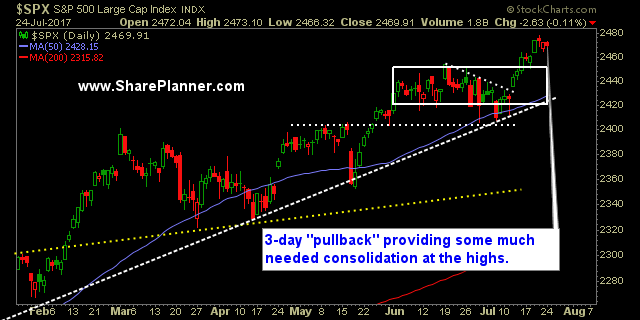

3 days of selling of less than one point per day

That is what SPX has averaged over the course of the last three days when it finished lower each day – less than one measily point. For the bears that has to be infuriating.

I don’t blame them – I would be too, if I were in their shoes.

Now the S&P 500 is looking to gap higher to new all-time highs this morning, because at this point, that is the only thing this market really knows how to do. Earnings have been fairly well received today, with Caterpillar popping a cool 5% in the premarket. Meanwhile, despite the three day sell-off on SPX, the VIX has been down 9 of the last 12, and below the “10” mark for 8 straight days – an all-time record.

I came into the day with a little bit of short exposure – That was my insurance in case this market wanted to fall apart on us unexpectedly. I’m not bothered by this one bit, but have a dominant amount of long positions in the portfolio. If I get stopped out of it, that is fine, the long positions should more than make up for that. Meanwhile, I was managing the risk, and making sure I didn’t get caught by surprise from the market.

Stay safe out there today – always manage the risk, use today, to move up your stop-losses on your existing longs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

- 5 Long Positions, 1 Short Position

Recent Stock Trade Notables:

- Alibaba Group (BABA): Long at $143.65, closed at $150.40 for a 4.7% profit.

- American Airlines (AAL): Long at $49.26, closed at $51.84 for a 5.2% profit

- Intel (INTC) Short at $35.21, covered at $34.46 for a 2.1% profit.

- Nvdia (NVDA): Long at $155.57, closed at $157.53 for a 1.3% profit.

- IBB: Long at $298.24, closed at $303.74 for a 1.8% profit.

- SPXU: Long at $15.68, closed at $15.25 for a 2.7% loss.

- Whirlpool (WHR): Long at $190.46, closed at $195.19 for a 2.5% profit.

- Ferrari (RACE): Long at $84.60, closed at $89.93 for a 6.3% profit.

- Amazon (AMZN): Long at $964.70, closed at $1001.23 for a 3.8% profit.

- American Airlines (AAL): Long at $49.18, closed at $50.62 for a 2.9% profit

- Alibaba Group (BABA): Long at $124.95, closed at $137.51 for a 10.1% profit.

- Starbucks (SBUX): Long at $61.78, closed at $63.68 for a 3.1% profit.

- Western Digital (WDC): Long at $91.24, closed at $89.29 for a 2.1% loss.

- Broadcom (AVGO): Long at $236.65, closed at $241.15 for a 2% profit.

- SPXU: Long at 16.60, closed at $16.98 for a 2.3% profit.

- JP Morgan Chase (JPM): Long at $87.84, closed at $85.98 for a 2.1% loss.

- Micron Technology (MU): Long at $29.00, closed at $28.04 for a 3.3% loss.

- Alibaba Group (BABA): Long at $116.25, closed at $124.09 for a 6.7% profit.

- Southwest Airlines (LUV): Long at $58.35, closed at 57.23 for a 1.9% loss.

- Broadcom (AVGO): Long at $223.63, closed at $228.65 for a 2.2% profit.

- Workday (WDAY): Long at 86.00, closed at 90.32 for a 5% profit.

- Univar (UNVR): Long at $30.96, closed at $32.20 for a 4% profit.

- Alibaba Group (BABA): Long at $111.91, closed at $115.48 for a 3.2% profit.

- Redhat (RHT): Long at $85.21, closed at $87.21 foor a 2.4% profit.

- Darling Ingredients (DAR): Long at $15.19, closed at $14.90 for a 1.9% loss.

- Apple (AAPL): Long at $143.82, closed at $147.11 for a 2.3% profit.

- Teradyne (TER): Long at $31.16, closed at $33.03 for a 6.0% profit.

- UPRO: Long at $92.75, closed at $94.78 for a 2.2% profit.

Sign up for Trading Block here.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Ryan gives his best secrets and tips to shorting stocks and what he focuses on, what he trades, and how he trades them, as well as the must-knows about shorting stocks that no one else will tell you.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.