My Swing Trading Strategy If this market has you tired and annoyed over the past week, you are not alone. The low volume, whimsical trading patterns, certainly makes for some unpredictable markets providing poor breadth and lack of consistency on a day-to-day basis. With four positions open, plan to stay put today, unless we get

Technicals are pretty much a disaster for all the sectors. Except for Staples and Utilities, which are actually on the up and up, but that is to be expected when the street is looking for safe havens for its capital. The bulls have suffered for five weeks strong, and it is showing on the charts

My Swing Trading Approach The bulls managed to hold the breakout to all-time highs, and at this point there is little reason to be attempting a short on the stock market. I will look to add one more swing-trade position today. Indicators

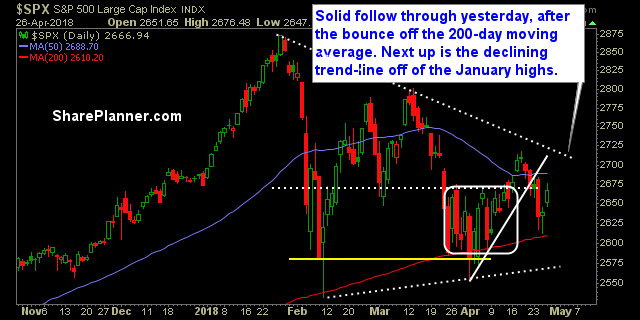

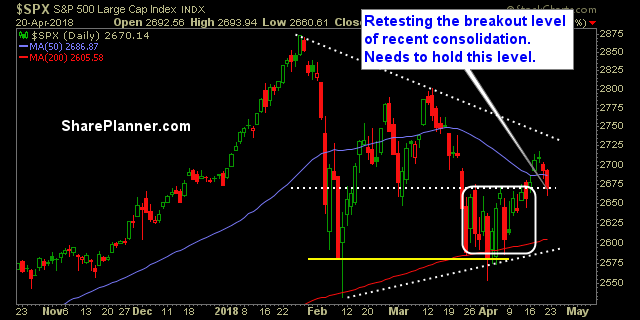

My Swing Trading Approach I will look to add 1-2 new long positions today once the market gets past the first 30 minutes of trading, and if it can hold on to its early morning gains. Raise the stop in my existing long, profitable trades. Indicators

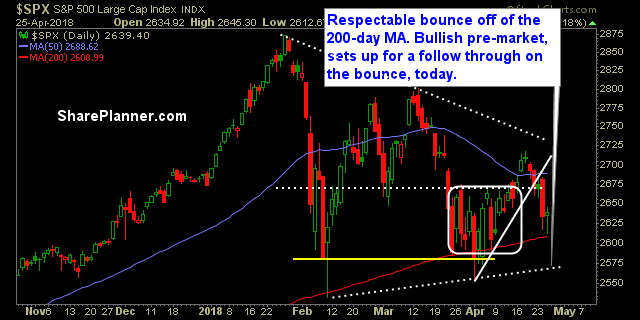

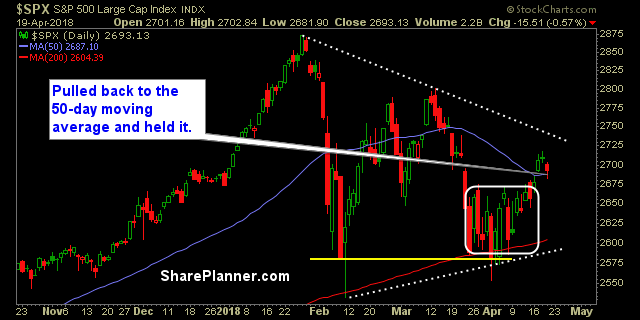

My Swing Trading Approach I have one long position coming into today. I covered my short position yesterday on SPY for a 3.1% profit. Looking to add additional long positions, as the market allows for, today. Indicators

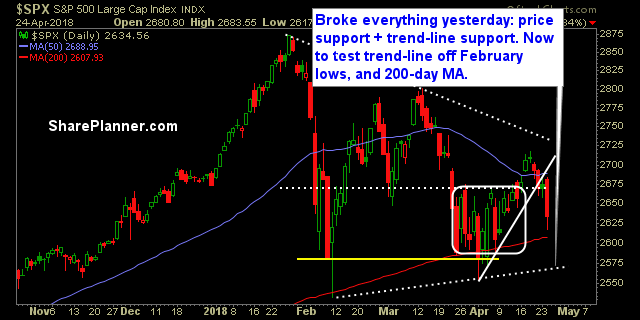

My Swing Trading Approach Flexibility over conviction. I want to play the market whichever direction it decides to take me. I don’t hold a strong conviction about this market either way, and as a result, I don’t want to have too much of my capital committed at once. Indicators

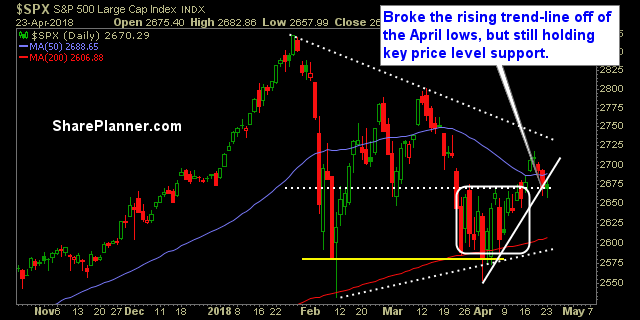

My Swing Trading Approach Gap ups of late have been difficult to hold, but nonetheless, should it do so, I will look to cover my one short position, and add to my long positions. Indicators

My Swing Trading Approach The 10-year rate is increasing, which is cause for concern. Also, a slew of earnings reports this week, to keep a close eye on. Lighter in the portfolio, is better, until there is some trading clarity. Indicators

My Swing Trading Approach I lightened up my portfolio yesterday, following the pullback, and booked 5% in my trade in Anadarko Petroleum (APC). The market remains bullish overall, and will look to add 1-2 new positions today Indicators

My Swing Trading Approach I added one new swing-trade position to the portfolio on Friday. I will raise the stop-loss to protect profits, and if the market can add to Friday’s gains, I will look to add more long exposure. Getting short is still on the table. Indicators