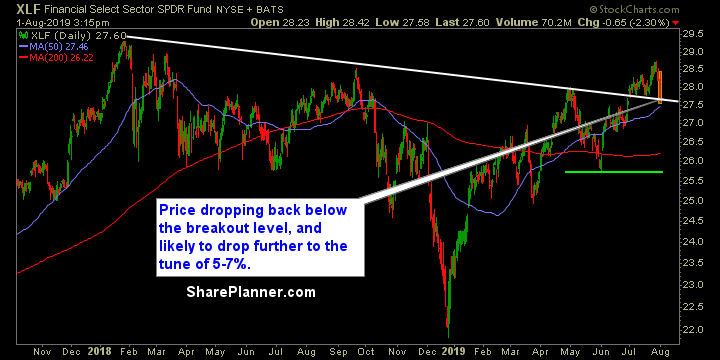

The market is shedding its bullish act, and taking on a much more bearish tone. Jerome Powell’s circus yesterday, coupled with Trump’s untimely Chinese tariffs tweets today, has instantly put this market into a tale-spin. Short -term support levels are being violated across the board, and traders are being whip-lashed all over the board. The

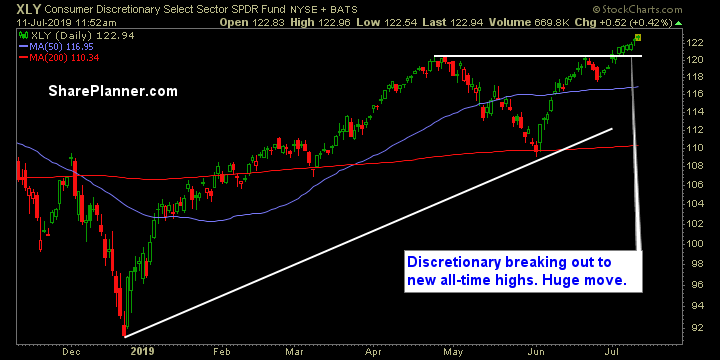

Very bullish look to the market. Maybe some pullbacks to existing trend-lines in order. I can’t find much to say that is negative about this market. Trade War headlines have died down and the Fed (for reasons beyond any reason) are still wanting to lower rates even though the market is at all time highs.

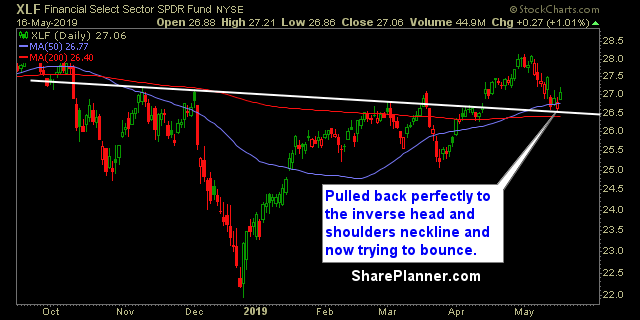

A lot of varying patterns among the sectors, but mostly bullish May was not kind for the market. June has been much better for the bulls, and last week’s bounce put SPX back to about 2% below all-time highs. There are triangle patterns (healthcare), head and shoulders patterns (energy), bull flags (technology), and downtrend

My Swing Trading Strategy I didn’t add any new positions yesterday as the market didn’t show much willingness to make any meaningful move. I will look to add one or two new positions today. Indicators Volatility Index (VIX) – Less than a 1% drop yesterday, and continued consolidation over the last five trading sessions. The 50-day

A number of head and shoulders patterns trying to form. Technology is not currently in the top three, but it is certainly the fourth best sector which places it right in the middle of the pack for now. The market has had a couple of weeks of late that has not been very easy for

My Swing Trading Strategy I added two new positions to the portfolio while taking a small profit in Aliababa (BABA) yesterday. I may consider adding one new position today depending on how strong the market can stay, considering the pre-market strength currently being seen. Indicators Volatility Index (VIX) – Expect more of a decline today

My Swing Trading Strategy I didn’t add any new positions to the portfolio yesterday nor did I subtract from it. The market in its current state is seeing strength in the small caps while neglecting large caps, by and large. Indicators Volatility Index (VIX) – Gave back nearly all of Tuesday’s gains with a decline of