My Swing Trading Strategy

I didn’t add any new positions to the portfolio yesterday nor did I subtract from it. The market in its current state is seeing strength in the small caps while neglecting large caps, by and large.

Indicators

- Volatility Index (VIX) – Gave back nearly all of Tuesday’s gains with a decline of 7%. At this point, the $VIX remains comfortable with not sustaining any multi-day run to the upside, and simply languishes sideways.

- T2108 (% of stocks trading above their 40-day moving average): A 9% pop yesterday following a strong small cap rally, pushed the indicator back up to 64%. Like the $VIX it doesn’t seem interested in committing to a direction, just languishing sideways for now.

- Moving averages (SPX): Reclaimed the 5-day moving average at the very end of the session and now trades above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Real Estate led the way, and one of the more consistent sectors of late in trending higher. Very little in the way of pullbacks. Technology stormed higher to new all-time highs yesterday. Discretionary poised to do the same in the weeks ahead. Energy had a notable bounce, but needs to really push a bit higher here before its next pullback. Avoid the Financials as they will be kicking off earnings tomorrow – not worth the gamble.

My Market Sentiment

This market is determined to stay afloat and not allow the bears to tank it going into earnings. Once earnings hit, I do believe the market price action will be largely driven by the earnings reports.

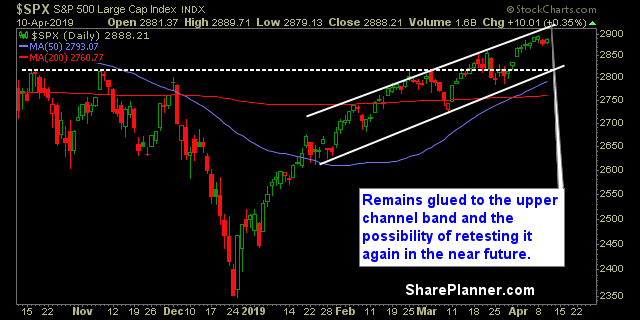

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.