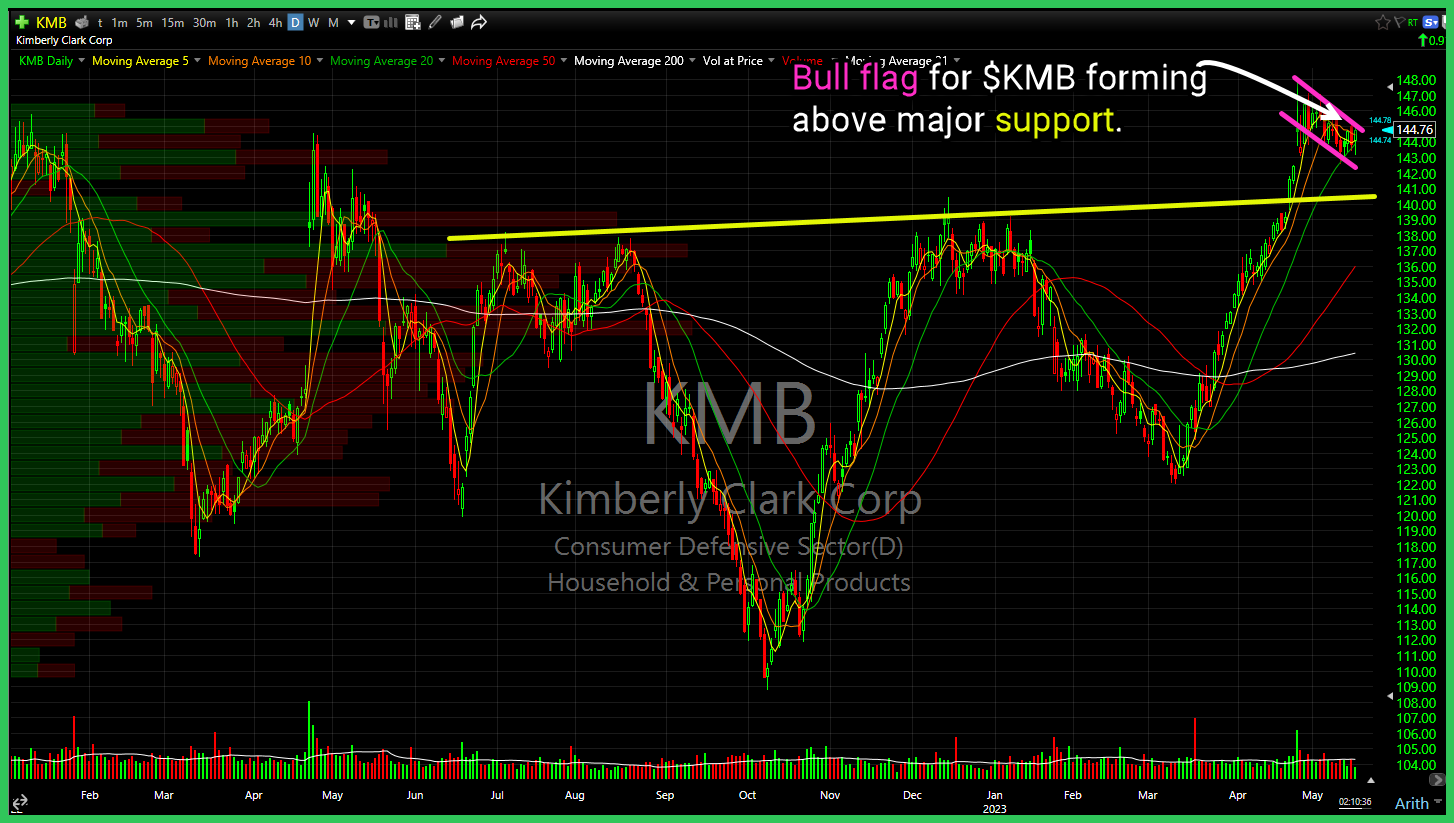

Bull flag for $KMB forming above major support.

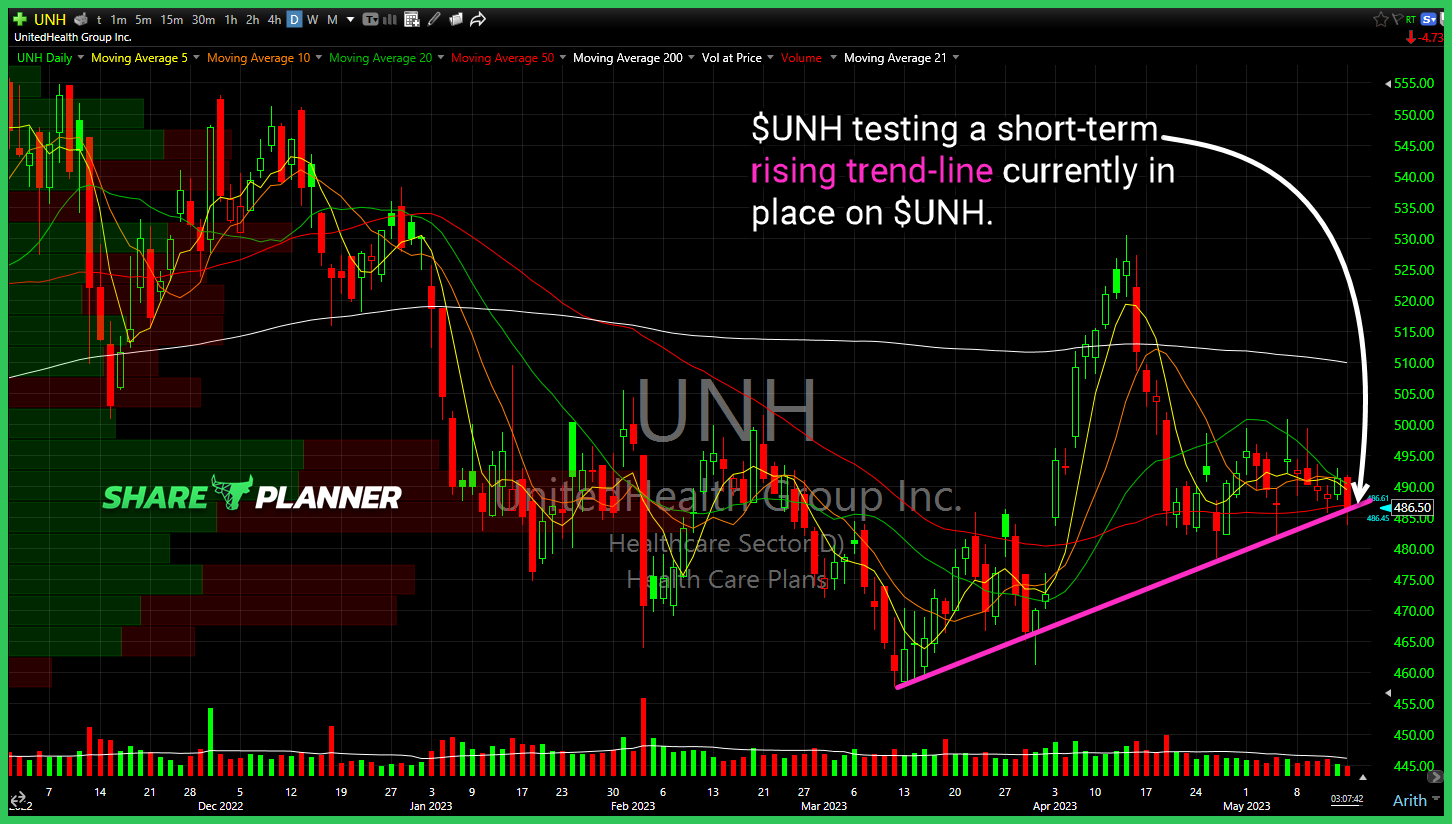

$UNH testing a short-term rising trend-line currently in place on $UNH.

$XLK fighting a major resistance level that goes back for the past year.

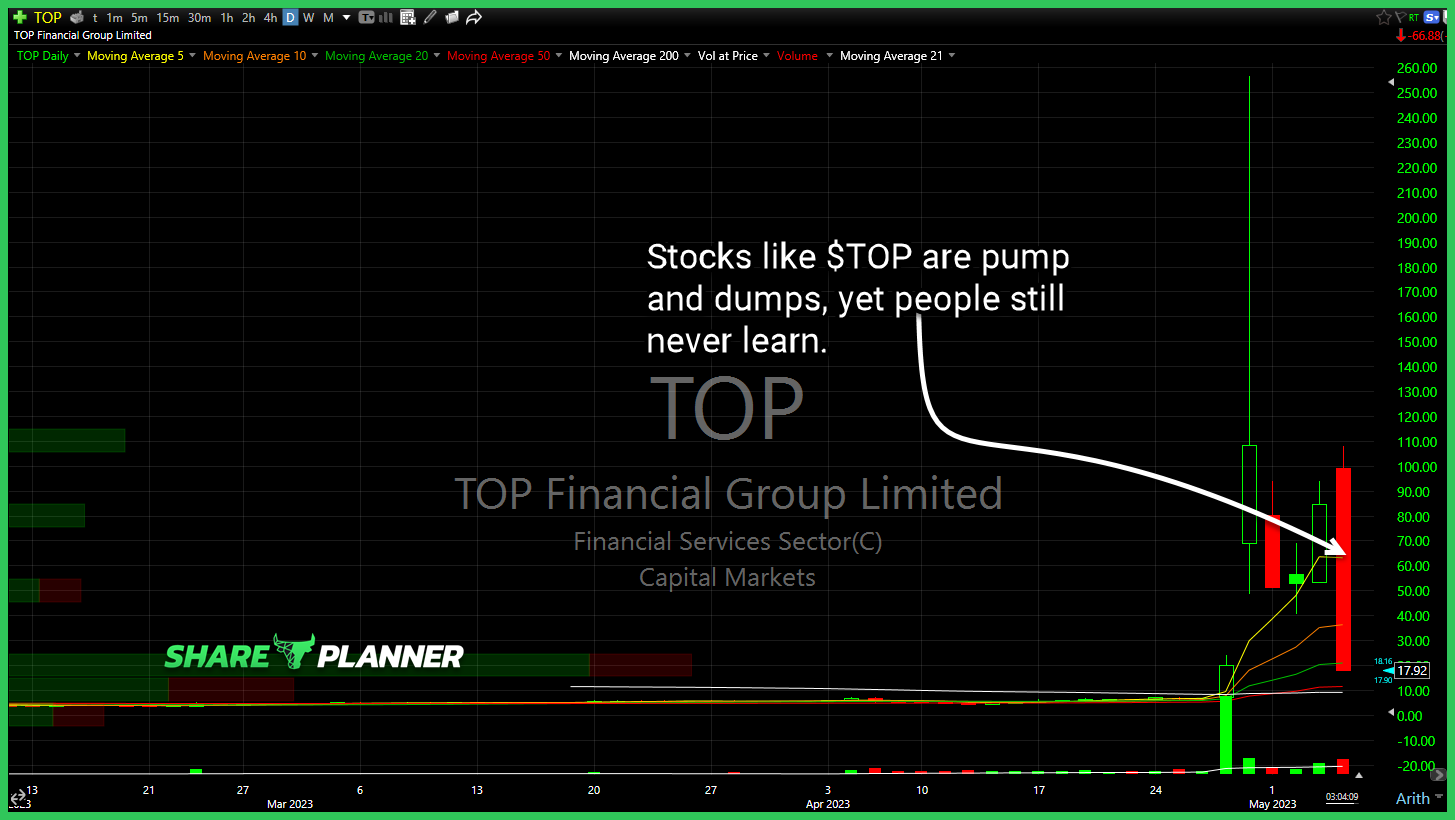

Stocks like TOP Financial Group (TOP) are pump and dumps, yet people still never learn. They still have to chase and then blame the boogeyman when it doesn't work out. Bearish Big move out of Advanced Micro Devices (AMD) on Microsoft (MSFT) news, but still within the short-term declining channel. Considering there hasn't been a

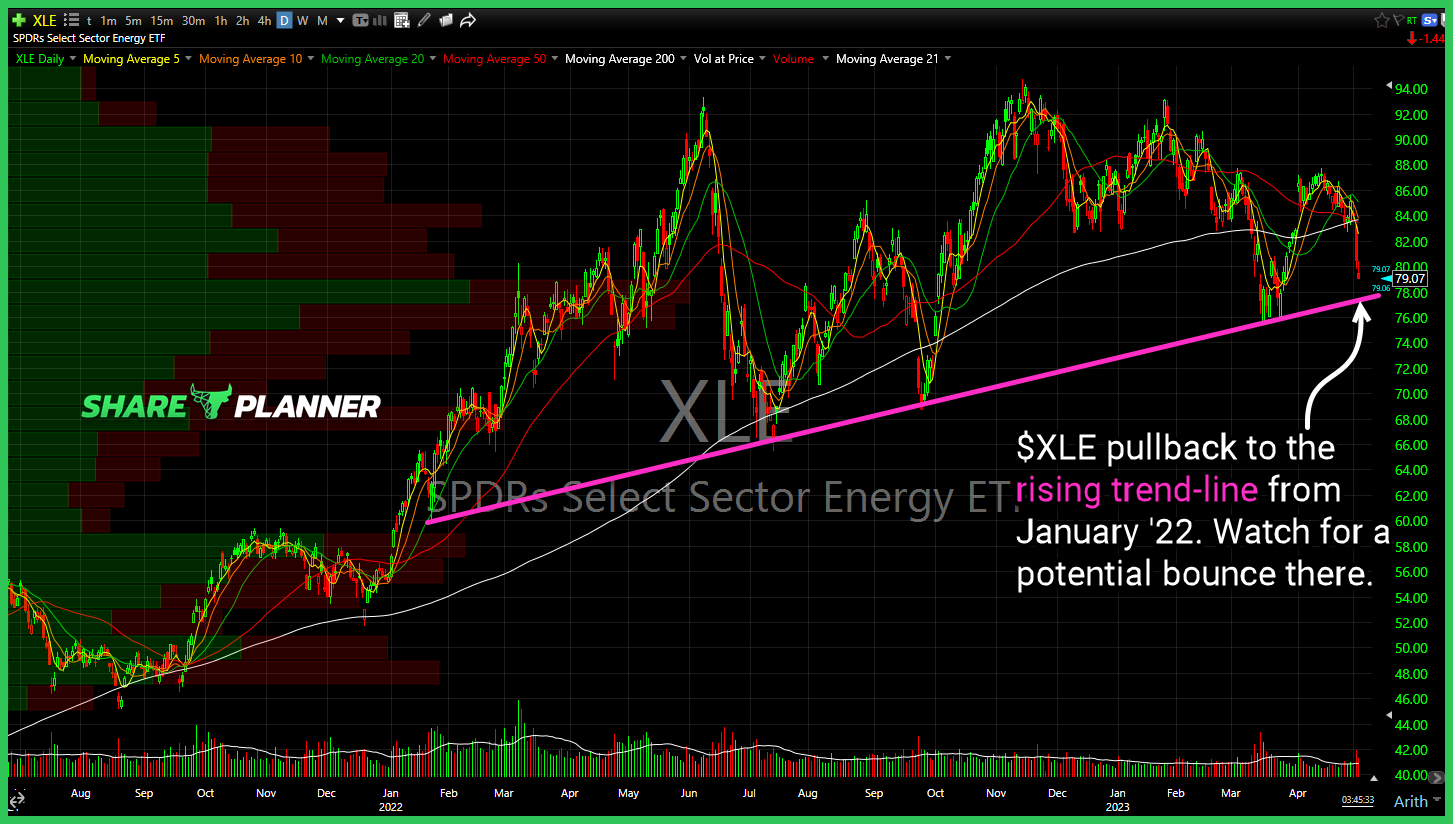

Energy Sector (XLE) pullback to the rising trend-line from January '22. Watch for a potential bounce there. Watch for a retest of the rising trend-line for Squarespace (SQSP) Stiff declining resistance looms for Discretionary Sector (XLY) Heavy sell-off in Starbucks (SBUX) today, worth waiting for a pullback to its rising trend-line before I'd

$XLK price level resistance and upper channel resistance pushing back on the $XLK move back to last August highs.

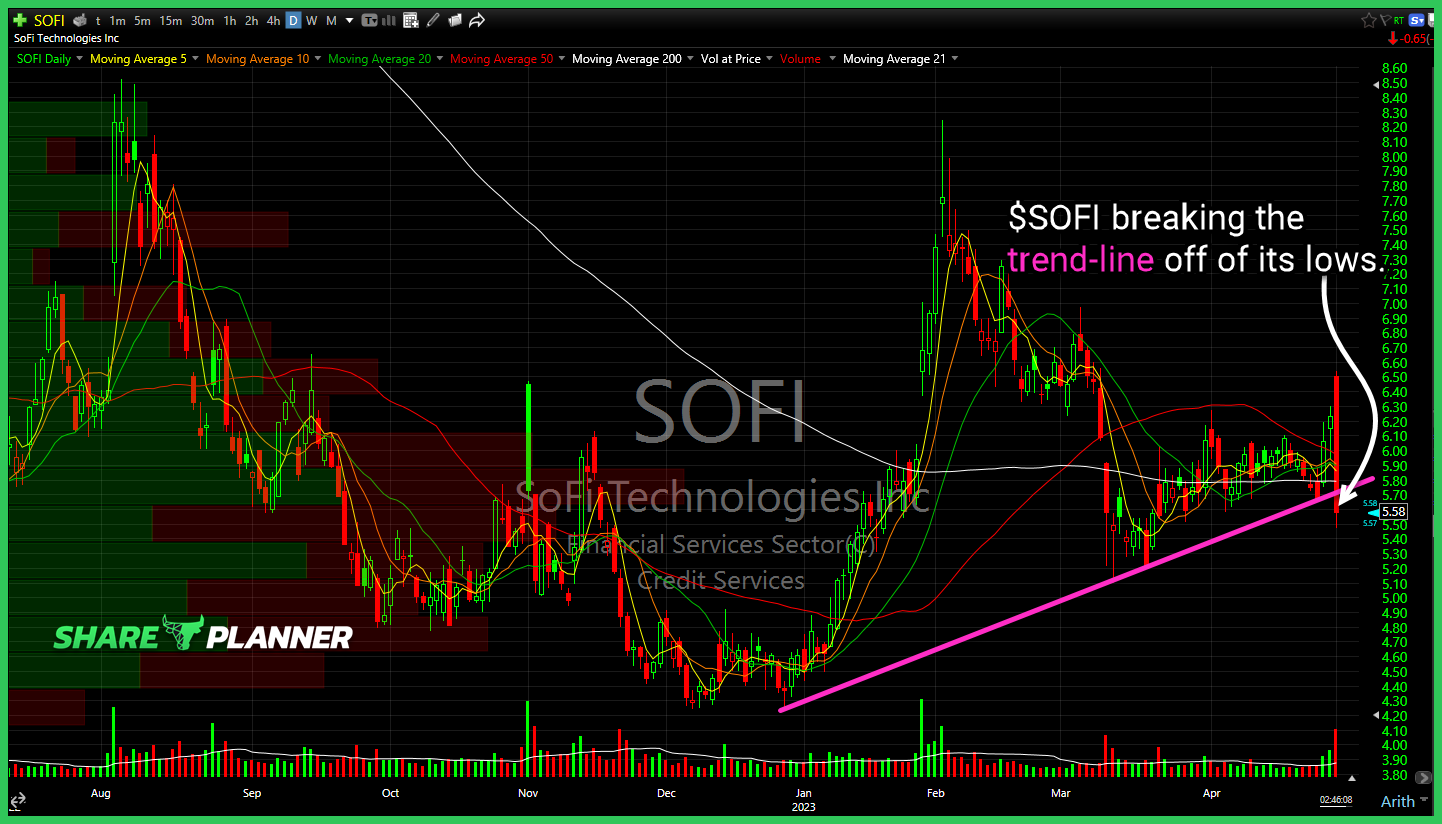

$SOFI breaking the trend-line off of its lows.

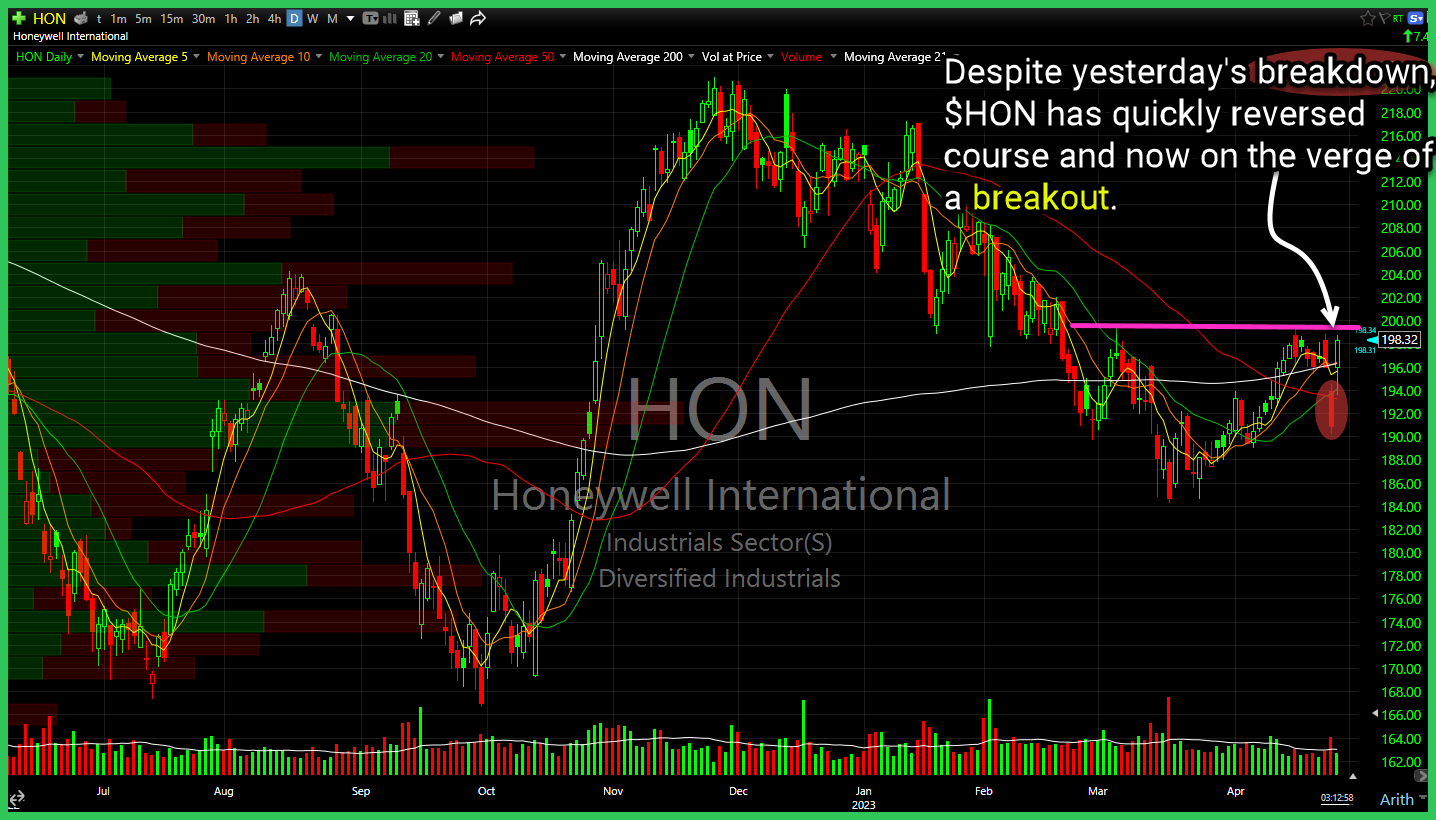

Despite yesterday's breakdown, Honeywell (HON) has quickly reversed course and now on the verge of a breakout. Quite the clown market we are in. Caterpillar (CAT) intraday breakdown of support has now seen a sharp intraday rebound. Watch declining resistance above. Communications Sector (XLC) ripping higher on Meta Platforms (META) earnings, but closing

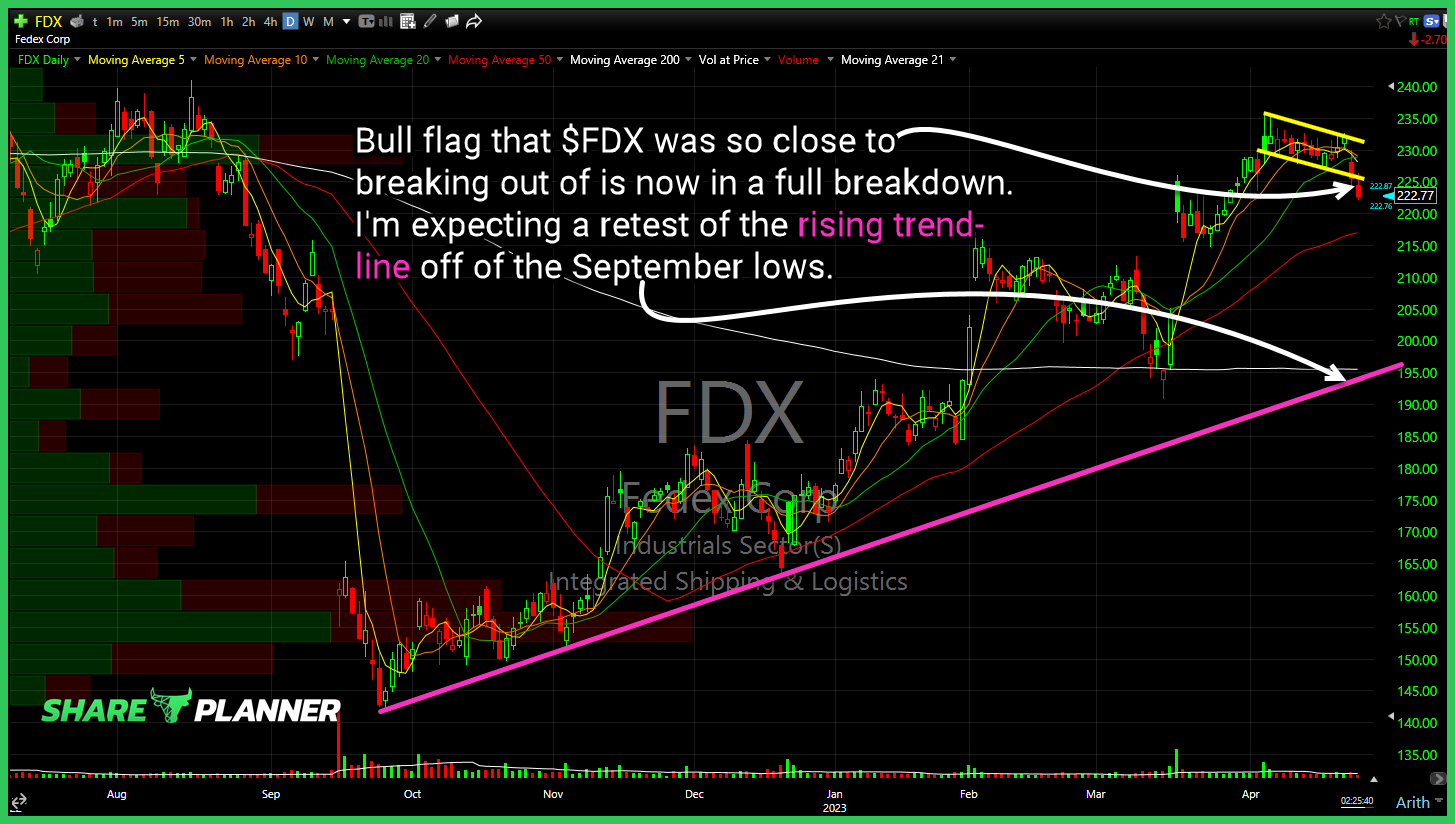

Bull flag that Fedex (FDX) was so close to breaking out of is now in a full breakdown. I'm expecting a retest of the rising trend-line off of the September lows. Snowflake (SNOW) testing the triangle resistance after testing its support yesterday. Massive head and shoulders pattern formed on the US Dollar (DXY)

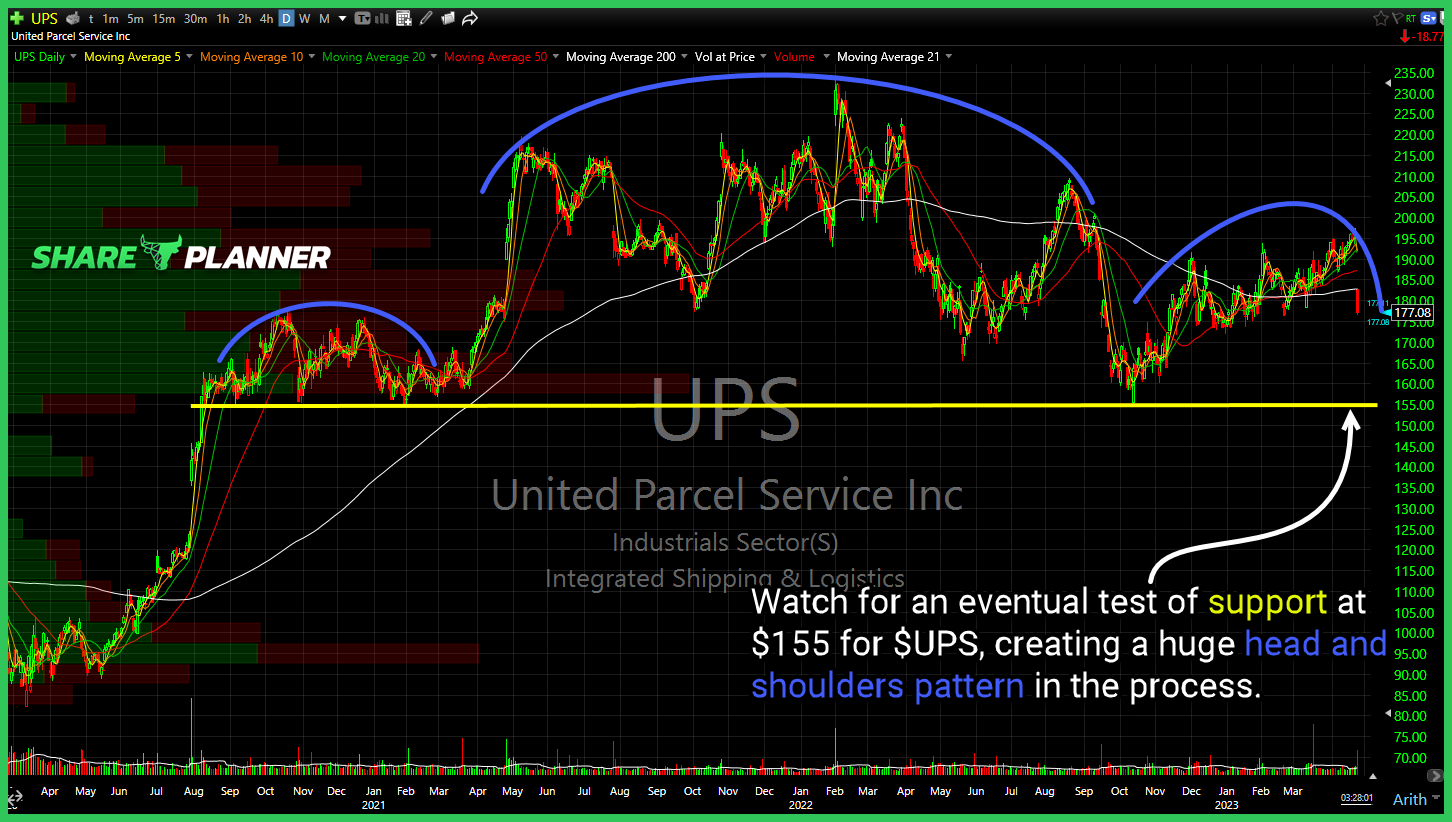

Watch for an eventual test of support at $155 for $UPS, creating a huge head and shoulders pattern in the process.