$VIX back below key support, after falling off a cliff, post CPI.

Watch $BLDR and the potential for a bull flag breakout.

Bed Bath & Beyond (BBBY) down 67% since the highs of Monday. Significant week for CBOE Market Volatility Index (VIX) as it was finally about to breakout of the downtrend. US 10 year treasury yield (TNX) breaking out of its declining trend-line from October highs. Alibaba Group (BABA) breaking that rising trend-line. Apple

Discretionary ETF (XLY) coiling above key breakout support. Bulls will need to hold this one in the coming days, to keep control. Technology ETF (XLK) Consolidation over the last five trading sessions still has tech sector holding key support. Robinhood (HOOD) coiling just below major resistance. Airbnb (ABNB) nearing a test of significant resistance that

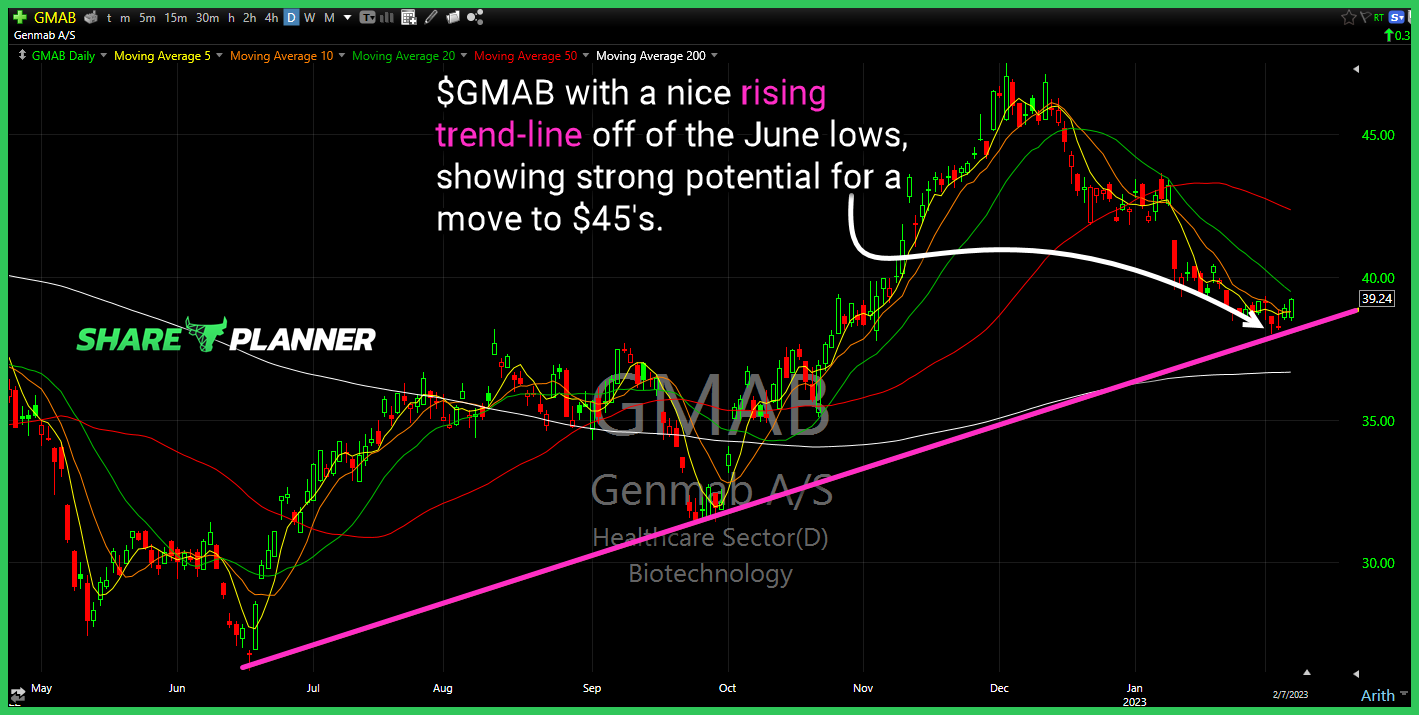

Genmab (GMAB) with a nice rising trend-line off of the June lows, showing strong potential for a move to $45's. US 10 year yield (TNX) testing declining resistance Amazon (AMZN) pulling back to the short-term rising trend-line, and attempting to bounce. Royal Caribbean (RCL) rally has been incredible of late, but may be facing resistance

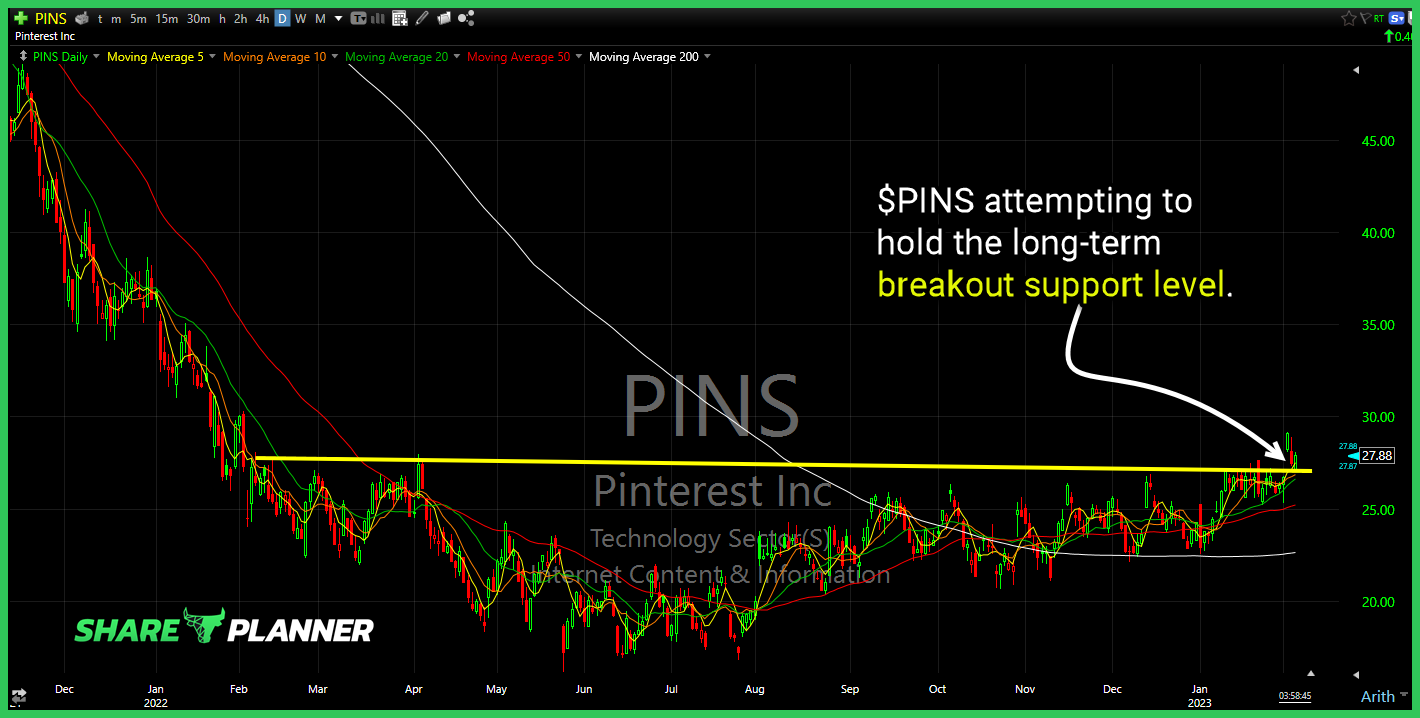

$PINS attempting to hold the long-term breakout support level.

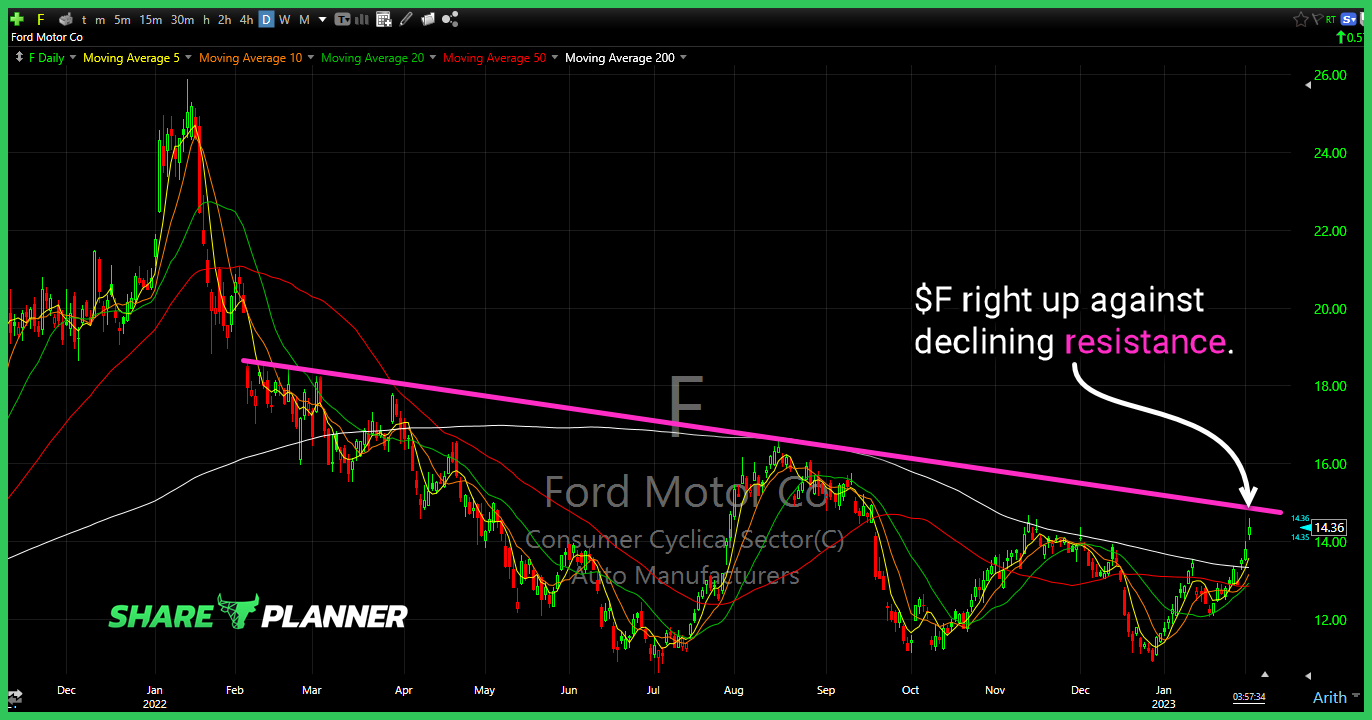

$F right up against declining resistance.

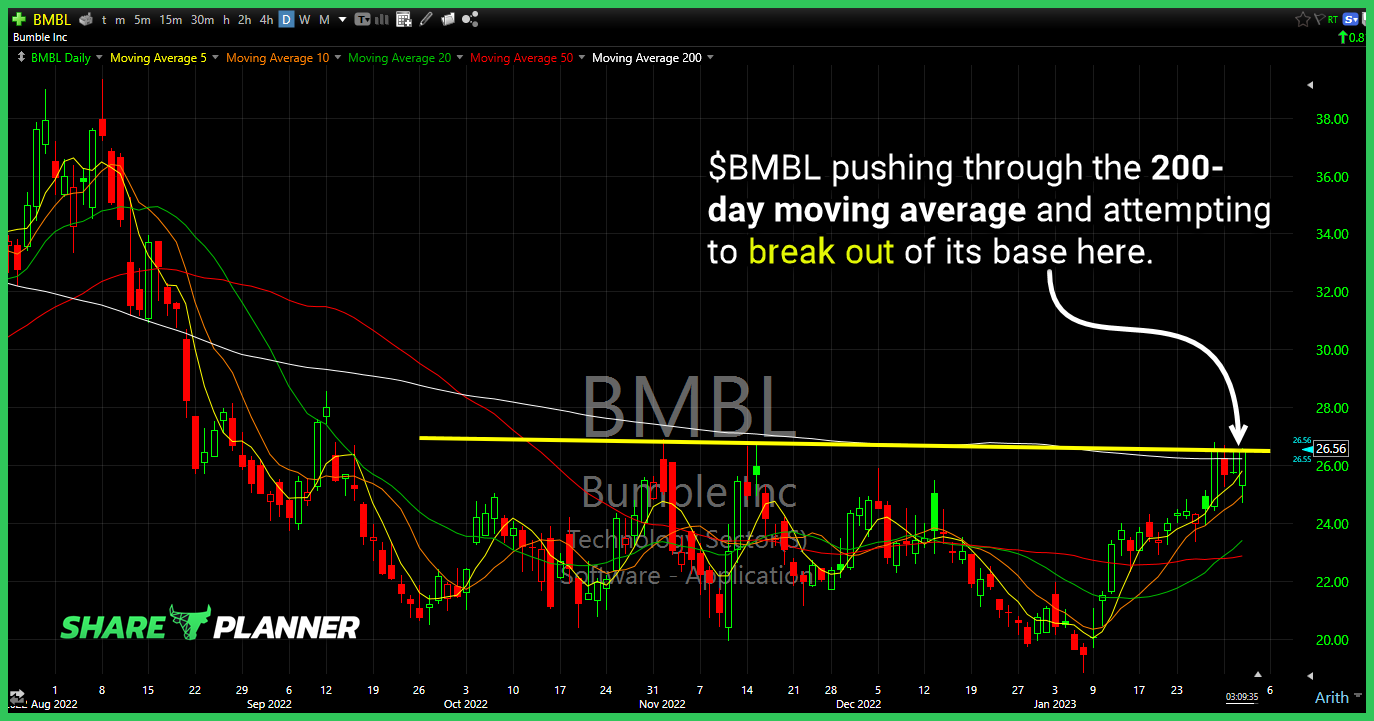

$BMBL pushing through the 200-day moving average and attempting to break out of its base here.

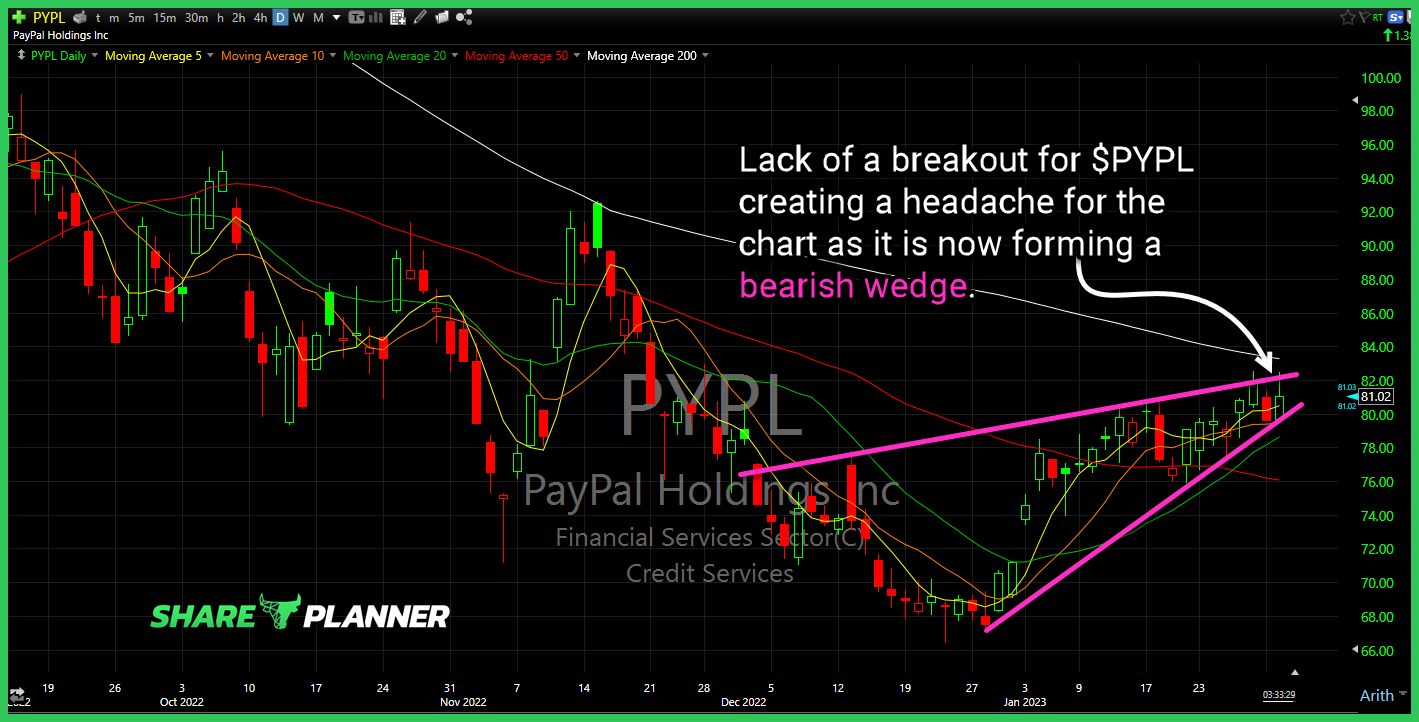

Lack of a breakout for $PYPL creating a headache for the chart as it is now forming a bearish wedge.

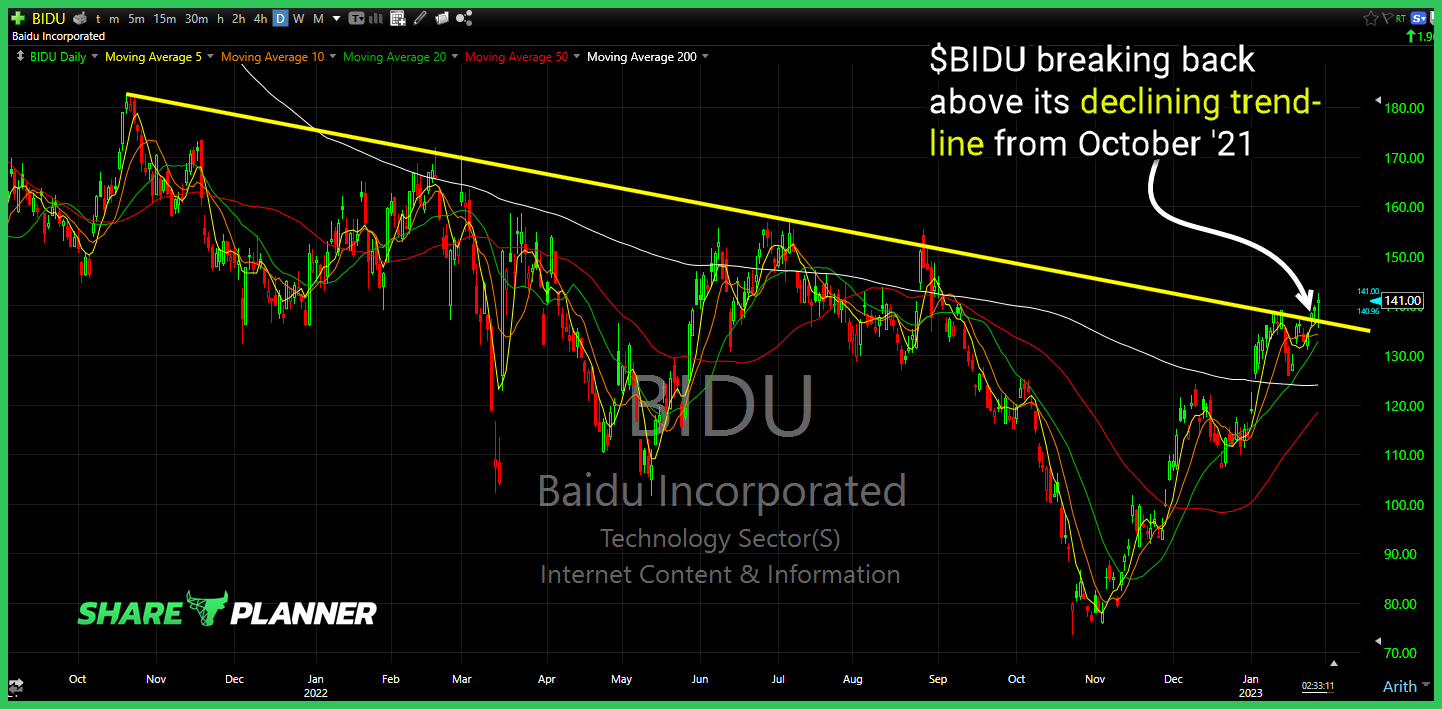

Baidu (BIDU) breaking back above its declining trend-line from October '21 Snap (SNAP) declining resistance starting to break despite being overbought all month long. Carvana (CVNA) finally breaking out of a base it has been forming since November. US Dollar holding its long-term trend-line and setting up for a bounce going into FOMC.