My Swing Trading Strategy

I didn’t add any new positions yesterday as the market didn’t show much willingness to make any meaningful move. I will look to add one or two new positions today.

Indicators

- Volatility Index (VIX) – Less than a 1% drop yesterday, and continued consolidation over the last five trading sessions. The 50-day moving average is still holding strong but could see a test today.

- T2108 (% of stocks trading above their 40-day moving average): A non-move yesterday. Still under-performing the broader move in the index which means much of the market’s move is taking place with a handful of large companies. Small caps have yet to participate to the same degree as large caps.

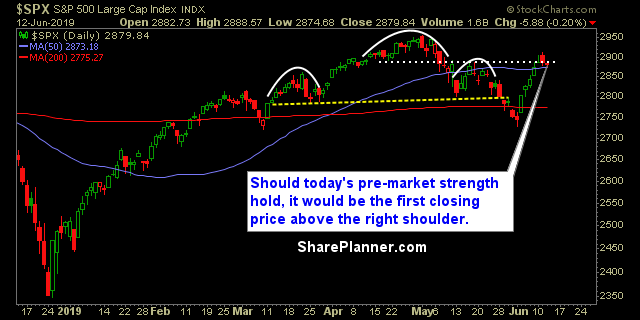

- Moving averages (SPX): SPX currently trading above all of its major moving averages. Tested and held the 5-day and 50-day moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Worth noting yesterday that your defensive stocks rallied the market yesterday – Utilities, Real Estate and Staples with Healthcare wedged in between. Energy took a huge spill yesterday and the primary source from yesterday’s weakness. However, you can expect a bounce today with the oil tankers being attacked in the Gulf of Oman. Technology has pulled back the last two trading sessions, and testing its 5-day moving average while facing resistance overhead with the 50-day MA.

My Market Sentiment

Two-day pullback has price sitting on the 5-day and 50-day moving averages and ready to bounce. Volume on the pullback has been very light and looking to bounce towards the market all-time highs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.